At some point, every person experiences money shortages. This happens due to inexperienced money management, sudden job loss, or even economic crisis and unpredicted circumstances. With the inability to receive a monthly salary and pay bills, people engage in borrowing money practices and take multiple credits. The European Central Bank made research according to which banks expect a net increase of 4% in demand for consumer credit and other lendings to households.

So, what is the peer-to-peer loan lending app development like in 2024? That's what we are going to discuss today, along with answering the question of "how to build a loan app?".

- Money Lending App Development in 2024

- Why is P2P So Popular?

- How does a money loan app work?

- Benefits

- Top P2P Lending Apps for Today

- Home loans

- Car loans

- Student loans

- Medical loans

- Small business loans

- Personal loans

- Best P2P Loan Apps on the Market

- Prosper (for users with established credit history)

- Funding Circle (for small businesses)

- Peerform (highly-rated among users)

- Upstart (for users with limited credit history)

- Payoff (for fair credit)

- Technologies Used to Make Lending Apps ‘Smarter’

- Money Lending App Development: Challenges To Consider

- Financial sector

- Regulatory compliance

- Finding a partner

- Do You Know How to Create a Money Lending Mobile App?

- 1. Study your target audience

- 2. Choose a platform

- 3. Think about the features your app should have

- 4. Find SDK/APIs and libraries that are available

- 5. Create your app’s UI/UX design

- 6. Develop an MVP

- 7. Gather user feedback

- 8. Don’t forget about app maintenance

- P2P Lending App Security

- Legal Part of Money Lending App Development

- How Much Does It Cost To Build A Money Lending App?

- Development team

- Integration with external systems

- App complexity

- Consider Inoxoft Your Trusted Partner

- To Sum Up

Money Lending App Development in 2024

In the financial sector, the process of lending money by individuals or organizations to other individuals or organizations is called giving a loan. The one, who borrows is exposed to debt that has to be fully repaid together with the loan interest – a percentage that accumulates from the loan costs and is paid together with the monthly repayment sum.

In times of quarantines and the need for money loans, financial operations are being transformed and digitized. The financial sector turns to loan servicing software and lending software development. So, now, money lending is mostly performed through apps. There are three possible ways to request a loan online

- through banks or traditional financial institutions

- with the help of credit unions

- via P2P lending platforms

Banks and credit unions appear to be the stricter institutions that require more obligatory documentation to apply for a loan. What’s more, they cannot give you full support as are used to provide services only within their working hours. The idea of how a bank/credit union and a borrow money app can differ is given in the table below.

| Banks/Credit Unions | P2P Lending Apps | |

| Annual Percentage Rate | Low | High |

| Loan Approval Time | Long | Fast |

| Application Requirements | Strict | Flexible |

| Annual Revenue, High Credit Score, Permanent employment Information | Obligatory | Optional |

| Support Service | Offline/online, limited | 24/7 |

| Preferable Loans | Big | Any type |

| Percentage of Approval | Depends on the client’s banking history | High |

As it is seen from the table, P2P platforms are more user-oriented and require fewer bank-related strict procedures to receive a money loan. That is, perhaps, one of the many reasons, users find the platform worth their choice.

According to a source, recently, traditional bank loans were substituted by P2P money lending apps. And, how to create a money lending app? Let’s imagine, there is a need for a peer-to-peer lending app on the market. P2P lending works on platforms, where the person investing money and the one that borrows costs can be connected without any intermediary, i.e. the bank. It is forecasted that by 2025 the value of P2P platforms will equal one trillion U.S. dollars.

Why is P2P So Popular?

A P2P lending website or loan app is an online platform that connects people, who need to apply for a loan and the ones, who can lend directly. Here, there is no mediator like the bank, because the platform is the mediator itself. The P2P lending app is designed to monitor the two parties that signed a deal and collect financial data such as service fees.

China has managed to outrun the world and became the first to use P2P lending apps as early as the 2000s. China’s first money lending app was WeLab. Then other countries followed the trend and numerous cash lending apps were created: in 2005 the world met Zopa (U.K.), in 2006 Prosper Marketplace (U.S.), in 2007 the Trustbuddy AB money lending application was launched (Sweden), and, gradually, the online lending marketplace experienced major growth. Today, there are lists of fully functional apps that loan money in every country.

How does a money loan app work?

If you want to apply for a P2P loan, you need to follow these steps:

- Apply online. This step includes a credit inquiry (soft/hard).

- Risk category assignment. Your credit rating will generate the interest rate and the loan terms.

- Request review. Moneylenders will expect you to mention why you need the loan and why it is a non-risk case to lend you money. Then, they will make bids for you to accept or pass on.

- Loan acceptance. Review the terms and conditions, and accept the loan. The money will be transferred to you according to the P2P platform policy.

- Monthly payments. Return money on time every month. Late payments trigger a decrease in credit score and increase late payment fees.

Benefits

- For Lenders

Lenders have a great understanding of the value they bring by establishing money loan services online (websites) and on mobile (Android/iOS apps). The biggest benefit of having such an app is that there is no face-to-face communication with customers and, this way, operational costs are being saved. Among the other benefits for lenders, there are:

- KYC procedures are being sped up

- Multiple customers are served at a time

- Underserved markets are being reached

- Lending products are improved with AI

Besides the lenders, the biggest benefit of a lending app belongs to customers.

- For Customers

Loan apps make life a bit easier for customers as they give much-needed money and remove face-to-face interaction with the lender. So, among the advantages one can speak about:

- Virtual loan application without visiting the office

- Money funding within 24 hours

- Personal information is secured with Rest

- Best available options for shopping

- Loan repayment within one app

Top P2P Lending Apps for Today

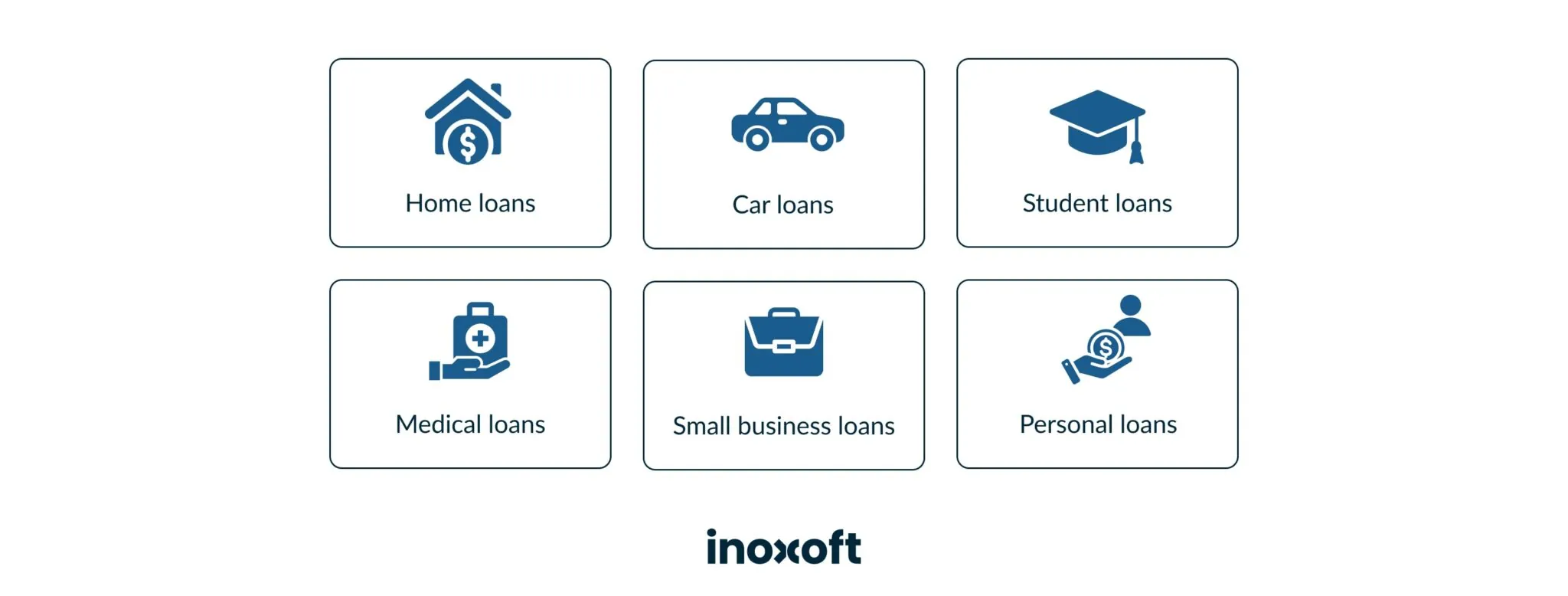

Various money loan apps have different types of offers. If you want to know how to create a loan app, get to choose your niche first. Borrowers can apply for such loans to cover their needs as

Home loans

A mortgage loan is the other name of a home loan. It includes a specific sum of money needed to buy a home and furnish it. The sum and interest rate to be repaid are determined by the customer’s monthly payment ability. Most of the platforms that specialize in home loans provide such an option as the home loan calculator.

Car loans

Car loans work pretty much the same as home loans. You request a specific sum of money to buy a car and accept the interest rate you will have to pay together with the monthly payments. The interest rate here may be very high, which is a drawback.

Student loans

Student loans usually include borrowing money for a tuition fee to a college or university. As higher education is not free of charge (only if you study hard and receive a grant), students need to pay for their college studies and, further, university education. Some of the best colleges and universities have high tuition fees and the only way students can manage to pay them (unless parents can afford to help) is to engage in a P2P lending process.

Medical loans

Most of the people worldwide in developed countries have medical insurances that cover all the necessary healthcare expenses. However, for some underdeveloped countries and people, who are not the country’s citizens, or cannot afford to have full insurance coverage, there is a potential need to request a loan. There are different emergency cases of health deterioration or even obligatory surgeries. Hence, people rely on the 2P2 lending platform to get the needed help. Of course, they receive their borrowed money together with the interest rate to repay.

Small business loans

The loans that are needed in business are usually the big ones. However, these are given usually after a thorough investigation of the business and its plans to grow. Startups rarely receive loans from P2P lending platforms as there is no confidence in the business, which is only starting its services, that it will be prosperous and grow.

Personal loans

Personal loans require little sums of money and the target population that experiences money shortages but needs to pay the bills, buy products and services, and so on. These loans are very specific and require less obligatory documentation while applying to get money. The interest rates here are minimal, which makes these loans quite popular among populations.

The first five types of loans are considered for specific purposes. Personal loans, in their turn, cover the larger area of applicability. E.g. personal loans can be taken to deal with emergencies such as sudden repairs, treatment, or financial difficulties.

Best P2P Loan Apps on the Market

According to Investopedia, there are the 5 best peer-to-peer lending apps as of December 2023. These are:

Prosper (for users with established credit history)

The P2P loan service in 2005. The company is proud to have helped borrowers obtain $770,000, proposed low rates of 7.95%, and allowed up to $40,000 per one loan.

| PROS | CONS |

| Low origination fee | Slow funding |

| Ability to change the monthly payment due date | Should have 3 credit accounts in use |

| High-interest rate maximum (35.99%) |

Funding Circle (for small businesses)

The company was founded in 2010 with 100,000 investors at its stake. The company helped more than 90,000 small businesses to grow.

No startup funding

Hard credit inquiry for general partnerships

| PROS | CONS |

| Open to business owners | For businesses with 3 years on the market |

| Fair personal credit | No startup funding |

| Fast funding | Hard credit inquiry for general partnerships |

Peerform (highly-rated among users)

The platform was founded in 2010 by Wall Street executives. To enjoy the app, users, who have an excellent credit history receive low-interest rates (5.99%). However, the maximum load possible is $25,000.

| PROS | CONS |

| Low-interest rate for users with excellent credit history | Low loan maximum |

| Non-existence of prepayment penalties | No 5-stage loans |

Upstart (for users with limited credit history)

The P2P lending software was founded in 2012 by former Google employees. Their initiative was to give a chance to any users (even the ones with limited credit records) to receive a loan they applied for. Throughout the years, the app received above $7.8 billion in consumer loans.

| PROS | CONS |

| Education/job history considered besides credit history | High maximum interest rate (35.99%) |

| High maximum loan amount | High origination fee (8%) |

| Fast funding | Co-signers are not allowed |

Payoff (for fair credit)

Payoff was launched in 2005 as of the first apps that let you borrow money. To request a loan you don’t need to have a perfect credit history. And, among the benefits, the loan interest rate is pretty low (5.99%). But, this app works only at specific locations.

Slow funding

Limited to certain locations

No joint applications

| PROS | CONS |

| Free FICO score access | Slow funding |

| No penalty prepayment personal credit | Limited to certain locations |

| Prequalification option | No joint applications |

Technologies Used to Make Lending Apps ‘Smarter’

Online loan websites or mobile loan apps belong to the fintech sector and are a type of renovation, process automation, and digitization. As fintech uses different technologies to ensure customer satisfaction, gain more clients and advance in its service provision, P2P money lending apps also use some of these technologies. For instance,

- Blockchain

- Smart contracts

- Big data

- Machine learning

- Artificial Intelligence

- Chatbots

Through Blockchain technology most of the lending apps can offer to borrow cryptocurrencies, e.g., Bitcoin, Ethereum, or Litecoin. This technology is also very secure. Big data together with AI and ML algorithms enhance consumer decision-making and allow active app users to choose the convenient interest rate and loan amount. Chatbots, in their turn, make the customer experience more personalized and minimize the load of lenders. With the help of each of the technologies, money lending becomes a better and more user-friendly experience.

Money Lending App Development: Challenges To Consider

Developing a money lending app can be a promising, yet challenging venture. Here are some key challenges you might encounter:

Financial sector

The financial industry, especially lending, is inherently complex: understanding the intricacies of lending, interest calculations, and financial regulations adds a layer of complexity to app development. It requires a deep understanding of financial processes to create a platform that is both user-friendly and compliant with industry standards.

Regulatory compliance

Legal regulations surrounding lending practices can vary significantly from one jurisdiction to another. Navigating the diverse legal landscape requires thorough research and ongoing compliance monitoring. Adapting the app to comply with different regulations if it operates in multiple regions can be a substantial challenge.

Finding a partner

Many money lending apps collaborate with traditional financial institutions or banks to facilitate transactions, manage funds, or comply with regulatory requirements. Establishing partnerships with banks involves negotiations, legal considerations, and integrating with their systems. The collaboration should align with the app’s goals and contribute to a seamless user experience.

Do You Know How to Create a Money Lending Mobile App?

Here is a list of the cost and features of developing money lending mobile app. It includes only the most relevant mobile loan app development features today.

1. Study your target audience

Do the groundwork and research your target users’ needs and pains together with the money loan market. The more your future app can relate to the customer needs and market expectations the more successful you will be among competitors. And, the closer you will be to understanding how to create a money-lending mobile app.

2. Choose a platform

Is your money lending platform going to be a website or it will also be available to tech-savvy mobile users? It can be both a lending website or a mobile money lending software. In both ways, consider a cross-platform loan lending app development. Discover what technologies to use in cross-platform development.

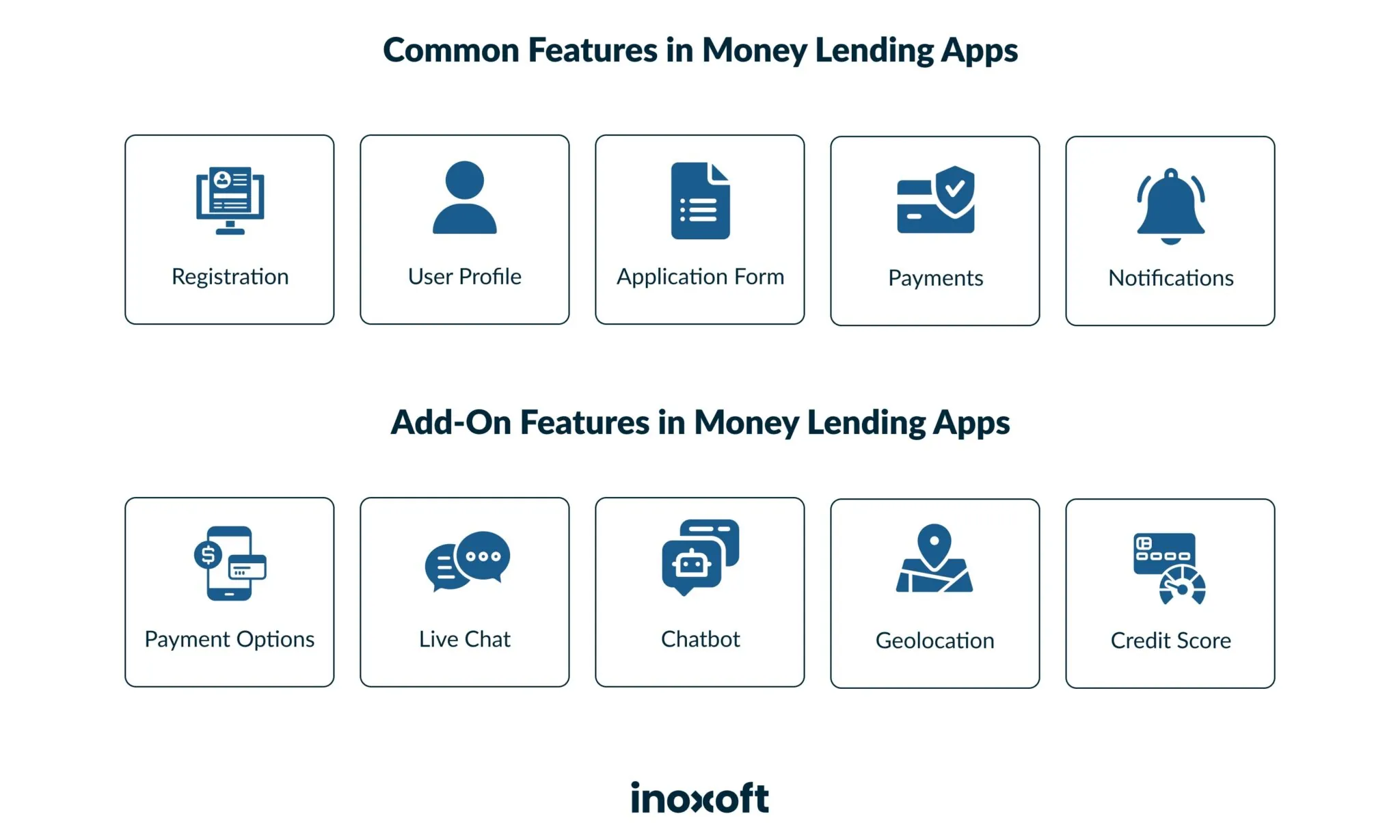

3. Think about the features your app should have

As the market is already full of loan app propositions, it is vital to produce your version of an app that will be competitive among its peers. How can this be done? Simply, by adding valuable features. For example,

- MVP features

- Add-on features

MVP features should provide the best functionality options and may include the following:

- Registration

- User profile

- Loans application form

- Payment log

- Notifications

Add-on features should give users a more personalized experience and offer:

- Payment options

- 24/7 live chat support

- Chatbot

- Geolocation

- Credit score

You can choose any features and add numerous add-ons, but remember, your app has to be unique to stand out among similar apps.

4. Find SDK/APIs and libraries that are available

There is an abundance of app building blocks present on the Internet and free to use. The only thing here is to figure out which ones you need the most.

For example, you can use Plaid (secure connection to bank accounts), Twilio (chat and 2-factor authentication), and Google, Apple, Facebook, and Twitter (quick login). The right pick of module combination can surely:

- Benefit in development

- Reduce costs

- Shorten the production time

- Enhance the app with useful features

5. Create your app’s UI/UX design

The right user-friendly interface and functional user experience can make your app a success from the start. For this reason, you need to create low-fidelity wireframes and high-fidelity mockups, carefully testing each screen. Perhaps, make a clickable prototype to produce a better user experience.

6. Develop an MVP

When UI/UX is ready and verified, build an MVP version of your P2P lending app. This will include a software engineer, loan app building, and web portal building, where you can administer loans. Add as many essential features as possible.

7. Gather user feedback

After the app was released, it is of great importance to start gathering valuable customer feedback. Some of the user comments may be an instrument towards improvement that has to be used wisely. Mobile performance metrics you should be measuring can be viewed here. The more insights you will get the better your app will function.

8. Don’t forget about app maintenance

If you think that app release is the last stage before getting customer satisfaction and monetary equivalent, then you’re wrong. The pace of technological progress is insane making trends, and features change all the time. To ensure your app is up-to-date it is vital to upgrade it and keep track of the tech changes, e.g. money lending app Android/iOs versions, the need for new convenient widgets, etc.

To make sure, the P2P money lending app will hit the market and receive top rates, you can always order a discovery phase, where the best software engineers and a business analyst will do all the work for you and describe each step, support and advance your idea, and many more to make your software unique and successful on the market. To read a detailed description of the discovery phase, click here.

P2P Lending App Security

Any procedure requiring money should be highly secure. Thus, during the peer-to-peer lending app development, you should make the app safe and secure for its customers. There are multiple ways to make the platform secure. These are:

- Authentication

The most common way to provide secure authentication for app users is biometric authentication (face recognition and fingerprint scanning), and two-factor authentication (strong password and email or phone confirmation of access). Also, you can use APIs to protect user data even more.

- Encryption

When taking a loan, users usually submit lots of sensitive information and receive money funding. Thus, the route of the money transfer as well as the personal data of customers should be securely hidden from third-party observers. What’s more, where there is money, there are cybercrimes and potential fraudulent actions. To avoid possible crimes and hacker attacks the connection of the P2P platform to servers should be highly encrypted. Also, you can use Rest and Transit to do the job.

Apps are being highly secured these days based on such legal compliance as GDPR and other international protocols, so there is no excuse if your app has security holes.

Legal Part of Money Lending App Development

The legal aspects of money lending app development play a pivotal role in shaping the framework and functionality of the platform. Several key components within this realm demand careful attention and adherence to regulatory requirements.

First and foremost, a comprehensive understanding of legal regulations governing lending practices: the development team must navigate a multifaceted landscape to ensure that the app aligns with regional and international financial laws. This involves in-depth research and continuous monitoring of legal changes to maintain compliance.

Сollaborating with legal experts or consultants is instrumental in addressing the intricacies of financial regulations. In-house or outsourced financial specialists can provide valuable insights, helping the development team navigate the complexities of interest calculations, risk management, and compliance.

In conclusion, the legal part of peer-to-peer lending app development encompasses a broad spectrum of considerations: from understanding the intricacies of financial regulations to adapting to diverse legal frameworks and establishing strategic partnerships with financial institutions. Navigating this legal landscape with precision is imperative to create a secure, compliant, and successful money lending app.

How Much Does It Cost To Build A Money Lending App?

The cost of developing a loan lending app may range from $50,000 to upwards of $400,000 — this significant range is attributed to various factors that impact the overall pricing. Here, we highlight key determinants that play a crucial role in shaping the development cost.

Development team

The skill set and expertise of the development team members directly impact their efficiency and the quality of the final product. Highly skilled professionals, such as experienced mobile app developers, UI/UX designers, and backend developers, may command higher hourly rates. Their geographical location plays a significant role in cost as well — development teams in regions with higher living costs typically charge more for their services.

Integration with external systems

Integrating with payment gateways is a fundamental requirement for a money lending app. The cost can vary based on the number of payment options you want to support, such as credit cards, bank transfers, or mobile wallets. Plus, some payment gateways may charge transaction fees, which should be considered in the overall financial plan.

App complexity

The complexity and breadth of features you want in your money lending app significantly impact the cost. Basic features might include user registration, loan application, repayment tracking, and notifications, yet advanced features like credit scoring algorithms, real-time data analytics, and fraud detection will add to the overall cost.

Consider Inoxoft Your Trusted Partner

Inoxoft is a fintech software development company providing banking software development services. We are experts in big data analytics in finance and will provide you with cutting-edge software at key. Look through some of the most outstanding case studies here.

If you don’t know how to build a p2p payment app, get a detailed and risk-free assessment from our expert team. Ask us about loan lending mobile app development and get the answers you need. Contact us right away. And that’s only a small part of the brilliant things we can do for you!

In software development, we always stick to all the needs and requirements of our clients. But, if we clearly see there is a better solution – we always share it with our customers. For instance, we can highlight all the advantages and disadvantages of mobile banking. And, our knowledge is not limited only to mobile banking. Our competency includes building peer-to-peer lending software and peer-to-peer loan software.

To Sum Up

With the pandemic, economic crisis, and unstable situations, money lending app development is becoming popular more and more. To produce such an app requires lots of steps and procedures, but with one great option available the customers will come in a flow.

The costs of a P2P lending platform can vary and highly depend on the features you want to include. Blockchain, Big Data with ML and AI, and chatbots can make the price higher but also make the app better in its performance. Think about what kind of app you’d like to produce and get our help right away with your lending application development.

Frequently Asked Questions

What is money lending app development?

Recently, traditional bank loans were substituted by P2P money lending apps. P2P lending works on platforms, where the person investing money and the one that borrows costs can be connected without any intermediary, i.e. the bank. In times of quarantines and the need for money loans, financial operations are being transformed and digitized. Thus, money lending is mostly performed through apps. There are three possible ways to request a loan online

- through banks or traditional financial institutions

- with the help of credit unions

- via P2P lending platforms

Why is peer to peer lending app development so popular?

A P2P lending website or loan app is an online platform that connects people, who need to apply for a loan and the ones, who can lend directly. Here, there is no mediator like the bank, because the platform is the mediator itself. P2P lending app is designed to monitor the two parties that signed a deal and collect financial data such as service fees.

How to create a loan app?

- Study your target audience

- Choose a platform

- Think about the features your app should have

- Find SDK/APIs and libraries that are available

- Create your app’s UI/UX design

- Develop an MVP

- Gather user feedback

- Don’t forget about app maintenance