Fintech industry remains in demand nowadays. The tendency shows that it will only grow bigger in the future. Financial transactions are always relevant, that’s why fintech apps have gained popularity over the years. There are many of them on the market, and each has unique solutions to offer. Fintech apps have changed the whole industry and have eased people’s lives drastically.

If you consider developing your own fintech app, there are many things you should take into account before you start. The main thing you need to learn better is fintech app development cost. There are many factors that influence the cost of developing a fintech app, that’s why it’s difficult to have one definitive answer to this question. However, it’s still possible to estimate fintech app building costs if you dive into the topic.

It’s not a secret that estimating your budget is extremely important to create a successful product. This guide will tell you everything you need to know about fintech app development prices and will answer the question of how to estimate fintech app development. If this topic interests you, scroll down.

- Most Common Approaches to Fintech Development App Estimate

- Factors Influencing the Cost of Developing a FinTech App

- Product Requirements

- Interactive UI/UX

- Location of the development partner

- Required time

- App Maintenance

- Advanced technologies used

- Tools and languages used

- Features integrated

- Variants of Cost of Developing Fintech App

- Cost defined by types of applications

- Cost defined by types of teams

- Cost based on location

- Risks in Estimation of MVP Development

- How Do We Estimate the Price of Fintech App Development at Inoxoft?

- Final Thoughts

Most Common Approaches to Fintech Development App Estimate

Even though there are many variants of the cost of developing a fintech mobile app, the approaches of fintech development app estimate are mostly the same. The estimation process consists of a couple of stages. Each of these stages helps you make a rough estimate.

- Breakdown. At this stage, every part of the app is being considered and sorted by priority. There are some must-have features, items that are beneficial for the app, and ones of low priority.

- Developer estimation. Now it’s time for developers to assess how long will it take to program every function of the app. The time required for programming also influences the fintech development app price.

- Project manager estimation. The main task of a manager is to find a balance between quality and price. Development team estimates should be reconsidered by the PM along with the hours required for internal and external communications, bug fixing, design, and so on.

- Final estimation. When all the necessary corrections are made, the final product is shown to you. This is the last stage of the fintech development app estimate.

Factors Influencing the Cost of Developing a FinTech App

How much does it cost to develop fintech app? Many factors and conditions may impact your budget.

Product Requirements

App requirements encompass two core aspects significantly affecting the overall costs:

- Project scope. It refers to the project objectives, deliverables, features, functionalities, constraints, and requirements. As the scope expands, the project size increases. It leads to a proportional rise in the required hours and resources.

- Product complexity. It depends on how sophisticated the concept and logic of your software product are. Complex apps often require more skilled developers, thorough testing, and more iterations to ensure they function correctly and securely.

In addition to these functional requirements, non-functional ones are also essential. You should ensure high scalability, security, usability, dependability, and performance. It demands extra resources, expertise, and time, increasing development costs.

Interactive UI/UX

An intuitive and easy-to-use interface enhances the overall user experience. It involves several design considerations, such as selecting appropriate fonts, using simple and concise language, and utilizing white spaces effectively.

Also, make sure users can easily navigate the app, understand its functionalities, and access the necessary information. It’s critical for user satisfaction and guarantees the app’s success.

The cost of hiring talented designers and the time required for design iterations impact the overall development budget.

Location of the development partner

The hourly rates of development teams vary significantly from country to country. For instance, developers in the US typically charge higher hourly rates than teams from India, Ukraine, or Poland. The hourly rate reflects the cost of living and market demand.

Required time

A shorter delivery time frame demands more extensive and efficient teamwork to meet the project deadlines. It often results in higher development costs, as experts might need to work overtime. Besides, they sometimes need additional resources to meet the accelerated schedule.

At the same time, a longer development timeline reduces the immediate resource demands. However, it may lead to higher costs due to extended project management, overhead, and potential opportunity costs.

App Maintenance

Regular maintenance ensures the app functions smoothly, remains secure, and complies with evolving industry standards. It includes fixing bugs, updating software components, and addressing security vulnerabilities. The ongoing maintenance cost accumulates over time. So, consider it in the overall app cost.

Providing technical support to users is integral to maintaining a fintech app’s reputation and ensuring customer satisfaction. The cost of technical support staff, resources, and tools is also an essential part of the maintenance budget.

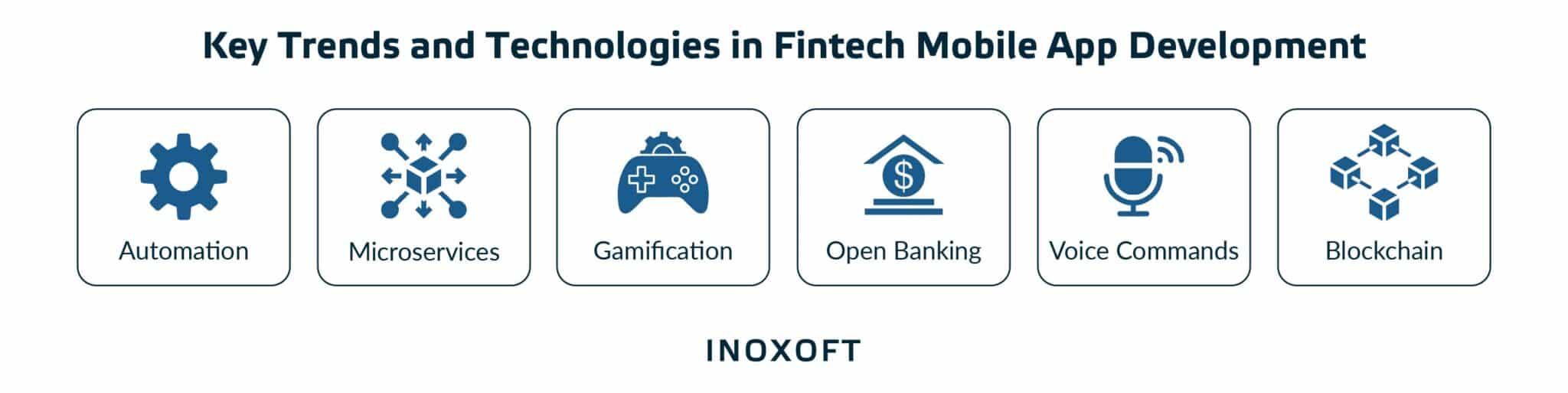

Advanced technologies used

What else affects the development cost? Progressive technologies are among the most critical factors. Let’s look at the most popular ones.

Digital analytics

Digital analytics enables collecting, analyzing, and presenting consumer financial data and insights. Thanks to this functionality, users access and track their financial activities, including purchases, savings, and investments. It provides clients with valuable information to make informed decisions and meet their financial goals.

The more advanced and comprehensive the analytics functionality, the more development time, expertise, and resources it requires. Such features include predictive modeling, real-time data processing, data visualization, customizable reports, etc.

Blockchain

Blockchain-based systems facilitate faster, more secure, and cost-effective payments, reducing the need for banks. Implementing peer-to-peer blockchain payments needs in-depth knowledge and expertise, raising development costs.

The choice to incorporate blockchain depends on the specific use case and its benefits to end users.

Artificial intelligence

AI plays a critical role in modern fintech applications. It offers multiple functionalities to enhance user experience and provide valuable insights. For example, you can add user-friendly chatbots, financial planning and analysis, fraud detection, etc.

AI integration increases the overall development cost due to the complexity and expertise required.

Tools and languages used

To estimate the project’s expenses accurately, carefully choose the technology stack for your fintech application. There are three distinct types of such solutions:

Native applications

These apps support a single platform, either iOS or Android.

- Native iOS applications use technologies like Apple Xcode, SWIFT, Objective C, and the iOS Software Development Kit (SDK).

- Native Android apps, on the other hand, are based on Android Studio, Java, Kotlin, and the Android SDK.

The choice between native iOS and Android app development depends on your target audience, budget, specific features, and performance requirements.

Cross-platform applications

Cross-platform apps work seamlessly on multiple mobile platforms, including iOS and Android, with a single codebase. They streamline the development process and reduce the need for maintaining separate codebases.

Developers use the following technologies to build cross-platform apps:

- NativeScript adopts JavaScript, TypeScript, or Angular.

- Xamarin enables developers to use C# and .NET.

- Flutter allows for the Dart programming language.

Hybrid applications

Hybrid applications combine elements of native mobile apps and web applications. They suit multiple platforms, including Android, iOS, and web browsers.

You need technologies like PhoneGap (Apache Cordova), HTML5, CSS, and JavaScript to build a Hybrid app.

Hybrid apps are a practical choice for businesses looking to reach a broader audience without the cost and time associated with fully native development.

Features integrated

The number and complexity of features integrated into an app are critical in shaping the development costs. Here are the most important functions:

- Tracking and management dashboard

- Multi-factor authentication (MFA)

- Know your customer (KYC)

- User profile

- Payments

- Card management

- Admin panel

- Notifications

Variants of Cost of Developing Fintech App

Now that you know how to estimate fintech app development costs, it’s time to consider different variants of these costs. It has been mentioned that many factors affect the final price of the app.

Now it’s time to take a look at some numbers to know what to expect from the development process and how to organize your budget. The average cost of developing a fintech app is $50 000-$300 000. Still, a lot of things can have a significant impact on the final price.

Cost defined by types of applications

The banking app includes a client-side app and admin panel, that’s why its cost is the highest out of all the types of applications. The investment app allows users to make careful decisions with the help of analytics data. Consumer finance manages the expenses of the user and helps with various financial operations. Insurance applications answer all your questions about the insurance company. The lending app allows you to borrow money without a government-regulated creditor, which is very convenient.

Here’s what the approximate calculation looks like, considering the $50 hourly rate:

|

Type of app |

Required time |

Cost |

|

Banking app |

1,250 |

$62,500 |

|

Lending app |

1,230 |

$61,500 |

|

Insurance app |

1,310 |

$65,500 |

|

Investment app |

1,260 |

$63,000 |

|

Consumer finance app |

1,180 |

$59,000 |

Now, let’s consider each financial application type in more detail.

Features development time estimation of a banking app

Banking apps are solutions financial institutions provide to let users manage their accounts, conduct financial transactions, and access other services directly from their smartphones.

Here are some of the most well-known banking apps:

- Monobank is a Ukrainian digital bank known for its user-friendly interface and various features, including budgeting tools.

- Revolut is a UK-based app with multi-currency accounts, international money transfers, and cryptocurrency trading.

- Chime is a US-based neobank offering a mobile app with early direct deposit, no-fee accounts, and a roundup savings program.

Now, how much does fintech cost? It depends on the development time of the required features:

|

Features |

Development time, hours |

|

Authorization |

80 |

|

KYC |

90 |

|

User profile |

80 |

|

Account activity |

60 |

|

Transfers |

140 |

|

Bill payments |

100 |

|

Cards management |

80 |

|

Security |

50 |

|

ATM & bank locator |

90 |

|

Settings |

60 |

|

Support |

120 |

|

Admin panel |

300 |

|

Total |

1,250 |

Features development time estimation of a lending app

Lending apps provide access to quick and convenient short-term loans, personal loans, or other financial products through users’ smartphones or web interfaces. They are suitable for streamlined loan application processes and rapid approval.

Consider the following examples of lending apps with decent functionalities:

- ZestFinance provides advanced underwriting and risk assessment tools. It helps lenders make more informed decisions about clients with little or no credit history.

- Dave is a US-based personal finance app that provides small-dollar cash advances, budgeting tools, and predictive alerts. With its help, users avoid overdraft fees.

- Brigit offers cash advances and financial tools. Users can manage their finances and avoid overdraft fees.

This table will help you determine what features to include and how many hours it will take to develop them.

|

Features |

Development time, hours |

|

Authorization |

80 |

|

KYC |

90 |

|

User profile |

80 |

|

Load management |

60 |

|

Payment & billing |

100 |

|

Transactions & EMIs |

80 |

|

Withdrawals |

120 |

|

Transfers |

40 |

|

P2P lending |

60 |

|

Settings |

20 |

|

Support |

170 |

|

Admin panel |

330 |

|

Total |

1,230 |

Features development time estimation of an insurance app

With insurance apps, policyholders and potential customers manage their insurance policies, submit claims, access policy information, obtain quotes, and more.

Let’s overview some popular types of insurance apps:

- Specific insurance apps for car, health, home, pet, life, and travel. With these apps, users manage their insurance policies, file claims, request quotes, and access features.

- Policyholder communication apps. These solutions serve as a communication channel between policyholders and insurance companies.

- Insurance marketplace apps. Such applications allow clients to explore and purchase coverage.

- Insurance broker apps. Thanks to these apps, insurance brokers, agents, and intermediaries streamline the insurance sales and advisory processes.

Here’s how long it takes to develop insurance application functions:

|

Features |

Development time, hours |

|

Authorization |

80 |

|

KYC |

90 |

|

Profile |

80 |

|

Policy |

40 |

|

Quotes |

90 |

|

Claims management |

110 |

|

Files upload |

40 |

|

Payments |

120 |

|

Settings |

20 |

|

Support |

90 |

|

Insurer module |

150 |

|

Car insurance specifics |

40 |

|

Health insurance specifics |

40 |

|

Admin panel |

320 |

|

Total |

1,310 |

Features development time estimation of an investment app

Investment apps facilitate and simplify investing in financial markets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), etc. They include access to investment accounts, trading tools, and financial information. Also, such apps provide various investment options for making informed financial decisions.

Here are some examples of famous investment apps:

- Acorns focuses on micro-investing. It also handles rounding up everyday purchases to the nearest dollar and investing the spare change in a diversified portfolio.

- Robinhood is a commission-free trading app. Users can buy and sell stocks, options, cryptocurrencies, and ETFs.

- CNBC provides access to market news, analysis, and financial content. With its help, investors stay informed and make data-driven decisions.

Pay attention to the following investment app features and the approximate time to develop them:

|

Features |

Development time, hours |

|

Authorization |

80 |

|

KYC |

90 |

|

Onboarding survey |

70 |

|

Investment portfolios |

170 |

|

Personal profile |

80 |

|

Withdrawals & deposits |

130 |

|

Dashboard |

160 |

|

Support |

160 |

|

Admin panel |

320 |

|

Total |

1,260 |

Features development time estimation of a consumer finance app

Consumer finance apps cover managing personal finances and budgets, tracking expenses, saving money, and making informed decisions. They typically connect to users’ bank accounts, credit cards, and other financial accounts. Such apps provide a comprehensive view of financial statuses.

Here are some popular consumer finance apps:

- Mint links users’ accounts and tracks spending. Also, it assists with setting budget goals, receiving bill reminders, and accessing credit scores.

- MoneyLion combines financial products, investment options, and credit-building tools.

- Finch is for saving and managing money more effectively. It offers automated savings, budgeting, and expense tracking.

Here’s how long it takes to develop features for a customer finance solution.

|

Features |

Development time, hours |

|

Authorization |

80 |

|

KYC |

90 |

|

User profile |

80 |

|

Account activity/Dashboard |

150 |

|

Account management |

70 |

|

Spending and income tracking |

40 |

|

Gamification |

60 |

|

Reminders |

40 |

|

Advice |

60 |

|

Settings |

30 |

|

Support |

170 |

|

Admin panel |

310 |

|

Total |

1,180 |

Cost defined by types of teams

The in-house development team gives you the possibility to have total control over the work of your developer. You also are able to engage in the process in case of an emergency. A local app development agency is also a good option if you want to take part in the development process. Freelance developers allow you to have deep insight into the process, so you can easily monitor everything that’s happening. Outsourcing development agency doesn’t require taking a lot of risks, and that’s why it is preferred by many people.

| Type of team | Cost of development |

| In-house | $90 000 |

| Local agency | $120 000 |

| Freelancers | $30 000 |

| Outsource agency | $40 000 |

Cost based on location

We’ve compiled a table of app developer salaries based on regional data obtained from Glassdoor:

|

Region |

Outsourcing country |

Hourly rate (USD) |

|

Eastern Europe |

Ukraine |

|

|

Poland |

$22 |

|

|

Hungary |

$16 |

|

|

Czech Republic |

$23 |

|

|

Western Europe |

France |

$22 |

|

Germany |

$33 |

|

|

United Kington |

$27 |

|

|

Sweden |

$41 |

|

|

North America |

USA |

$53 |

|

Canada |

$28 |

|

|

Mexico |

$17 |

|

|

South America |

Argentina |

$12 |

|

Brazil |

$13 |

|

|

Chile |

$23 |

|

|

Colombia |

$12 |

|

|

Australia |

Australia |

$30 |

|

Asia |

Philippines |

$14 |

|

India |

$6 |

|

|

Japan |

$28 |

|

|

China |

$34 |

Now, let’s consider how these rates affect the approximate price of developing a specific application.

|

Type of app |

The USA, $53 |

Ukraine, $15 |

India, $6 |

|

Banking app |

$66,250 |

$18,750 |

$7,500 |

|

Lending app |

$65,190 |

$18,450 |

$7,380 |

|

Insurance app |

$69,430 |

$19,650 |

$7,860 |

|

Investment app |

$66,780 |

$18,900 |

$7,560 |

|

Consumer finance app |

$62,540 |

$17,700 |

$7,080 |

It’s a common fact that prices in the USA are always the highest. Ukrainian prices are much cheaper, however, they are still higher than Indian ones. In Ukraine, you can count on the good quality of the product. Indian prices are the lowest, but the reason behind that is that the quality of Indian development leaves much to be desired.

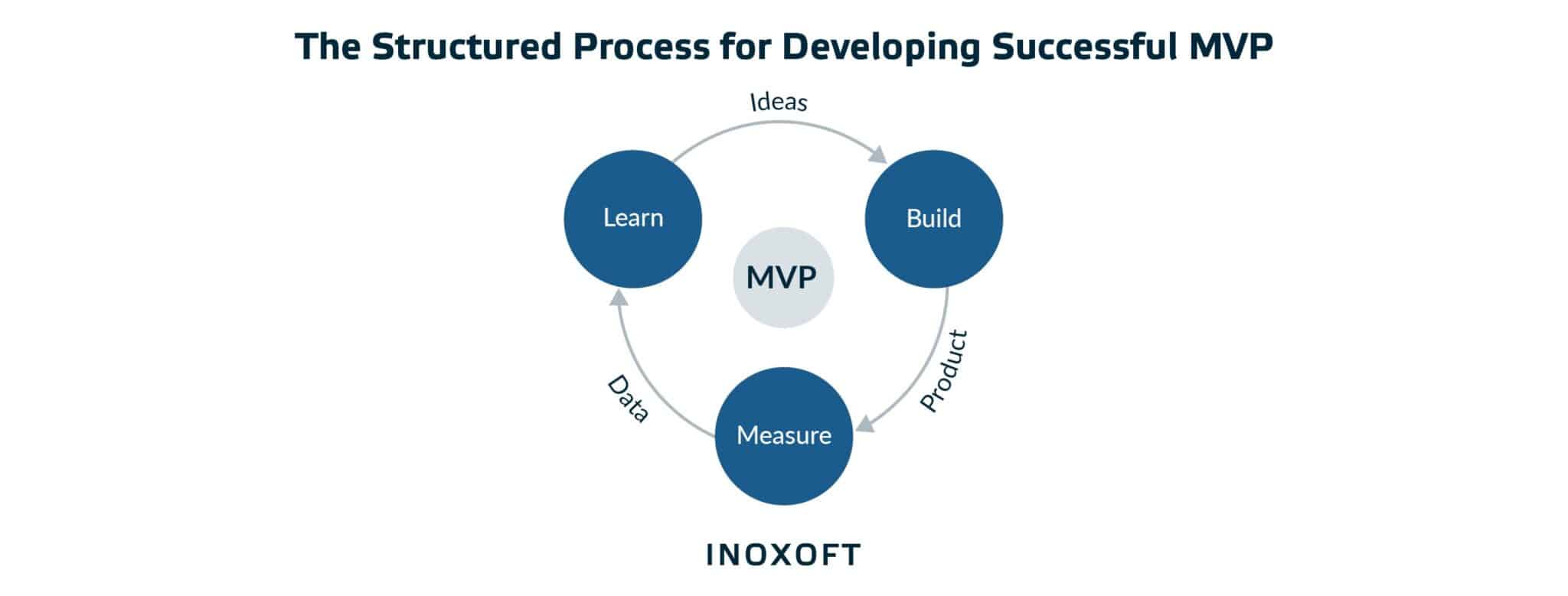

Risks in Estimation of MVP Development

Any development process has its risks and challenges you may face in the process. It’s important to be aware of them and know how to fix possible problems. Let’s have a look at the main risks in the estimation of MVP development and figure out how to solve the main problems that might occur.

- Cybersecurity. It’s vitally important to keep your data in security, however, it’s not always that easy to avoid fraud and hackers. Any leak of the data can be an end to your startup, and it sounds really terrifying. It’s essential to write secure code, use data encryption properly and test the app. Keep in mind, that safety is the key to the client’s trust.

- Big Data and AI incorporation. Big Data and Artificial Intelligence are the basis of any web development process. However, their use of them can also cause some confusion. Sometimes it’s difficult to sort out Big Data, as it’s coming from many different sources. That’s why the optimal solution to this issue is hiring Big Data analysts who will help you cope with all the complicated information. Moreover, the analysts can save your frontend and backend hours.

- User retention issues. The continuous use of your fintech product by customers is user retention. This can happen if the quality of your product is poor. There are many ways to avoid user retention, but there is no universal solution to this issue. You need to constantly improve your product, update it, and change its functionality. This is the ultimate way to perfect your product.

How Do We Estimate the Price of Fintech App Development at Inoxoft?

Inoxoft has a great experience in the fintech industry. Our company provides top-notch fintech development services for clients all around the world. With the help of Inoxoft, our customers are able to invest in the development of fintech software solutions. We provide fintech development services, fintech app security solutions, cloud computing in banking, and software development time estimation. All these services are helpful for customers who want to estimate the price of their product.

Inoxoft can help you estimate your costs and manage your budget accordingly to your business needs and expectations. Our company uses the most effective approaches to estimate costs, as they are reliable and stood the test of time. We can help you create a list of items and features that interest you and add up their prices. Moreover, we will help you manage your time, which also influences the final cost of the product. It’s extremely important to have a couple of estimation stages because every development phase requires new financial resources.

Our company is always open to working with clients who are interested in every development stage. We will tell you everything you need to know and will guide you through the whole process. If you feel that you need a consultation and a devoted partner, you can rely on Inoxoft. Contact us, and we will help you estimate your costs!

Final Thoughts

The fintech industry gets more popular each year. In today’s world, there are many ways to manage your financial resources. People nowadays cherish simplicity and comfort, that’s why fintech applications are in such high demand. The market is full of such applications, as each of them has something unique to offer. No wonder a lot of developers want to create their products in the fintech industry. Not only is it profitable, but it is also a great possibility to succeed in the world of app development.

Before you create your product, it is essential to estimate your costs. There should be a couple of estimation stages, such as breakdown, developer estimation, project manager estimation, and final estimation. Many things influence the cost of app development: fintech application types, essential features, choosing a programming language, and so on.

It’s important to consider all the factors that influence the cost of the app. Proper estimation can help you solve all the issues that arise during the development process. If you feel like you need help, contact Inoxoft and make your business plans come true!

Frequently Asked Questions

How much does it cost to build a fintech app in the USA?

Building fintech app in the USA is expensive, but the quality is definitely worth it. The price of building fintech app in the USA varies from $180 000 to $500 000.

How long does it take to develop a FinTech app?

The development timeline for a fintech app varies significantly based on the app's complexity and features. It also depends on the team's size and expertise. Developing a simple solution may take 3 to 6 months, while more complex apps need up to a year or longer.

Can you build quality fintech app in Ukraine?

You can count on a good quality from building fintech app in Ukraine. The cost will be lower, so for many people Ukraine is an ultimate location to develop their apps.