Today’s world offers a lot of opportunities for people. Digitalization has brought a lot of novelty into industries, and therefore, changed the way they work. Real estate, fintech, education - everything has become digitized and tightly connected with modern technologies. Of course, the banking industry is not an exception.

A lot of people still choose to use traditional banks’ services. It gives them a feeling of stability and reliability. Sure, traditional banks can still offer excellent services and be useful for a lot of people. However, as time goes by, there are new ways to run your finances. Neobanks - non-bank fintech startups - are digital banking platforms that are made to ease your customer experience as a bank user. The tendency shows that neobanks will become more popular with time.

The global neobanking market grew from $79.1 billion in 2022 to $118.51 billion last year at an annual growth rate (CAGR) of 49.8%. The market is expected to grow to $556.66 billion in 2027.

This guide will tell you everything about developing a neobank from scratch and why it is so important. Neobanks mobile app development is a really interesting topic, especially if you are looking for advanced banking services. If you feel like this is what you need, read the article!

- What is a Neobank?

- How does a Neobank work?

- How do neobanks make money?

- Benefits of Building a Neobank

- Lower operational costs

- Effortless banking methods

- Speed

- Use of technology

- International payments

- Features That Should Be In Your Neobank

- Onboarding

- Authorization

- Personal account management

- Customer support

- Transaction history

- Internet limits

- Payment templates

- Contact database synchronization

- Credit lines

- Notifications and reminders

- Add Unique Features

- What to Consider Before Opening a Neobank?

- Regulatory compliance

- Market research

- UX design

- Security measures

- Customer acquisition strategy

- Partnerships and integrations

- Scalability planning

- Steps of Developing a Neobank From Scratch

- Step #1: Marketing research and product discovery

- Step #2: UX design

- Step #3: Testing

- Step #4: UI design

- Step #5: Development life cycle

- Step #6: Launch

- Step #7: Feedback Analysis

- Step #8:Improvement

- What Problems Can You Face When Developing a Neobank?

- Security

- KYC

- Two-factor authentication

- Fast payment

- Regulations

- Pros And Cons of Developing a Neobank From Scratch?

- Pros

- Cons

- Cost of Developing a Neobanking App From Scratch

- Expert Advice for Developing a Neobank

- Be Ready For Possible Issues

- Double Check Everything You Do

- Decide Things In Advance

- Consider Inoxoft Your Trusted Partner

- Final Thoughts

| TRADITIONAL BANK | NEOBANK | |

| SERVICE PLATFORM | Physical banking establishment | Web&Mobile services |

| CLIENTS RELATIONS | Long-term, in-person with minor challenges | Flexible, virtual, easy to modify |

| CUSTOMER SUPPORT | In-person, phone, online | Online |

| FEES | High, complex | Low, transparent |

| BANKING LICENCE | Entire | None, partial, entire |

| CONFIRMATION PROCESS | Long | Instance |

What is a Neobank?

Neobank is a financial institution that operates entirely online. Unlike traditional banks, neobanks don’t have physical branches as they rely on technology to provide financial services to customers.

Key characteristics of neobanks are:

- Online-only Presence

- Mobile-centric

- Technology-driven

How does a Neobank work?

Neobanks operate like traditional banks but with a focus on digital channels and technological innovations:

Digital Operations

- Online-Only Presence: Neobanks rely on digital platforms such as mobile apps and websites for customer interactions and transactions.

- User-Friendly Interface: Neobanks prioritize a user-friendly interface to provide a seamless digital experience.

Financial Services:

- Basic Banking Services: Neobanks offer traditional banking services: checking and savings accounts and payment services.

- Additional Financial Products: Some neobanks expand their services and include advanced features like budgeting tools, investment options, loans, personalized financial insights, etc.

Technology and Innovation:

- Modern Infrastructure: Neobanks leverage modern technology and infrastructure to streamline operations and reduce costs.

- Marketing Strategies: Neobanks often employ digital marketing strategies to attract customers, leveraging social media, online advertising, and other digital channels.

How do neobanks make money?

Neobanks use various revenue streams to generate income:

- Transaction Fees: Neobanks charges transaction fees for certain services e.g. international transfers, ATM withdrawals, or overdrafts.

- Subscription Models: Customers pay a monthly or annual fee for premium features and services.

- Interchange Fees: Another way to earn revenue is through interchange fees (fees paid by merchants to the bank for processing card transactions).

- Subscription Models: Clients pay a monthly or annual fee for premium features and services. This can include enhanced account features, additional financial management tools, or other perks.

- Data Monetization: Neobanks gather valuable data on customer spending habits and financial behaviors. They may anonymize this data to provide insights to third parties or for targeted advertising, generating additional revenue.

- Affiliate Marketing: This approach promotes financial products and services from other companies within their platforms. They can earn referral fees or commissions when their customers sign up for or use these products.

- Customized Financial Products: Neobanks offer unique financial products tailored to specific customer segments.

Benefits of Building a Neobank

To start with, you need to understand what exactly neobank is. Put simply, neobanks are fintech companies that provide all the banking services digitally. It attracts a lot of customers, especially young people, because the remote lifestyle has made its changes to the way clients interact with banks and other institutions. Neobanks do not have usual bank branches and are not licensed as banks. That is what sets them apart from traditional banks. Though there are still people who do prefer offline banking, neobanks already have a great client base and are forecasted to gain an even larger one.

To persuade you that building your neobank is a good idea, here are some key benefits of neobank app development. On the contrary to traditional bank development, building a neobank can give you a lot of business opportunities and useful business ideas.

Lower operational costs

Physical branch networks and personnel in traditional banks require more costs. Neobanks are much cheaper at this point, because to set up a neobank you don’t need to maintain personnel and physical branch networks. What is even more important, there are no monthly fee payments, and that is a big plus for all your customers.

Effortless banking methods

It’s safe to say that one of the main pluses of neobanking app development is banking methods that don’t require too much of your time. Visiting traditional banks, you had to stand in queues for hours just to make some transactions. Building your own neobank completely frees you from this struggle. All you have to do is open an app and use digital self-services. If you create a neobank app, you will enable your customers to execute all the transactions without leaving their houses, from any place on the planet.

Speed

If you want to start a neobank app, it’s also worth noting that all the operations in neobanks are really user-friendly and fast. You can make all the necessary transactions in a couple of minutes, so these operations won’t be burdening you. At the same time, to commute to a traditional bank branch and spend time in a queue, you would have to spend half of your day. That’s why the speed of operations and convenience matter so much.

Use of technology

Digitalization connects a lot of industries with the help of AI usage. To develop a neobank app, you need to implement artificial intelligence. AI is responsible for all the services that clients are using. Artificial intelligence is also important when you need to understand a customer’s interaction with the bank, learn what interests this or that customer and what services are in the highest demand. If you are aware of the specific needs of your clients, you can provide top-notch services to them and attract even more customers.

International payments

Sometimes it’s really difficult to execute international transactions, especially in traditional banks. However, you can forget about it if you are using neobank. It only takes to open your account and make a payment. You don’t have to perform any form of upgrades to your account to make an international payment. This is another reason why neobanks are so convenient and user-friendly.

Features That Should Be In Your Neobank

If you want to build a neobank from scratch and make it of high quality, you should consider a lot of things. To build a neobank application you need to implement many basic features so your app could function properly and provide all the essential services. Let’s have a look at the most crucial features you should consider in the neobank development process.

Onboarding

All the neobank applications can be different, as each of them has its unique set of features. To make it easier for your clients to figure out how to use your application, you need to give them some beginning tips. Your customers will know what buttons to click, where to go to do this or that etc.

Authorization

The crucial first step to start using neobank is authorization. With the help of it, customers can enter the app and start using it. Not to mess things up, authorization should be simple and clear for the customer.

Personal account management

Personalized approach is appreciated in any sphere. If a customer is able to manage their own account, change settings, customize it, then the chances that the client is engaged in the process are much higher.

Customer support

Your customer should feel that all their issues can be resolved. If a client has any questions, they must give answers and help them. Customer support should be working 24/7 and be fast. One more thing is that young clients do not feel comfortable talking on the phone. That’s why using messengers can be an excellent solution.

Transaction history

It’s convenient for your customer if they can control their spending. Adding a transaction history is helpful this way. If people can control how much money they spend, they can manage their costs better and understand what transactions are the most successful.

Internet limits

Being able to set Internet limits is another benefit for a user. If a client can set a limit on the Internet, they can also limit the payment on it. This way, customers spend less and can control their spending.

Payment templates

This feature can be easily called a must since it makes the payment process much easier and more convenient for a user. Filling out the same forms is tiring and time consuming, that’s why ready-made templates come in handy.

Contact database synchronization

Many applications have this feature, and rightfully so. Database synchronization allows users to upload their contact information to the app. It also automatizes the payment process and makes it easier.

Credit lines

Taking loans from the bank is one of the features that attract customers. It can be linked to the user’s rating. The higher is the rating of the user, the bigger the loan can be.

Notifications and reminders

Receiving notifications is crucial, because the user can monitor all the processes that are happening in their account. The client knows when to make transactions, when the money is received etc.

Add Unique Features

When you build a neobank, it’s important to take into consideration not only the basic features, but also the advanced ones. These unique features will help you make your application more complex and attractive to potential users. Let’s take a look at some of the most popular functions you can incorporate into your neobank.

- Cashback. This feature is one of the reasons people choose neobanks over traditional banks. It’s always pleasant to receive a certain percentage of the money you spend. The percentage you receive depends on the type of goods you spend money on.

- Dynamic CVV2. There is always a danger of hacking when your phone is lost. Dynamic CVV helps you find your phone and increases the protection of your costs this way.

- Cost tracking. With the help of this feature, you can categorize your spendings (food, medicine, home, etc.), and it’s a must if you want to get statistics about your spending.

- Referral system. Every neobank needs to be popularized among users. The referral system is a possibility for a client to invite their friends, family and colleagues to the bank. Moreover, it’s a good chance to receive some bonus that goes along with it.

- Accumulation system. It’s an essential feature for those who want to save some amount of money. If a person is accumulating costs for a certain purpose, the accumulation system allows you to do it once in a period.

- Stocks and cryptocurrencies. It’s not a secret, that cryptocurrency has become popular in the last couple of years. The ability to make cryptocurrency transactions with the help of your neobank increases your chance of staying relevant on the market and interesting for your potential clients.

What to Consider Before Opening a Neobank?

Building your neobank is a significant undertaking that requires planning and consideration of various factors. Here are key aspects to consider before developing your neobank:

Regulatory compliance

Being financial institutions, neobanks are subject to regulatory oversight and require a banking license from the relevant local authority, such as the OCC in the USA or EBA in the EU. Acquiring this license is a complex process, involving meeting specific financial requirements.

Once granted the license, neobanks are obligated to adhere to standard banking regulations, and adherence to know-your-customer standards. Prudential regulations aimed at ensuring a bank’s stability also come into effect.

Market research

Market research is a vital step for neobanks before launch, that offers insights into customer needs and the competitive landscape. Evaluating market size informs you strategic planning, while insights into customer behaviors guide effective marketing and branding strategies. In essence, researched market will help you make informed decisions and successful entry into the competitive financial landscape with a unique value proposition.

UX design

Unlike traditional digital banking, neobanking solutions place a premium on user-centricity, emphasizing simplicity and intelligence in their development. A clear and intuitive interface, coupled with timely push alerts and robust customization options, is essential for ensuring a top-tier user experience. With a concise and relevant textual content that enhances user engagement, you neobank will stand out in a competitive market.

Security measures

Advanced data encryption, multi-factor authentication, and the integration of biometrics, form the foundation for safeguarding private client data. Beyond technological defenses, you should prioritize employee training on cybersecurity best practices, and regular testing of contingency plans. These collective efforts will cultivate trust among clients, and establish a secure digital banking environment.

Customer acquisition strategy

For a successful neobank customer acquisition strategy, prioritize a holistic digital marketing approach. Optimize online visibility through SEO and PPC advertising, engage audiences on social media, collaborate with fintech apps, and utilize targeted email campaigns. Showcase enticing incentives like sign-up bonuses and limited-time offers to attract users, and heighten brand awareness.

Partnerships and integrations

Neobanks rely on cutting-edge technology, third-party services, and API integration: collaborations with fintech companies will enhance service offerings, and foster innovation. A well-thought-out integration strategy contributes significantly to the neobank’s ability to provide a comprehensive and customer-focused banking solution.

Scalability planning

Plan for scalability from the beginning: anticipate the potential surge in demand for your digital financial services, and design your technology infrastructure with a forward-thinking approach to accommodate the evolving needs of a growing user base.

You should establishing a foundation that can easily scale for avoiding disruptions, and ensure a smooth customer experience during periods of expansion. Consider cloud-based solutions that offer the flexibility to scale resources up or down based on demand, so that your neobank can adapt swiftly to changing market conditions.

Steps of Developing a Neobank From Scratch

Now you know everything about essential features that need to be implemented in your neobank. The next question is: how to start a neobank from scratch? There are some steps of creating a neobank that you should follow to develop a high-quality product.

Step #1: Marketing research and product discovery

How to start a neobank for it to be successful and relevant in the market? First of all, it’s necessary to conduct marketing research and product discovery. It’s essential to understand what is in demand in the market. Don’t forget to study other neobanks, so that you can come up with unique creative ideas. Product discovery will help you understand whether creating a new product is needed at all.

Step #2: UX design

Now that you have studied the market, it’s time to create a UX design. This process includes sketching, creating wireframes, prototypes, design specification and design system. Always remember, that a good design is half of your success.

Step #3: Testing

To know if you have built the product logic correctly and if you have done everything right, you need to test your product. The results of the testing will show you whether you need to change something in your product or not.

Step #4: UI design

UI design is responsible for the visual appeal of your application. Aesthetics play a great role in marketing, that’s why you need to pay your attention to the way your product looks. The interface should be not only pleasant and engaging, but also easy to use.

Step #5: Development life cycle

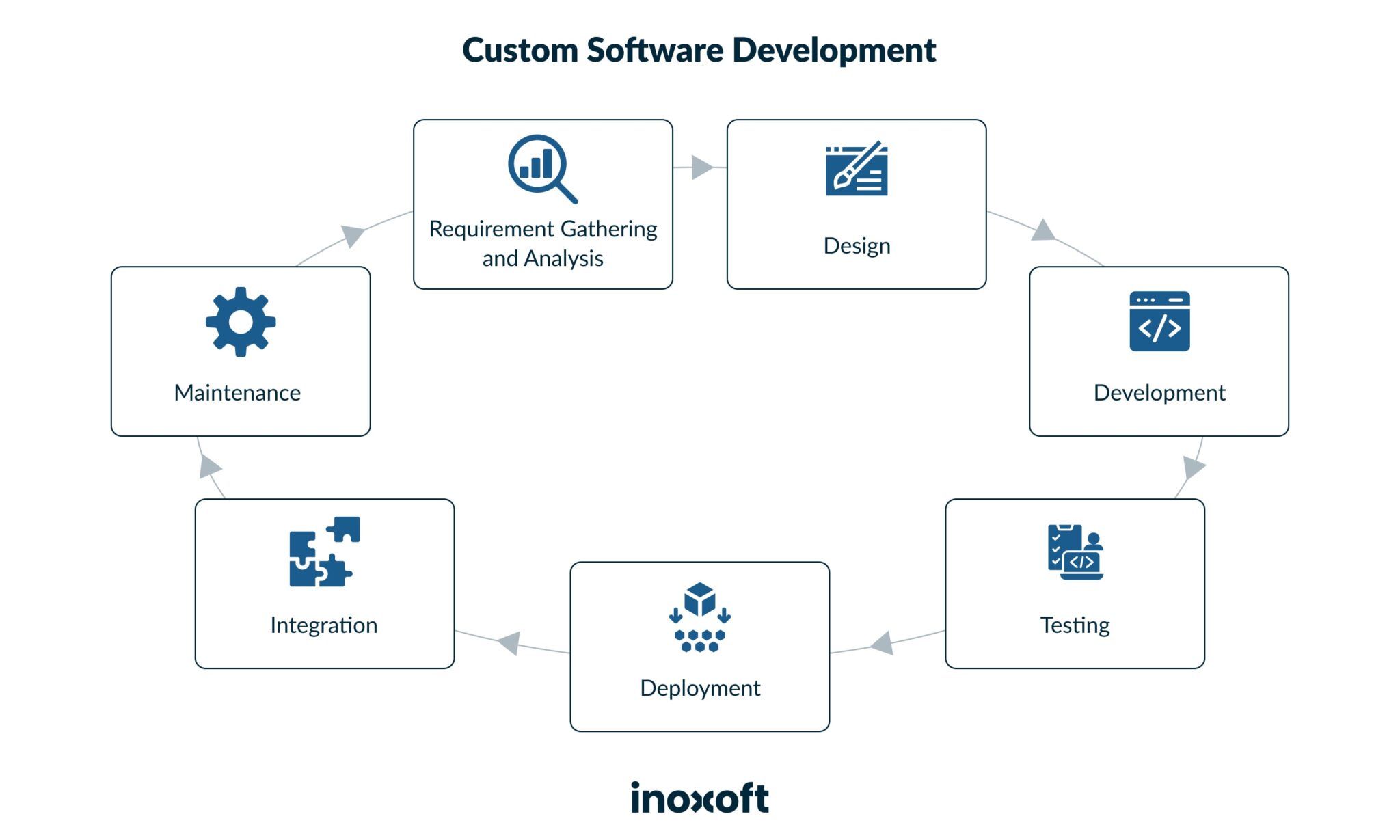

After you’ve done all the preparational steps, it’s time to transform your design into a working product. Neobank development life cycle consists of several steps. They are product technical documentation, development, testing, deployment & integration and maintenance.

Step #6: Launch

When your project is ready, it’s high time you showed it to the world! To know if a customer is ready to use your product, it’s essential to identify your target audience and be sure that it is interested in your neobank. Don’t forget about advertising your product.

Step #7: Feedback Analysis

You need to know the reaction of your audience. To get the necessary feedback, you can take a survey. It will help you study your customers better and improve the product according to their needs.

Step #8:Improvement

Successful product doesn’t end in the development stage. Maintenance is crucial if you want to stay relevant in the market and appeal to a larger audience. Digitalization brings something new everyday, so it’s essential to be able to follow the trends.

What Problems Can You Face When Developing a Neobank?

Now you know how to build a neobank. If you follow all these steps, the development process should not cause any difficulties. However, there still may be some challenges while developing a neobank. Let’s look at some of them.

Security

Your product will be connected to a large number of people’s data, that’s why it is essential to provide security. User’s data should not be leaked under any circumstances.

KYC

KYC is deciphered as “Know Your Customer”. It’s a demand to verify the identity of your client. It protects the company from frauds and hackers.

Two-factor authentication

To provide even more security, it’s important to implement two-factor authentication. This way, the chance of your customer’s account being hacked is lesser.

Fast payment

Neobanks are made to provide people with fast and convenient services. That’s why you need to ensure that all the operations are made fast and clients are satisfied with the speed of the application.

Regulations

Your application should be developed according to the law and not violate any rules. Keep your country’s regulations in mind while building your neobank.

Pros And Cons of Developing a Neobank From Scratch?

It’s clear to you how to develop a neobank from scratch. Still, you need to know basic pros and cons of developing your product from scratch to be ready for possible issues. Here are some of the best and worst aspects of such development.

Pros

- You are the owner of your product. You can choose an appropriate design, control implementation and maintenance process.

- The built infrastructure can be later turned into SaaS for other startups on neobanking. Moreover, your product can become an example for future developers.

- You can add new features to your application. With the help of your customers’ feedback, you can make your project close to perfect.

Cons

- Creating a neobank from scratch is a time consuming process. If you have some base to work with, it is much easier to start your project. Developing from scratch requires a lot of preparational steps.

- It’s not a secret, that creating a neobank means serious investments. For that reason it may be difficult for many developers to begin their project.

Cost of Developing a Neobanking App From Scratch

Neobank development is not only hard work and creative decisions, but also financial investments. As we have told before, it can become a problem for beginning developers, as many of them have the idea, but don’t have enough costs to make it come true. That’s why you need to get acquainted with the cost of developing a neobanking app from scratch.

The price of developing a neobank from scratch varies from $350 000 to $580 000. Of course, the price depends on many different factors. You need to take into account app complexity, tech stack used in banking and finance app development, location of the development team, type of cooperation. Features that you decide to include in your application also influence the final cost. The more complex features you decide to incorporate, the more money you will have to spend to make your app of a high quality. If you are a beginning developer, you have to be ready for high prices, as this is a common issue for a lot of startuppers.

Expert Advice for Developing a Neobank

When you only begin to do something you have never done before, it can cause a lot of stress. You already know all the pros and cons of developing a neobank from scratch and are acquainted with the main steps of neobank development. However, beginners usually need expert advice to make their journey easier.

Be Ready For Possible Issues

You may have unrealistic expectations, but you should not follow them in any way. Problems in the beginning are okay, and it’s good if you prepare yourself for them. As long as you are progressing and improving, difficulties only give you more experience.

Double Check Everything You Do

It means you shouldn’t fully rely on machine learning technologies, as sometimes they can let you down. You should also make reserve copies of the security system. When you have finished some process, it’s better to double-check it to be sure there are no mistakes.

Decide Things In Advance

You should decide on the architecture of the project beforehand. It’s always good to have some kind of a plan in your head before you start. Also decide on the mobile platform in advance. All these preparational processes will help you have a clearer vision of your future project.

Consider Inoxoft Your Trusted Partner

Inoxoft is a software development company that provides top-notch services for people all around the world. Our devoted team will provide you with personalized services, automated processes and high security. You can be sure that all your business expectations will be fulfilled.

Inoxoft provides fintech software development and banking software development. Moreover, we will tell you how to estimate fintech app development. Our company will help you calculate your costs, choose features to implement in your application and other important aspects of neobank development from scratch.

Inoxoft’s top priority is our clients’ content. That’s why we do everything to satisfy our customers’ business needs. Contact us and develop a neobank of your dreams!

Final Thoughts

In today’s world, people choose to do a lot of things remotely. Instead of standing in queues and spending hours commuting to a bank, now you can simply open an app and execute all the necessary transactions. Neobanks have substituted traditional banks for a lot of people. Developing your neobank is beneficial and profitable if you want to advertise yourself in the market.

There are many benefits of developing your neobank: lower operational costs, speed, effortless banking methods, use of technology and international payments. To make your neobank relevant and interesting, you have to implement a lot of basic and advanced features. Of course, there are going to be problems when you only start your development process, but if you follow all the important steps, be sure that the result will be worth it.

Neobanks can be called the future of the banking industry. If you feel like you are ready to start your own business in this sphere, it’s the right time to try!

Frequently Asked Questions

How much does it cost to develop a neobank?

So how much does neobank development cost? The price of developing a neobank depends on different factors, but the price usually varies from $350 000 to $580 000.

What’s the difference between neobank and bank?

Unlike traditional banks, neobanks provide their services digitally. They do not have usual bank branches and they are not licensed as banks. Neobanks are really popular now, in the digital age.

How do neobanks make money?

Neobanks earn money from every transaction their customers make. If you want to know more about how neobanks work, read the article!