Almost every day people have a necessity in peer-to-peer money transfer services. The most common reason to transfer money is to pay for a service/product, to repay a debt, to send money to relatives or sellers. And this list has many more options because it’s not just a one-time activity.

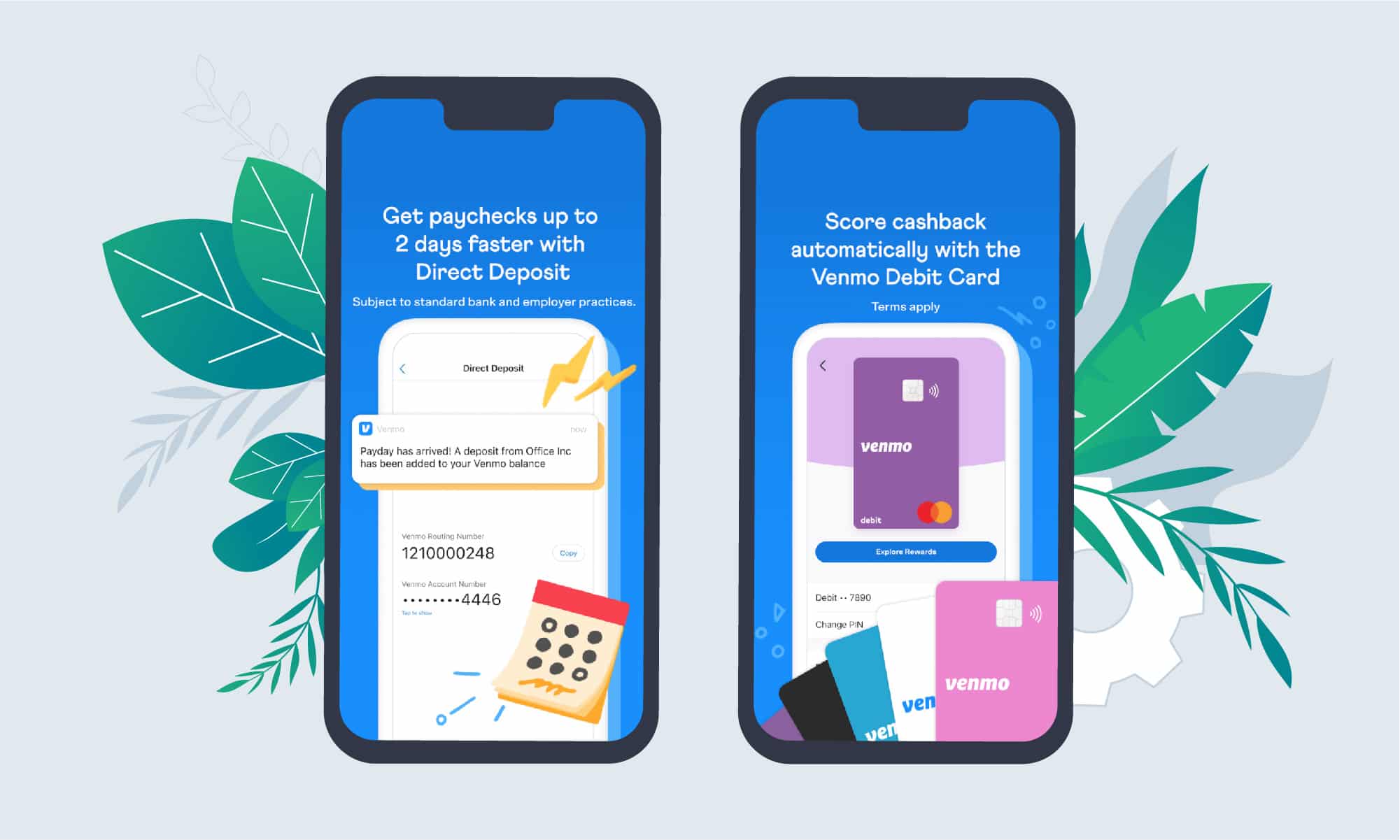

If you try sending your online funds to peers once, there’s a big chance you’ll never use any other payment option. Why? Online paying is an easy, convenient, on-the-spot, and contactless transaction. The world needs this technology more and more these days. Startups try to build a payment app like Venmo, because they understand that the type of payment application is in-demand and there’s a target audience to use it.

If you are a startup or an existing business, who wants to know how to build a p2p payment app, specifically how to make an app like Venmo, this article is what you’re looking for. Here, we will talk about:

- what is a peer-to-peer payment app?

- payment application’s market share

- types of P2P payment systems

- P2P payment app features

- how to create a p2p payment app like Venmo

- Inoxoft’s experience with payment apps

- What is a Peer-To-Peer Payment App?

- PayPal

- Cash App

- Zelle

- Types of Peer-to-Peer Payment Systems

- 1. Discrete Services

- 2. Banking Services

- 3. Social Platforms

- 4. Mobile OS systems

- Features of a P2P Payment App

- Real-time payments

- Transfers to bank

- Cash transfer security and user authentication

- Unique ID/ OTP

- Fingerprint security lock

- Simplicity of usage with seamless UI/UX

- Transaction history

- Customer support

- Chatbot

- Push notifications

- Account personalization

- Scan and pay touch-free

- Digital wallet

- Bill & invoice

- Cryptocurrency trading

- How P2P Payment Apps Work?

- Create an account

- Add a payee

- Specify the amount

- Confirm the transaction

- Get the receipt

- Why Choose P2P Payment App Development?

- Unique requirements handling

- Fast payment processing

- Improved transparency

- Higher security

- Lower transaction costs

- Steps to Create a P2P Payment App Like Venmo

- 1. Research your target audience and set up the purpose of the app

- 2. Choose a development team and a technology that will match your needs and expectations

- 3. Implement various online payment methods for your users

- 4. Think about the best ways to enclose a user’s account or card details

- 5. Engage in performance testing to ensure your system works well under different loads

- 6. Make sure to use ready-made solution APIs or build your own

- Consider Inoxoft your trusted partner

- Final thoughts

What is a Peer-To-Peer Payment App?

A peer-to-peer payment application is a user-oriented platform that allows two peers to send each other money via a bank account or debit/credit card. So, this app connects a buyer with the seller directly, and vice versa. Washington Post displays the top 3 P2P payment apps that are currently disrupting the world’s markets. These are:

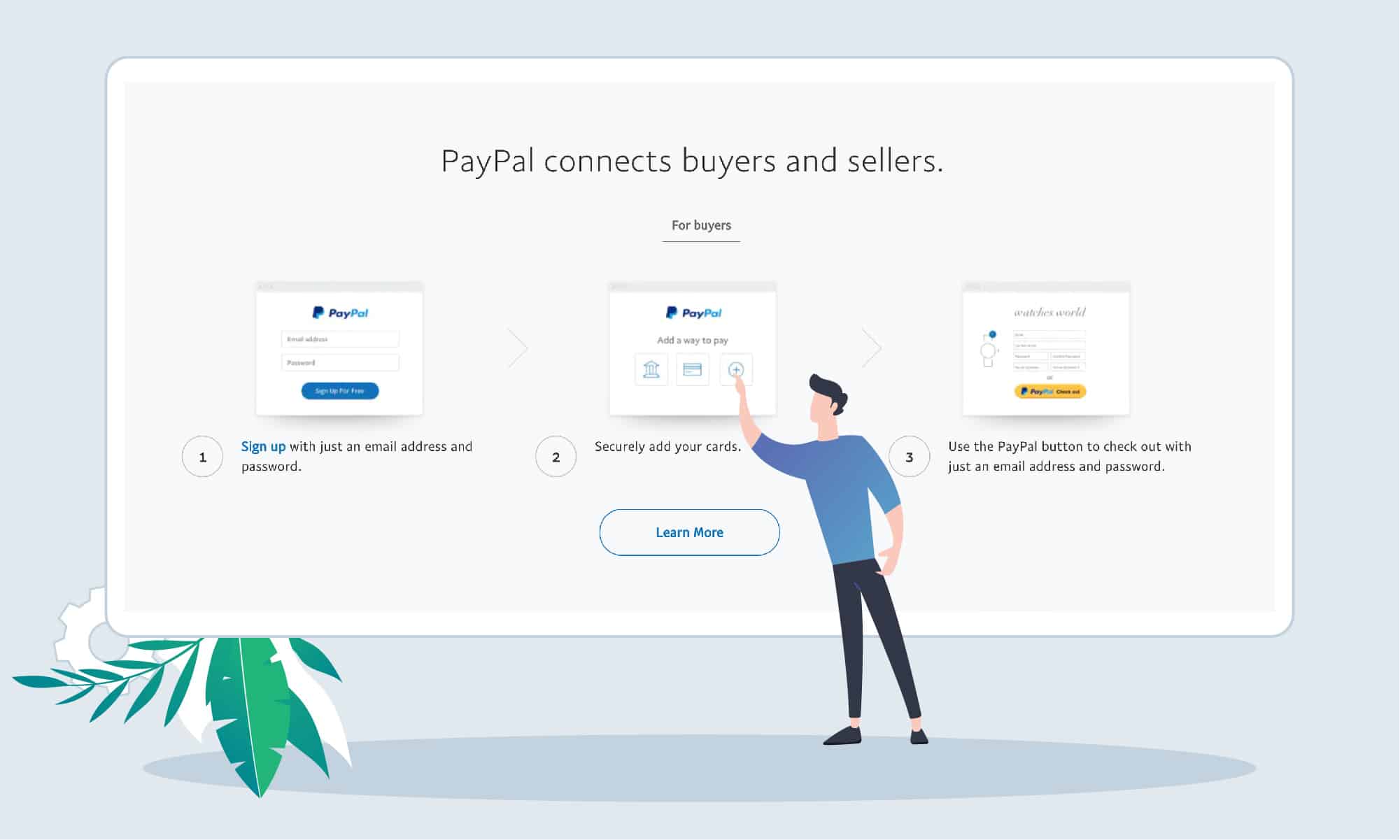

PayPal

The motto of PayPal is

PayPal connects sellers and buyers and has more than 200 million active accounts all over the world.

The benefits of PayPal are in:

- buying online

- sending money

- buying directly on eBay

- making secure transactions

- being simple and convenient in use

- being cross-platform and available worldwide

- being free-of-charge and upfront

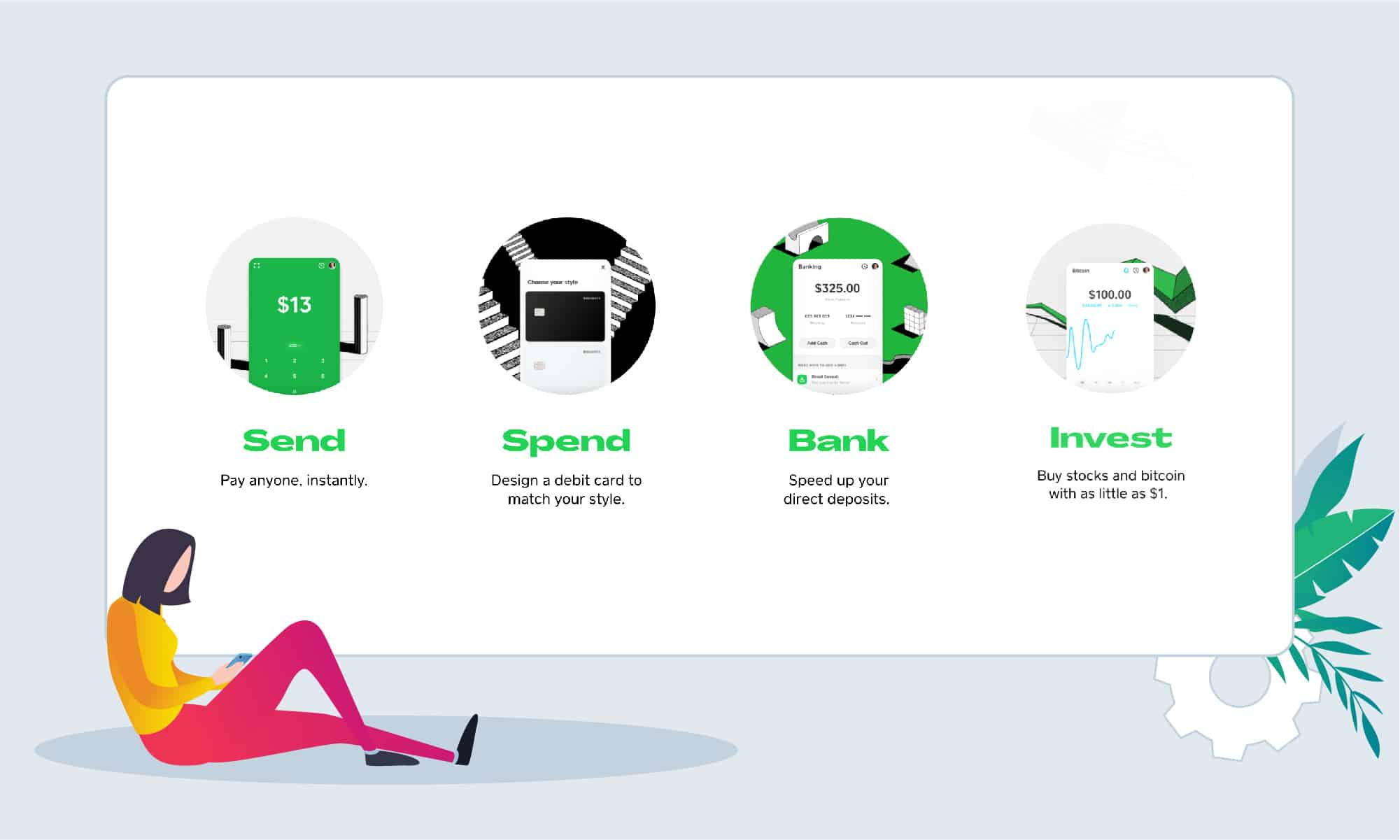

Cash App

Cash App is the P2P payment application that makes it easier for you to

Among the benefits of Cash App you can find:

- A QR code to download a mobile app

- Send payment to anyone instantly

- Design a style-matching debit card

- Direct deposits time is way faster

- Use a minimum of $1 to buy stocks and bitcoin

- Each transfer is highly secure

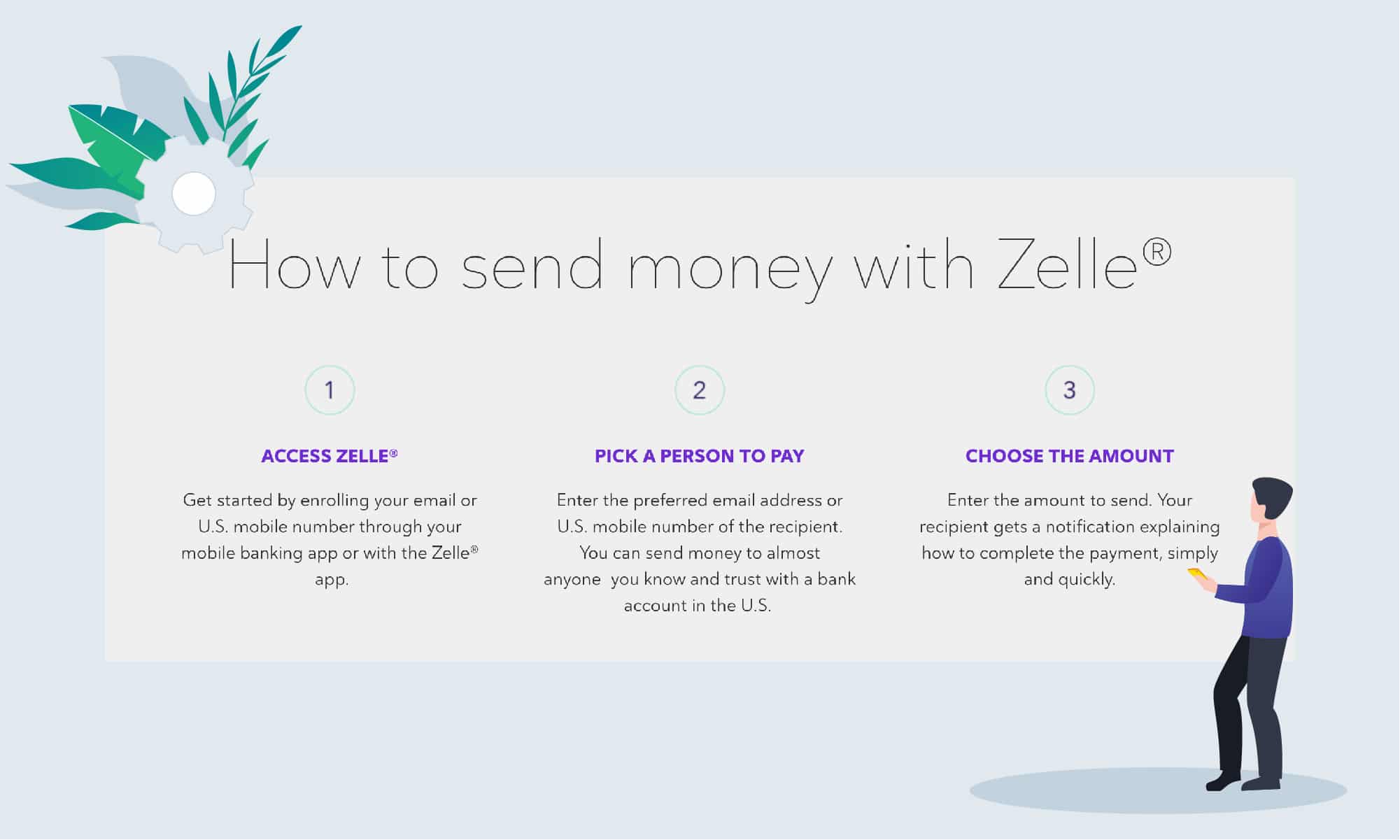

Zelle

Zelle is a financial payment app that allows sending money to

… repay somebody or be the one to get paid back for your contributions instantly.

The benefits of Zelle are in:

- Sending money for all kinds of things

- Reaching an account within 1 minute

- Transferring money safe

- Being present in numerous banking apps

- Working between U.S.-based banks

- Being free-of-charge to use

Types of Peer-to-Peer Payment Systems

Before diving into creating a P2P payment app, it’s essential to determine your business model. Let’s explore the various options available to help you make an informed decision.

1. Discrete Services

Discrete services are digital platforms or apps allowing users to link their bank cards, create a digital wallet, and facilitate digital transactions. They enable individuals to send and receive money, make P2P payments, and store electronic funds within a dedicated wallet. Users have the flexibility to hold money in their digital wallets, postponing withdrawals to a traditional bank account if they choose to do so.

Discrete P2P payment service providers often have a substantial user base, making them a popular choice for P2P transactions. Some of these services, like PayPal, have a global presence, enabling cross-border transactions and serving users in various countries.

In addition to personal transactions, some services offer business solutions, helping companies process payments and expand their reach into new markets.

Examples of discrete P2P payment services include PayPal and Venmo.

2. Banking Services

Banking-centric P2P payment systems integrate directly with banks. Users can access them through their banks’ solutions or P2P payment apps collaborating with financial organizations. Individuals send money to friends and family, pay for services, and settle bills, including utility, mobile, fines, insurance, etc.

Unlike discrete systems, banking-centric apps like Zelle do not typically include a digital wallet feature. Money is drawn from and deposited directly into the user’s bank account. Banking-centric P2P payment systems adhere to strict safety and security standards, protecting users’ financial information and transactions.

Examples of banking-centric P2P payment services include Zelle and Popmoney.

3. Social Platforms

Social platforms have expanded their horizons by integrating P2P payment systems into their services. This innovative approach allows users to seamlessly transition from chatting, sharing, and connecting with friends and family to conducting financial transactions.

Some social platforms offer advanced features beyond simple money transfers. For example, WeChat users can use the platform to pay for goods and services, settle bills, purchase tickets, call and pay for cabs, book hotels, and more, all within the app.

In certain countries, Facebook offers a payment feature called Facebook Pay. Users can link their payment information to Facebook, Messenger, Instagram, or WhatsApp. They can send money to friends, make purchases, and donate funds. This integration enhances the functionality of social networking services.

Examples of social media P2P payment services include Facebook, Instagram, Snapchat, WeChat, WhatsApp, etc.

4. Mobile OS systems

Mobile operating system (OS) platforms have revolutionized how users interact with their smartphones, turning them into digital wallets. People install dedicated apps on their smartphones, link their bank cards, and then utilize their mobile devices for making payments at points of sale (PoS) equipped with Near Field Communication (NFC) technology.

Mobile OS systems offer the capability to make online purchases. Users no longer need to carry their plastic bank cards; they can complete transactions securely and conveniently with their smartphones.

Examples of mobile OS systems include Google Pay, Apple Pay, and Samsung Pay.

Features of a P2P Payment App

A payment app like Venmo should include the following features to be in-demand and quite popular on the market of competitors:

Real-time payments

An option to make payments to accounts or private debit/credit cards in real-time and without fees. This will ensure users will not waste hours waiting for the transaction to be a success. Especially, when digital cash has to be sent and received immediately. Here, speed is the priority.

Transfers to bank

Users seek the ability to effortlessly transfer money from their cards to both other cards and bank accounts. Security remains a paramount concern for senders and recipients during P2P money transactions. Ensuring the safe transfer of funds to bank accounts is critical to this feature.

Cash transfer security and user authentication

Encryption of fintech data transfer by providing security of connection and data protection with blockchain technology is one of the most common things in P2P payment app. Also, an authentication option that will be confirmed only by a unique pin code or your fingerprint should be implemented by the development team. This will eliminate the possibility of account attacks by cybercriminals.

Unique ID/ OTP

Including this feature in your product significantly bolsters its security measures. It ensures that users must verify their identity with a unique ID and One-Time Password (OTP) before initiating any transaction in P2P payment apps. This proactive step helps prevent unauthorized transactions and elevates overall security levels.

Fingerprint security lock

Fingerprint security leverages unique biometric data, making it an exceptionally secure authentication method. It’s difficult for unauthorized individuals to replicate a person’s fingerprint. As a result, you get robust protection for the app and the user’s information. At the same time, it saves users time and eliminates the need to remember complex passwords.

Simplicity of usage with seamless UI/UX

An easy and convenient money transfer process that has a few steps to follow should be a priority. Users like it when the app is simple to navigate through and the actions are logical. And the design of the interface has to be app-specific, i.e. it should contain a digital card or a prototype of a wallet.

Transaction history

Let users access a comprehensive list of all their previous P2P transactions within the app. This feature helps individuals find specific payments, offering an intuitive and organized transaction history. With it, your app can stand out and provide a more user-centric approach to tracking financial operations.

Customer support

Customer support is what makes your app extra approachable. Thus, with the help of customer support, your users will feel taken care of while asking about transaction status and unexpected technical issues, or anything else. What’s more, if this is a mobile app and you’d like to store it in Google Play or the App Store, customer support will be one of the crucial factors your app will be accepted to these application storage platforms.

Chatbot

A chatbot is necessary for peer-to-peer payment platforms, serving as a responsive virtual assistant. It swiftly addresses user queries and concerns, such as rectifying erroneous withdrawals and managing disruptions caused by connectivity issues. This feature enhances user support and ensures smoother transactions.

Push notifications

Push notifications will inform users their money transaction has been successful both in receiving and sending cash. And this is great to be notified right away instead of wondering if it was successful or whether the person received your transaction at all.

Account personalization

Account settings personalization will make it easier for users to set up their accounts and choose the preferred payment option. Also, they will be able to fill in and manage their personal details like age, location, status, etc.

Scan and pay touch-free

Paying for the products or services using a contactless payment method that requires only your setting up of the online P2P payment account is the technology of today. Of course, to pay with the smartphone your device should support NFC.

Digital wallet

To enhance your app, establish a dedicated space for users to securely store their bank cards and funds within a digital wallet. We strongly advise giving this feature proper attention during the development phase. Let users conveniently save credit and debit cards, maintain their financial resources, and even top up their digital wallets from external sources.

Bill & invoice

Integrating a bill and invoice function enhances the versatility of your P2P payment app and caters to the needs of both individual and business users. This feature simplifies the billing process. Also, it ensures transparency and serves as a digital record of the financial transaction, enhancing trust and accountability.

Cryptocurrency trading

Include cryptocurrency in your app to open the door to a modern and dynamic product. Let users swiftly purchase and trade cryptocurrencies like Bitcoin, Ethereum, and others. This feature can potentially revolutionize the financial landscape by attracting a broad audience interested in cryptocurrencies, reflecting the growing popularity of digital assets.

How P2P Payment Apps Work?

Establishing P2P payment accounts is straightforward, irrespective of the chosen platform.

Create an account

You initiate the process by creating an account on the app. During this step, you must enter your essential contact information, including your full name, bank name, phone number, address, etc.

Once you’ve provided your personal information, establish a secure password or Personal Identification Number (PIN). This is a crucial security measure to safeguard your account and protect your transactions.

Add a payee

Following the initial registration, you are typically required to complete a Know Your Customer (KYC) process. This step involves verifying your identity and is essential for security and regulatory compliance.

Once your KYC process is complete, you need to add the necessary details of the person or entity you intend to make a payment.

Specify the amount

Then, you need to clearly define the amount you intend to transfer. While specifying it, you may also have the option to provide a justification or note for the payment. However, this step is typically optional, and you can choose to include additional information if needed.

Confirm the transaction

To confirm the transaction, you must enter the password you set initially when signing up for your account. Alternatively, you can authenticate the payment transfer using a One-Time Password (OTP). It provides an additional layer of security and is a common practice in many P2P payment systems.

As an extra precaution, users have the option to set up a security question in the event they forget their password. Thus, they have a backup method for account access.

Get the receipt

An instant payment receipt is automatically generated after the transaction’s successful completion. That means you can download or print it for your records, simplifying further tracking.

Why Choose P2P Payment App Development?

A tailored peer-to-peer payment system empowers seamless fund transfers without geographic limitations. Here are compelling reasons why investing in such a system is imperative:

Unique requirements handling

Whether you’re operating a banking or financial institution that requires peer-to-peer payment services, a customized solution can provide features that precisely meet your requirements.

Additionally, P2P apps assist businesses, including retailers, in optimizing their payment processes. For example, that means timely payments to suppliers. This, in turn, contributes to increased efficiency in invoice processing and streamlined financial operations.

Fast payment processing

In the past, the conventional way of transferring money often meant enduring long hours in bank lines. Peer-to-peer payment apps have streamlined the procedure by minimizing extensive data entry requirements. They provide a remarkable solution to the once time-consuming issue. This transformation allows users to complete transactions more swiftly and conveniently.

Improved transparency

When it comes to currency exchange rates, users can expect a fair and market-driven rate, determined by the frequency of demand rather than being dictated by the government or banking institutions. This level of transparency in payments is a significant factor that appeals to many users, as it fosters trust and fairness in financial dealings.

Higher security

Peer-to-peer payment services are highly dependable and ensure top-notch security, primarily due to their integration with the 3-D Secure system. Furthermore, the provider of 3-D Secure services must hold a global PCI DSS certificate. This robust security mechanism provides users with a reliable safeguard for their financial transactions.

Lower transaction costs

Peer-to-peer money transfer app operators typically offer cost-effective transaction solutions, charging customers lower fees than other transaction intermediaries or credit card processors. Developing a money transfer app can facilitate cost savings for your users, making it an attractive option.

Steps to Create a P2P Payment App Like Venmo

Now that you know about the most needed app features of how to create a mobile payment app, it is time to focus on the very process of app development. So, consider the following steps to build an MVP and also:

1. Research your target audience and set up the purpose of the app

If you’re having that contagious idea to create a p2p payment application but aren’t sure how to create a payment app and if this app will be feasible and in demand on the market, then start from a product discovery service to be on the safe side. The discovery phase allows gathering valuable product analytics and user feedback. It is risk-free and will cost you less than deploying an MVP or a full product without being sure of the final results. By making a discovery phase you will understand your target audience better and will certainly define the aim of your app both for yourself and your users.

2. Choose a development team and a technology that will match your needs and expectations

Selecting a team to bring your project idea to life is as essential as everything else. A team of software engineers should know how to build a payment app with seamless mobile application architecture and a great UI/UX design. They should not only be experts in software development but also be on the same page with their clients so that the final product was in everyone’s best interest. The features that should be present when you build a peer-to-peer payment app that will impact your technology choice are:

- notifications and push messages

- unique ID and fingerprint verification

- digital wallet account

- bill and invoice sending

- Money transfers (sending and receiving)

- transaction history

If you need tips on how to hire software developers or hesitate which technology to choose, you can always view our guidelines according to the choice of a team to outsource as well as how to hire a CTO for a startup.

3. Implement various online payment methods for your users

If you want your app to bring profits, have a look at the possible mobile app monetization models and try to meet as many reasonable user expectations as possible. And, also, the main methods of online payment are:

- Online eCommerce payments

- On-the-spot payments at retailers

- P2P payments within the system’s network

Thus, in your pursuit of how to build a mobile payment system, don’t forget these payment options.

4. Think about the best ways to enclose a user’s account or card details

Data encryption, two-factor authentication, PCI-DSS, and other regulations compliance adherence are the main pillars of how to create a money transfer app. Also, get to see our post on Mobile Banking App Security to get more insights.

5. Engage in performance testing to ensure your system works well under different loads

Performance testing should start parallel to the development process. It is best to ensure your app is

- fast and responsive towards user actions

- in-demand and has a good feedback

- effective with a max amount of simultaneous users

- innovative, simple, and gets user preference among competitors

- stable under different loads

To ensure all these factors are met, don’t underestimate the power of performance testing and the work of testers.

6. Make sure to use ready-made solution APIs or build your own

APIs can cut down the development time. The APIs are already the ready-made solutions you can integrate into your P2P payment application. However, some of the APIs like in Cash App and Venmo cannot work outside of U.S. So, to be on the safe side and work according to your needs, you can always build your own APIs. But, everything depends on the niche you choose, type of app, development team, technology, security, and so on.

Consider Inoxoft your trusted partner

Inoxoft is your international software outsourcing partner that can help you implement your best ideas into real life. We provide custom mobile applications development, QA automation testing services, UI/UX design and development services, and other services.

Inoxoft has experience in working with the financial industry and integrating different payment systems into applications both in mobile and web development. Our success can be measured with the help of our satisfied clients, who obtained not only a product to grow and develop their businesses further, but a sophisticated, innovative, and user-friendly application that impacts the daily lives of users in a simple but effective way.

So, if you are looking for a company to build you a peer-to-peer payment app – choose Inoxoft. Contact us to receive a detailed consultation, initiate a discovery phase, or build an MVP based on your requirements.

Final thoughts

The article has spoken about the most common aspects of how to develop a peer-to-peer payment app. In developing an innovative app, better than Venmo, it is vital to understand what your audience desires to see, what are your requirements, what technologies to choose, and what features would positively impact your users. P2P app development is a process you should approach with reason. The more your app will allow you to do, be user-friendly, and be easy to use, the more you will win among your competitors.

Frequently Asked Questions

Are there any ready-made solutions that I can use to spearhead P2P payment app development?

Yes, there are ready-made solutions and software development kits (SDKs) that can significantly expedite the development of a P2P payment app. These include popular platforms like Stripe, PayPal, and Square, which provide APIs and SDKs for integrating payment functionalities. With pre-built infrastructure, you can reduce development time and effort.

How much does it cost to develop a P2P payment app?

The cost of a P2P payment app development depends on its complexity, features, platform (iOS, Android, web), and geographic location of development teams. A basic P2P payment app with essential features may start at around $30,000 to $50,000, while more advanced solutions with robust security measures cost $100,000 to $250,000.

What are the payment app features?

- Real-time payments

- Money transfer to any person

- Cash transfer security and user authentication

- Simplicity of usage with seamless UI/UX

- Transfer Tracking

- Customer Support

- Push Notifications

- Account personalization

- Scan and pay touch-free