Can you imagine if you have to pay for the rent or groceries and your bank application crushes? Sounds like a nightmare, right? The recent years have made us so hooked on cashless transfers that some feel nostalgia while holding a bill. The сurrent trend in the financial services industry is the move to digital, specifically mobile banking.

According to a survey conducted by the American Bankers Association, 39% of bank clients managed their personal accounts through mobile banking apps — making it the most convenient approach to interact with financial organizations. We have a tremendous opportunity to examine the latest and future trends in mobile banking technology that have already taken over the application market or are only expected to evolve further.

- Statistics of Mobile Banking Grow: Nowadays and Future

- Latest Trends in Mobile Banking You Need to Know

- 1. From mono-functional to super-app

- 2. Platform for tech-savvy consumers

- 3. Mobile payment options

- 4. Focus on cybersecurity

- 5. Biometric authentication

- 6. Voice payments

- 7. Smart bots

- 8. Personalization of banking for the customer based on data

- 9. Ecosystems & Marketplace

- 10. Edutainment

- 11. Gamification

- 12. Cardless ATM withdrawal

- 13. Cryptocurrency and blockchain

- 14. Convenient Debt Management

- 15. Integrations with IoT (Internet of Things) devices

- 16. AI And Machine Learning

- Top 3 Mobile Banking Apps: Features and Functionalities

- Capital One Mobile

- Chase Mobile

- Monobank

- Mobile Banking Security Concerns

- Authentication and Identity Theft

- Phishing Attacks

- Malware and Mobile App Security

- Public Wi-Fi

- Account Lockout and Denial of Service (DoS) Attacks

- Data Encryption and Storage

- Final Thoughts

- Consider Inoxoft Your Trusted Partner

- Our integrating online payment services

Statistics of Mobile Banking Grow: Nowadays and Future

With the growth of digital transformation, accessing your bank account to view your balance or transit money via a few clicks without going to AMT sounds like a sure thing. It’s expected that the target audience for easy, accessible and quick experience of managing finances is not confined to a certain age group. But what is the general picture of the mobile banking industry? Let’s take a look at the field itself: its mood, tendencies and the future trends of mobile banking.

Mobile Banking Competitive Edge Study conducted by Insider Intelligence shows that 89% of survey respondents use mobile banking. The pandemic influenced the future of mobile banking apps. The 26% increase in mobile banking and 46% in payment applications are speaking for themselves. The discovered convenience of using mobile banking applications made many users attached to it: turns out we can transit, shop and pay for our orders while.

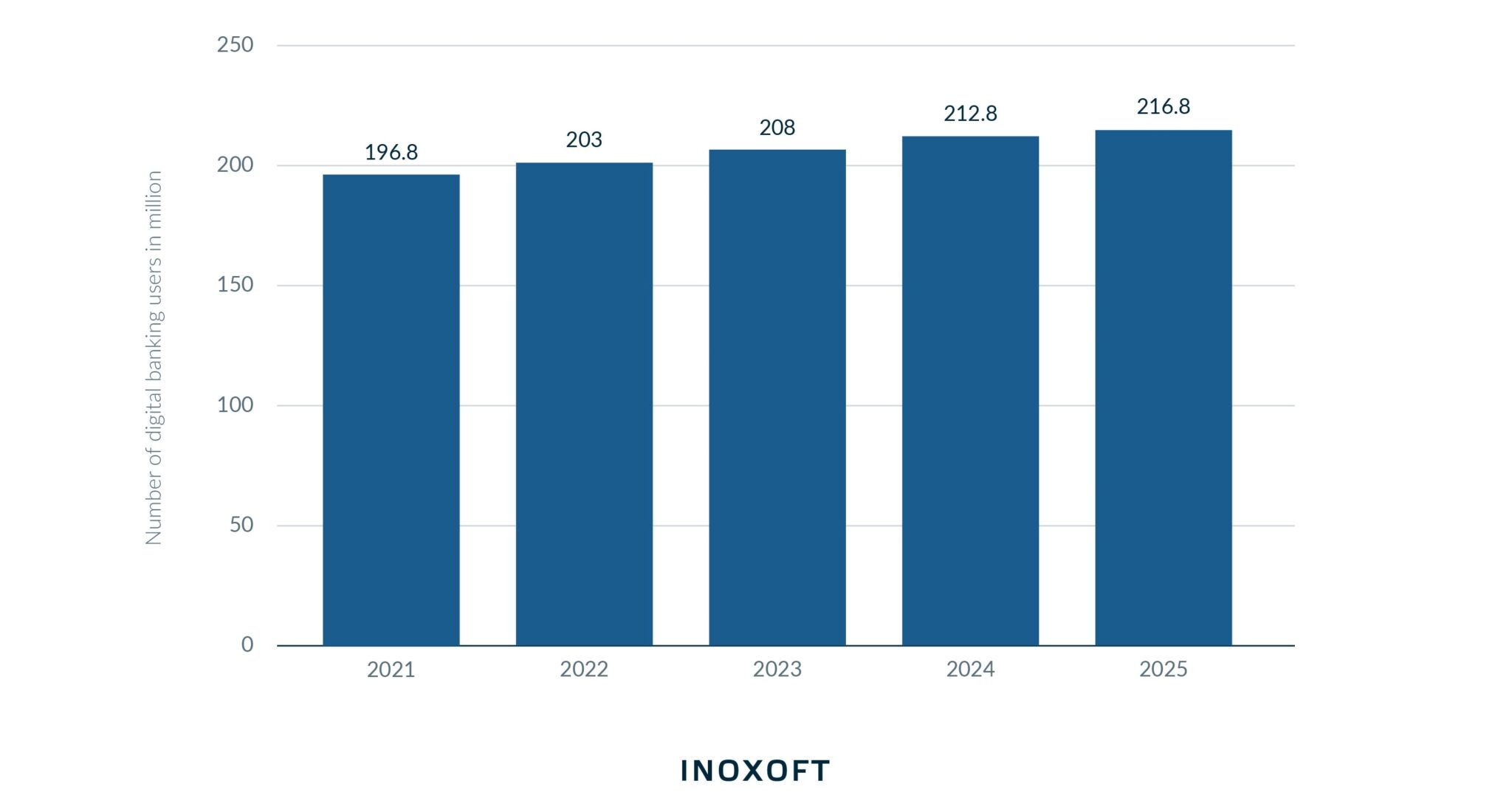

Statista claims that the total revenue in the mobile app market is forecasted to reach $542.80 billion by 2026. With this immense and rapidly growing situation within the mobile app market, the demand for conveniently developed apps for completing personal necessities is not even close to decreasing: from 197 million 2 years ago, the number of digital banking users is expected to reach 217 million by 2025.

According to Google, 6 out of 10 smartphone users prefer using a finance app over a mobile site to manage their accounts. People are fond of mobile applications since it’s a convenient way to satisfy their nonessential needs without bothering the bank itself, for example, to check the balance any time a day in an accessible app with handy features considering the device’s operating system.

Discover more about big data analytics in finance!

Latest Trends in Mobile Banking You Need to Know

Beyond their widespread use, these apps continually evolve in design and technology, with numerous newcomers making strides this year. Explore the forefront of innovation as we delve into the latest trends in mobile banking app technologies and design.

1. From mono-functional to super-app

One of the most based mobile banking technology trends is the extreme functionality of the application. Mobile banking shouldn’t be an additional alternative application with a minimum of functions that complement Internet banking. But rather a full-fledged channel of access to all banking products.

These include banking operations, services with different roles to conduct all desired operational activities simply by using a smartphone or tablet, etc. As technology continues to develop, there’s no doubt that the utility of apps will also keep growing.

Essential features of the mobile banking app:

- 24/7 access to your personal account

- Money transfers

- Security

- Fraud alerts

- Customer support

- Cashback

- Loan payments

- Bill payment alerts

- Full range of services that are of interest to clients (pay for public transport, order a tax shop, etc.)

2. Platform for tech-savvy consumers

Customers want to do more operations with their accounts without additional help from bank employers, including a service access process. Usually, we do not have plenty of time to think where this or that service is located – everything should be as obvious as possible straight from the main screen. This should be achieved, first of all, through the minimization of interfaces, a color palette for different sections of the application, and so forth. It’s easier and more effective to use existing markers of recognition than to invent your own.

Consider personalization in banking products. Ask Inoxoft how!

3. Mobile payment options

When the WHO recommended switching to non-cash payment methods to prevent the spread of the coronavirus, the behavior and habits of the fintech market users changed dramatically. The result was the significant growth in the popularity of various payment methods (contactless payments, e-wallets, online payments), financial literacy, and people’s awareness of all kinds of fintech products.

Cashless transactions have become almost obligatory remaining one of the biggest mobile banking trends in 2023 and will evolve even more in the future. Nowadays, digital sales channels must include the maximum variety of payment methods, providing a smooth journey for their users. The latest digital banking tendencies can also simplify converting different currencies, which allows consumers to proceed with transactions across the globe even faster and easier.

Learn about the latest trends in money transfer app development!

4. Focus on cybersecurity

Security has always been a sensitive matter and an essential aspect of the banking industry. One of the main challenges today is mobile banking safety. Alas, cybercriminals used the pandemic situation to their advantage, which made app users vigilant about all their online banking operations. .

In order not to fall victim to targeted attacks, both businesses and users have to follow the basic rules of cyber hygiene. Thanks to Big Data and predictive modeling of fraud, banks, and financial organizations can improve consumers’ data security significantly.

Several banks, for example, Capital One and Bank of America with the help of AI provide users with warnings of fraud alerts and double charges. They notify their clients of any additional charges if the subscription rate increases.

Mobile Banking Security Features:

- Touch ID (fingerprint login)

- Facial recognition

- Voice recognition

- TAN/PIN systems

- Strong password

- Cellular network

5. Biometric authentication

Unfortunately, using a simple PIN is not a guarantee to secure a mobile banking experience. Here come biometric authentication methods. Those include fingerprint reading, eye scanning, and facial recognition. All of those enable access to the application or even completing transactions without a need to swipe the card or enter a password. The mobile banking technology trend is making the way of accessing bank accounts much quicker and more secure since it is harder to replicate or hack.

6. Voice payments

As people are highly conscious of security concerns, several banks have already purchased voice recognition as one of the methods for two-way authentication. Meet another mobile financial services trend — voice payments in banking.

Alexa already pays off credit card bills, Siri allows consumers to transfer money to other accounts, and with Google Assistant you can shop simply with your voice from nearby stores. Combined with machine learning, voice technology will make the future of mobile banking more responsive and user-friendly. Some experts expect the growth of voice payment services even faster than we think: Statista forecasts that the amount of voice assistants used worldwide will reach 8.4 billion units by 2024.

7. Smart bots

According to Business Insider, 64% of consumers will first check the innovations bank offers before signing contracts with them. The usage of chatbots is one of the proper ways of offering immediate answers and help to a customer. The advantage of this service is that it can also instruct the bank’s employers on how to communicate with clients, work with software and follow security rules.

8. Personalization of banking for the customer based on data

It has been one of the online and mobile banking trends for a while and is not planning on going away anytime soon. Naturally, more people use mobile banking apps. Thus, financial institutions utilize Big Data to study and analyze thousands of their customers’ data from sources like mobile banking history, social media, and so forth.

Personal consulting based on expenses, credit history or set goals will definitely increase customer loyalty. For example, the application will be able to send notifications that, taking into account expenses and income, the balance on the customer’s current account may not cover the expected activity (shopping, restaurants, taxi) for the next 7 days.

Even more necessary tool in today’s world – future subscription notifications that tell customers when they’re being charged for, say, Netflix or when their free trial is over. Other warnings notify customers in case their money may have been mistakenly written off twice by the seller or restaurant. By integrating these technologies into existing platforms, companies improve all their processes and systems.

Financial data analytics to learn about. Click here!

9. Ecosystems & Marketplace

To keep it up, financial institutions are turning their applications into ecosystems that meet all the users’ needs. Financial transactions and user tasks that were accumulated within the authorized area of the mobile bank begin the way to exit previous mobile applications. Today, marketplaces have already appeared in mobile banks. Seriously, here you can buy movie tickets, subscriptions to entertainment services, and pay for services such as a doctor’s appointment. We believe banks will actively integrate mobile solutions with messengers and social networks. Both of those in terms of communications (and increasingly – using AI), document exchange, and transactions.

10. Edutainment

Nowadays, mobile banking apps can be considered state-of-the-art if they successfully perform the role of a personal financial assistant that not only informs but also entertains. So let’s consider the name of the next mobile banking industry trend “edutainment”. Mobile banking today is about being a financial-edutainment personal assistant for its clients. American Express and PayPal have already taught their bots to provide financial services and educate their customers if necessary.

11. Gamification

By infusing interactive elements into the app, fintech companies can imbue users’ banking experiences with a sense of amusement and entertainment, fostering heightened engagement. Gamification can be seamlessly integrated with loyalty and reward programs, offering a dynamic platform for analyzing customers’ behaviors. Gamification serves as a powerful tool for presenting diverse propositions and incorporating additional valuable features, further enhancing the overall mobile banking experience.

12. Cardless ATM withdrawal

The concept of contactless ATM interaction has emerged as a trend, revolutionizing traditional mobile banking usage. Such integration with ATMs facilitates easy and contactless transactions, which is a real challenge for the usual brick-and-mortar banking model. This trend aligns with the growing preference for digital and mobile-centric banking experiences that offers greater flexibility in customer service.

One common method of cardless ATM withdrawal is using QR codes displayed on the ATM screen to scan with mobile devices through the banking app. Alternatively, modern solutions like NFTs may be employed for secure authentication and transaction authorization. This enables bank customers to conveniently locate the nearest ATM through their mobile apps and initiate transactions without the need for a physical card.

13. Cryptocurrency and blockchain

Blockchain has emerged as one of the most prominent trends in mobile banking. The Economic Times states that there are up to 8,832 active digital currencies worldwide. And financial institutions can save up to $12 billion each year using blockchain technology.

By leveraging the decentralized distributed ledger, blockchain facilitates autonomous money transfers without the need for intermediaries. This paves the way for mobile banking to embrace a branchless model, relying on a cloud-based system that offers a seamless user experience.

14. Convenient Debt Management

Among the аuture trends in mobile banking are innovative solutions for debt management that Fintech companies can offer. These include AI-powered debt consolidation platforms, mobile apps for tracking and managing debt, and personalized debt repayment plans.

15. Integrations with IoT (Internet of Things) devices

The Internet of Things (IoT) creates opportunities for innovative services in Fintech making it to our list of mobile banking industry trends.

- Enhanced Data Insights: IoT devices generate vast real-time data, and fintech companies take advantage of this. IoT devices help them to gain deeper insights into consumer behavior and spending patterns. For example, smart home devices provide information about energy usage and help users make cost-saving decisions.

- Personalized Financial Services: Wearable devices can monitor your health and financial goals simultaneously, allowing fintech apps to offer tailored investment or insurance recommendations based on your lifestyle and health data.

- Risk Mitigation: IoT devices also contribute to risk assessment and mitigation. Insurers can use data from connected homes to assess property risks better, while auto insurers can adjust premiums based on individual driving behaviors monitored by IoT sensors.

The goal is to make it easier for clients to understand their debt, create a manageable repayment strategy, and ultimately reduce their financial stress.

16. AI And Machine Learning

As AI technology continues to evolve, it’s expected to play a more significant role in Fintech as well. Not only it improves the accuracy and efficiency of financial services, offering better customer experiences, and reducing operational costs. AI algorithms analyze vast amounts of data to make predictions, automate tasks, and provide personalized financial recommendations.

Top 3 Mobile Banking Apps: Features and Functionalities

Capital One Mobile

Provided by a prominent financial institution in the United States, the Capital One Mobile app enables users to conveniently manage their banking accounts, view transactions, make mobile check deposits, and receive proactive alerts about unusual transactions. With 5th place in the AppStore Finance category, the app provides personalized spending insights, credit score monitoring, and cardholder travel notifications.

Chase Mobile

Chase Mobile, the mobile banking app offered by JPMorgan Chase, allows users to manage their accounts, deposit checks, pay bills, gain rewards, and access credit card and investment accounts. Chase Mobile integrates with the Zelle network to send and receive money easily, provides fraud monitoring and budget planner.

Monobank

A popular mobile banking app from Ukraine that provides hassle-free account opening process, deposit services, P2P payments, return on expenses, achievements and real-time customer support. Monobank emphasizes a user-friendly interface and customer-centric approach with biometric authentication to deliver a seamless banking experience.

Mobile Banking Security Concerns

Except for convenience and accessibility mobile banking also brings security concerns that must be addressed to protect users and their financial assets. Let’s review a few of them:

Authentication and Identity Theft

- Weak Passwords: Users often choose weak passwords, making it easier for hackers to gain access to their accounts

- Biometric Vulnerabilities: Biometric authentication methods such as fingerprints and facial recognition can be spoofed or compromised.

Encourage users to create strong, unique passwords and consider implementing multi-factor authentication (MFA) to add an extra layer of security.

Phishing Attacks

- Phishing Emails and SMS: Hackers send fraudulent emails and text messages that appear to be from legitimate financial institutions, tricking users into revealing sensitive information.

Educate users about phishing threats, advise them not to click on suspicious links, and ensure that official communications from the bank are clearly identifiable.

Malware and Mobile App Security

- Malicious Apps: Users can accidentally download malware-infected apps that may steal personal information or manipulate banking transactions.

- App Vulnerabilities: Even legitimate banking apps can have vulnerabilities that cybercriminals can take advantage of.

Encourage users to download apps only from official app stores, keep their devices and apps up to date, and use mobile security software.

Public Wi-Fi

- Unsecured Networks: Public Wi-Fi networks can expose users to potential attacks, where hackers intercept data transmitted over the network.

It’s better to avoid public Wi-Fi for banking transactions and use VPNs when necessary to encrypt data traffic.

Account Lockout and Denial of Service (DoS) Attacks

- Brute Force Attacks: Attackers try to gain access to accounts through repeated login attempts, leading to account lockout.

- DoS Attacks: Hackers overload banking servers with requests, disrupting service availability.

Implement account lockout policies and monitor for unusual login patterns. Use DoS protection mechanisms to ensure uninterrupted service.

Data Encryption and Storage

- Data Breaches: Weak data encryption or storage practices can expose sensitive user data to hackers.

Use strong encryption protocols to protect data during transmission and storage, and regularly audit security practices to identify and fix vulnerabilities.

Final Thoughts

To prosper in the market and stay up with the quickly developing environment of a cashless world, institutions must adopt the newest trends of mobile banking. From the advent of biometric verification to the integration of machine learning, these developments are transforming the way we engage with our banks and manage our financial activities.

The mobile banking future trends mentioned in this article will lead the way and acquire significance in the future. Thanks to them, financial institutions may provide a smooth and convenient banking experience that fits the requirements and expectations of today’s tech-savvy consumers.

Consider Inoxoft Your Trusted Partner

Whether you are looking for a fintech software development company or a banking software development company, Inoxoft will provide you with expertise in a team of professional people and help your businesses grow!

Having experience in delivering trading solutions for world-scale traders, Inoxoft specializes in custom financial software development. Our products completely automate traders’ work and facilitate trade across the globe, hence, every fintech company can rely on us in designing, delivery, and architecture for building cutting-edge financial software.

We offer fintech development services for businesses that will:

- resolve their automation challenges

- leverage trading success

- digitize banking services

We invite you to start your banking software project with Inoxoft — a software development company with broad experience in mobile and web development and 80+ tailored solutions used by businesses across the globe.

The banking industry can count on our expert team who will perform: discovery of client’s business needs and requests, market and trends investigation, a reasonable choice of the tech stack, timely risk prediction and management and so on! If you are wondering how to develop a secure and cutting-edge banking app, don’t hesitate to contact us.

Our integrating online payment services

At Inoxoft, we specialize in seamlessly integrating online payment services with businesses of all sizes and industries. Our expertise lies in adapting “PayPal-like” online payment solutions to meet the unique requirements of your business, simplifying financial transactions and processes.

Experience the benefits of seamless online payment integration and take your business to new heights with Inoxoft. Contact us today to explore how we can transform your payment processes and drive your business’s success.

Frequently Asked Questions

What are the latest trends in mobile banking?

- From Mono-Functional to Super-App

- Platform for a Tech-Savvy Consumers

- Mobile Payment Options

- Focus on Cybersecurity

- Biometric Authentication

- Voice Payments

- Smart Bots

- Personalization of Banking for the Customer Based on Data

- Ecosystems & Marketplace

- Edutainment

- Gamification

- Cardless ATM withdrawal

- Blockchain

What mobile banking technology trend is the most useful?

We suggest you consider all of the valid in 2023 mobile banking trends, so that you’ll have an understanding of what your target customers would like or hate.

What are the pros of augmented reality in fintech?

One of the advantages is that augmented reality in fintech can add positive features to security solutions through authentication using biometrics. With the help of AR, you can access your bank services, and initiate payments and money transactions from the app.

What banking activity do most consumers use mobile banking for?

Checking account balances is the most popular banking activity for which people utilize mobile banking. They regularly use mobile banking to transfer cash, pay bills, deposit checks, monitor transactions, manage cards, and locate ATMs and branches. Mobile banking provides a variety of capabilities that cater to clients' different demands while also providing ease and accessibility in managing their accounts.

What is the difference between online banking and mobile banking?

Both online banking and mobile banking offer comparable features but differ in platform and convenience. Yet, the main difference between them is the platform used for accessing banking services.

Online banking is accessible through a computer or laptop using a bank's website or specialized software, whereas mobile banking is accessed via smartphones or tablets through mobile banking apps or mobile-optimized websites.

What is neobank?

A neobank is a digital-only bank that solely works online and has no physical branches.They offer banking services via mobile applications and websites, such as checking accounts, savings accounts, payments, and money transfers. Neobanks often provide an easy-to-use and intuitive digital experience, employing technology to expedite operations, lower costs, and deliver new financial solutions with simple and flexible banking alternatives.

Learn more about Developing a Neobank From Scratch: Key Steps And Expert Advice