Revolutionizing Trust: Explore how personalized banking transforms customer experiences, fostering trust and loyalty in the digital era of finance.

Key Takeaways:

- Customer Trust as a Priority: Gaining customer trust is paramount in banking, achievable through personalized services.

- Personalization in Banking: Tailoring services to individual needs enhances customer satisfaction and loyalty, revolutionizing the banking experience.

- Strategies for Effective Personalization: Includes understanding customer behavior (Customer DNA), offering customized services, and using analytics for continual improvement.

- Types of Personalization: Banks can employ prescriptive, real-time, and machine-learning personalization for more individualized customer interactions.

- Channels and Content: Utilizing multiple channels and segment-specific blog content for effective communication and engagement.

- Segmentation: Understanding different stages of the customer journey (awareness, consideration, decision, evaluation) to provide targeted services.

- Inoxoft's Expertise: Offering advanced fintech development services to create personalized banking platforms tailored to unique customer needs.

Personalization in banking refers to customizing banking services to meet the specific needs of individual customers. It plays a crucial role in enhancing customer satisfaction, trust, and loyalty. This approach involves understanding customer behaviors, preferences, and financial goals, and then tailoring products, services, and communications to each individual. Effective personalization can lead to increased customer engagement, improved loyalty, and higher conversion rates. By focusing on personalized experiences, banks demonstrate a deeper understanding and commitment to their customers, thereby strengthening trust and establishing long-lasting relationships in the competitive financial sector.

- How Does Banking Personalization Work?

- How to Use Personalized Banking the Right Way?

- 1. Build Up a Customer DNA

- 2. Make Up a Personalized Curriculum

- 3. Gather Customer Analytics and Learn from It

- Examples of Using Personalization in Banking Projects

- Prescriptive Personalization

- Real-Time Personalization

- Machine-Learning Personalization

- Channels

- Blog Content

- Segmentation

- The Future of Using Personalization for Banking Services

- Consider Inoxoft as a Reliable Partner for Developing Products in Banking Industry

According to Statista’s survey, 59 thousand bank customers across 28 nations in the world, should trust their bank to use its services. So, trust ranks as the first and utmost factor across every country. But, the question is, how can banks achieve customer trust? There are some ways to consider.

Believe In Banking had a feature in 2021, where it claimed there were 5 ways to get customer trust and satisfaction. These were:

- Increased personalization

- Provision of customer-centric services

- Offered consultations 24/7

- A big influence on the market

- Operations led with transparency

Let’s speak about the first factor – personalization. What is personalization in banking?

Personalization is a service that adjusts to the specific needs of individuals. It is used to improve customer satisfaction in every business aspect. Moreover, it enhances digital sales, marketing results, and branding, and improves website metrics.

In banking, personalization triggers client trust and already is the future of the banking industry. How did it happen? What are the best examples of personalization in the finance sector – let’s explore!

How Does Banking Personalization Work?

Personalized digital banking was rather a non-intentional client request from the very beginning. Banks understood that clients had to be shown they were being cared for, and their needs would be met. But, most importantly, the banks knew their clients well.

With a personalized banking experience, clients can fulfill their aim in a faster, better, and safer way. And, banks are more than glad to make the existing clients stay longer. But, also, to provide personalized banking services and receive more of the new ones.

Among the common personalization tasks banks try to cover, there are product selling and promotion of the long-term financial well-being of their customers. So they put every customer’s need on a pedestal and try to solve their problems effectively.

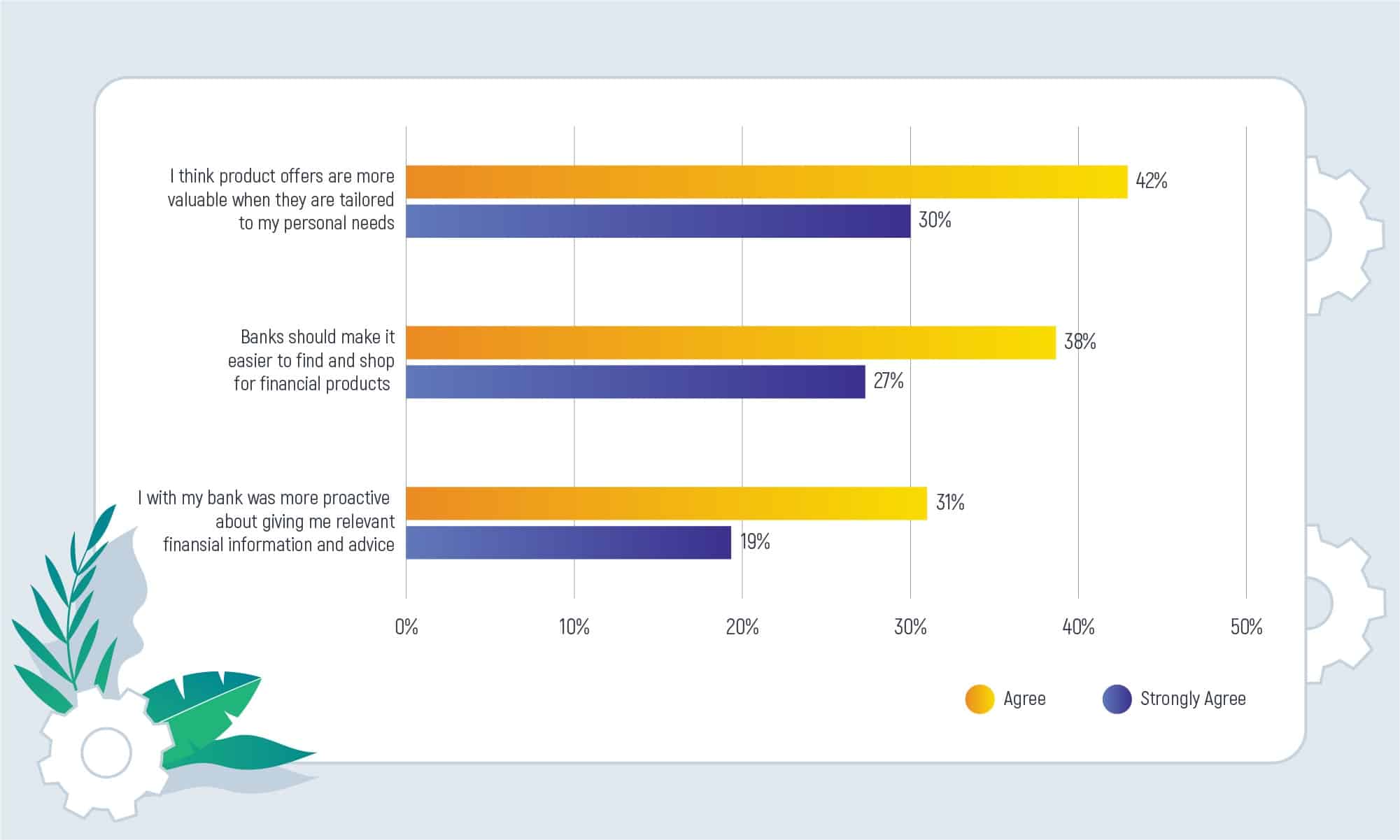

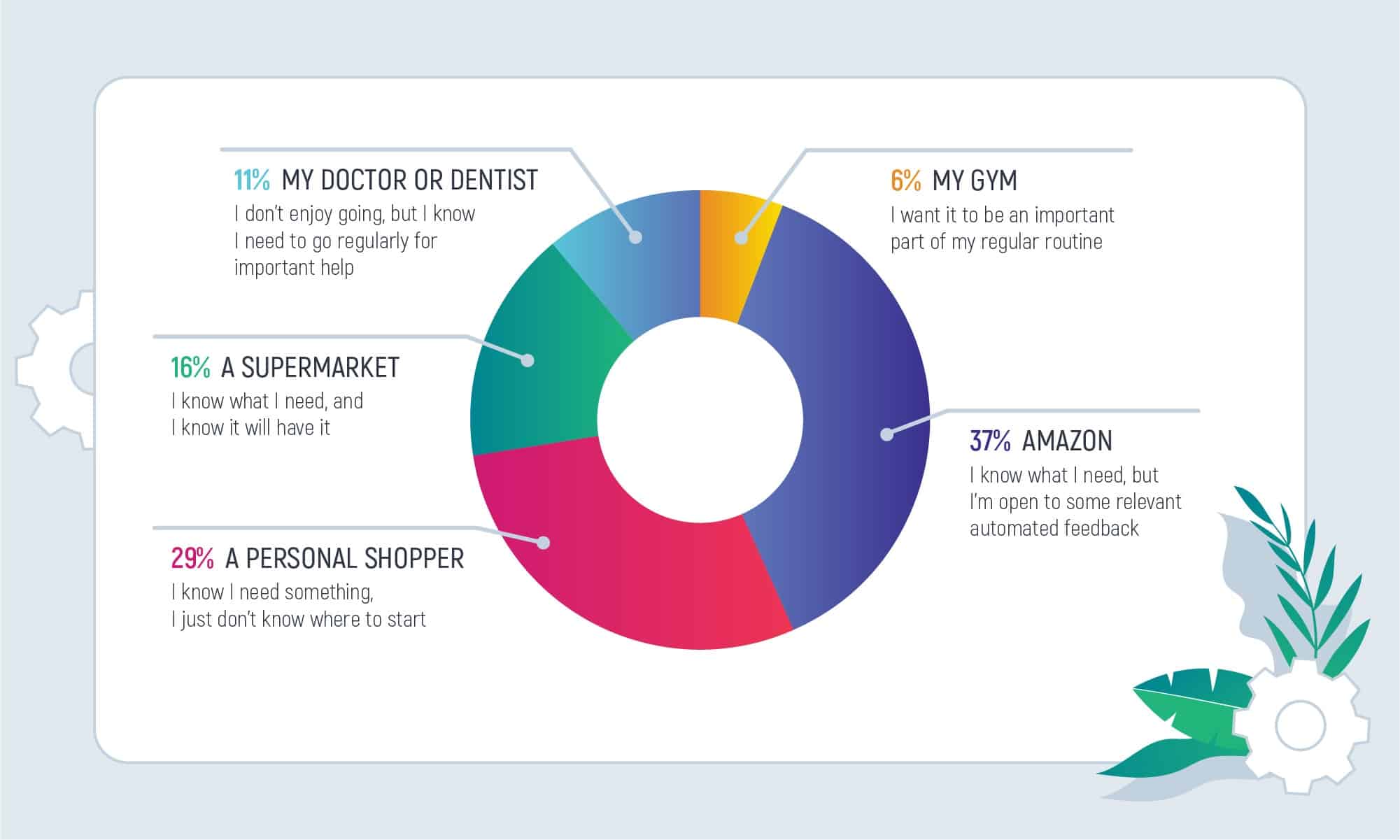

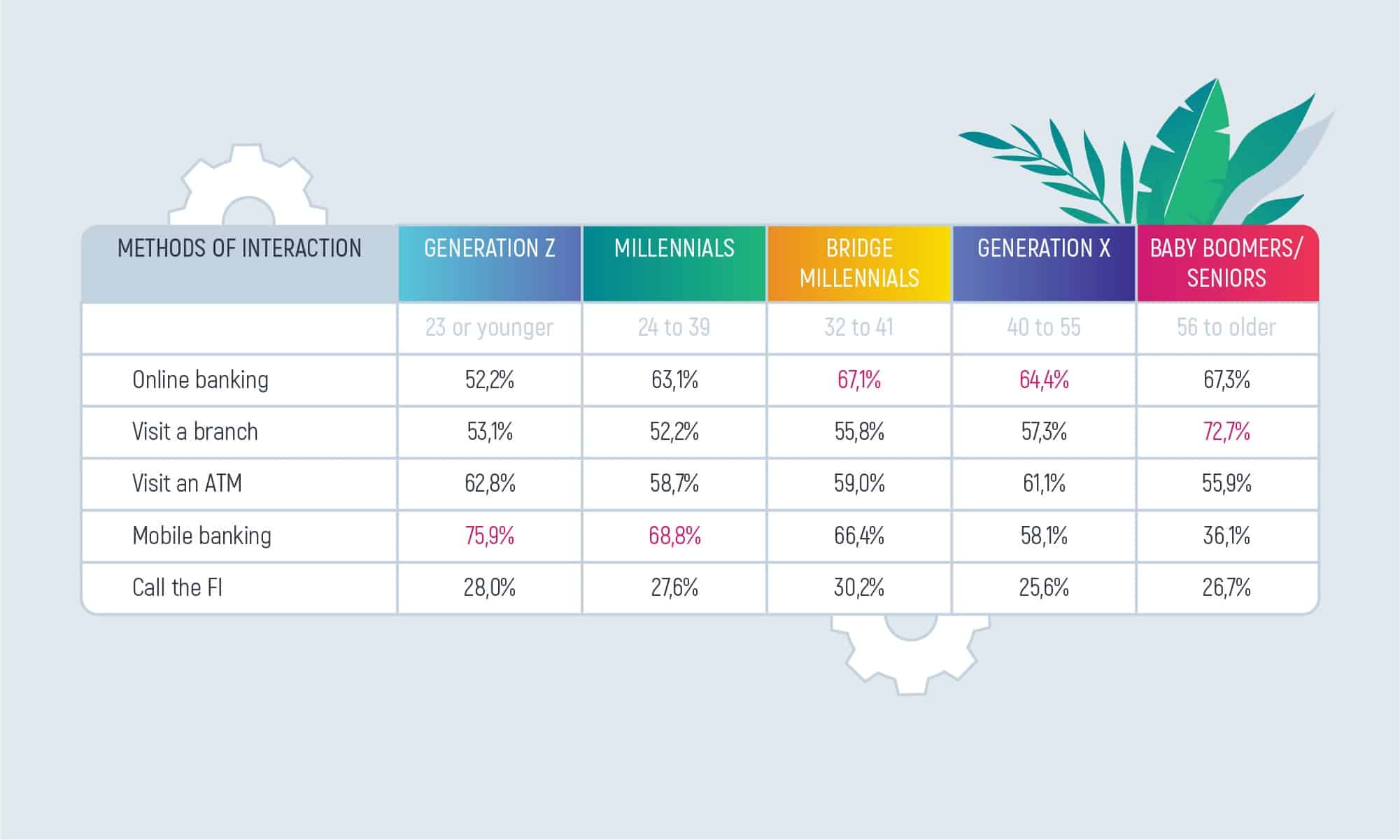

What personalized digital banking experience is important for customers? And, how much?

Are there any banking personalization examples that clients/customers look up to? Of course, there are! For instance,

How to Use Personalized Banking the Right Way?

With the right application of personalization in the banking industry, it is possible to:

- Increase customer engagement and conversion rates

- Improve customer loyalty and retention

- Enhance customer experience

- Provide consistent messaging across channels

- Receive a stronger marketing ROI

How can a bank achieve these results? Mainly, by trying to

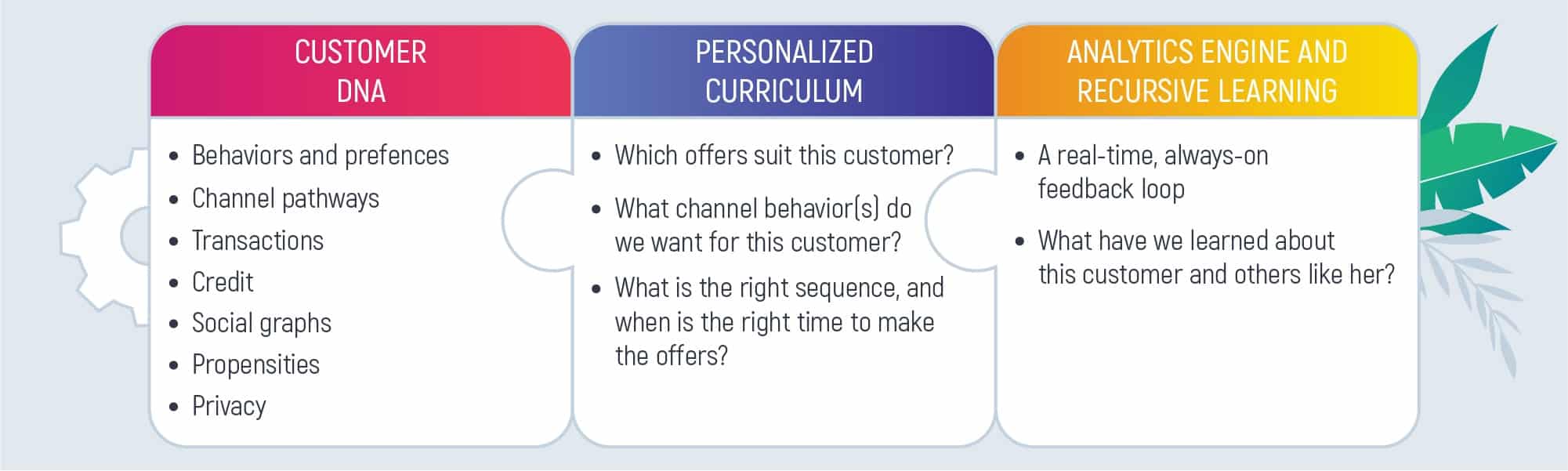

1. Build Up a Customer DNA

It is vital to understand customer behavior and adjust banking performance to maintain the “demand-supply” chain. Also, it is important to focus on the channels you can provide your customer with personalization for banking services. These are transactions, credits, privacy, propensities, social graphs, etc. Anything is applicable. As long as your user uses the service there is always room for improvement.

2. Make Up a Personalized Curriculum

To be able to provide great and seamless services, it is necessary to figure out:

- How the customer should behave using this service?

- What kind of offers will this customer be glad to receive?

- Should offers be in a sequence?

- Is there a particular time an offer can be made?

Think about these possible questions and their derivatives to better picture your user persona. Maybe your customer wants to take credit and he/she is in pursuit of great terms and conditions. So, you can impact his/her behavior by making an irresistible offer. Here, you’d personalize every aspect of the offer up to your customer’s needs and he/she will be extra satisfied to accept it. This is the benefit of personalization.

3. Gather Customer Analytics and Learn from It

Every business needs to gather analytics. At least to know, what is customer feedback and where is it going with its implementations and innovations. For instance, real-time analytics and results based on the gathered customer data, etc. How can this information change your banking? Literally, upside down. With extra knowledge of your customers’ intentions and opinions, it is possible to adjust services to their liking and eliminate issues occurring in the process. This is a perfect sneak-a-peek into what’s making your bank popular among your competitors.

Examples of Using Personalization in Banking Projects

There are three types of possible personalization. So, let’s view the best examples of personalization in banking:

Prescriptive Personalization

To manage users easier, historical data is taken into account. What does that give you? A possibility to track all the past needs and wants of the customers. And, having these in mind, create certain rules and workflows. That would be a personalization strategy that can meet your business goals.

Real-Time Personalization

Here, banks use historical data as well, but mostly the one obtained at this moment exactly. This is done on the go to create the top personalized service possible. For example, customers can be active on the site and receive a recommendation just with a snip of the finger. If you get to interest the customer, then you have a new engagement. And, if you happen to interest lots of customers – new conversions.

Machine-Learning Personalization

Have you heard about ML personalization algorithms? That’s when AI-powered algorithms can track your customers’ behavior and offer more individual content. You can get to your customers by analyzing tons of their clicks and interests. And, then, offer your services. And, not just to a single individual, but to any individual of your key audience.

What concerns projects, the best examples of personalization in banking would be through

Channels

To have a good picture of user preferences, you cannot use just one channel to gather customer information. There should be several ones to be sure. Marketers know that a whole picture of what works and what doesn’t work can be achieved with multiple channels. Only then it is possible to track customer actions and understand what makes them click this and avoid that option.

Blog Content

What can be blogged for customers in the banking industry? Simple as that – how to use custom banking services. You can produce articles on your offers, benefits, how to use this or that offer, how to apply, and so on. Don’t concentrate on all of the bank users, do it in segments. For instance, adjust content for the ones having deposits. Or the ones, that need to take a loan. These groups of people are significantly smaller, but you will meet their informational interests.

Segmentation

Buying cycles matter in banking personalization. There are at least 4 different cycles every customer goes through

- Awareness, when buyers learn about your offer and need to satisfy their needs;

- Consideration, when the buyer considers buying but still looks through offers of competitors to compare; and you need to focus on why your services are the best;

- The decision, when the buyer is ready to make a purchase and needs a little call to action or urgency of the matter to do ut quicker;

- Evaluation of choice, where you should offer your customers more content from time to time that is informative and might be of great interest to them.

What about Inoxoft? We are a custom fintech development services company after all. To produce a top market personalized banking platform it is necessary to initiate the data collection process. We are surrounded by tons of user data, so why not use it? Especially, when it includes personalization opportunities in banking.

Our team has deployed numerous financial platforms for the financial sector. For example, the AI-powered Customized Software for Sales Institutions. The case’s goal was to improve communication between the sales and their customers. So, they needed a customer personalization tool to increase engagement, ROI, and so on.

Another great example is the Trading Automatization Platform. This case includes currency trading on all levels. So the digital platform had to be personalized on all levels to achieve the best experience in the trading sector.

The Future of Using Personalization for Banking Services

According to the latest tendency, fintech businesses are thriving to implement personalization into their business lifecycles. They either need a personalized digital banking platform or to transform systems they have via implementing personalization in banking services. All of this says that this trend is going to advance and stay with us in the future. 75% and more of bank customers plan to stick to the digital banking habits they’ve adopted.

Inoxoft’s team believes that personalization is the only reasonable update any bank can give its users without copying competitors. For its the way they provide services and approach their clients. It has to be innovative and unique. That’s why we highlight it on our website:

…financial services have become online, we can not imagine our lives without mobile payments software, application of our favorite bank, and customized web and mobile app for personal money management.

Consider Inoxoft as a Reliable Partner for Developing Products in Banking Industry

Inoxoft is a banking software development services company with 7+ years of experience in the fintech sector. We will always consider your business requirements and the goals your end-users want to achieve. For example, personalized banking includes

- Voice payment technology

- Forecasting of customer expenses

- Robo-advisors

- Use of biometric data

- Live chatting

- Appointment scheduling

- Self-service features

- Loyalty program integration

With our help, you can create value for the financial market and offer personalization in banking products for your customers.

Consider Inoxoft as your software development partner. Contact us to receive an extended consultation. Experience innovations with Inoxoft!

Frequently Asked Questions

What is digital banking personalization?

Personalization is a service that adjusts to the specific needs of individuals. It is used to improve customer satisfaction in every business aspect. Moreover, it enhances digital sales, marketing results, and branding, and improves website metrics.

How to enhance the personalized banking experience?

Get to know customer DNA, create a personalization curriculum, and gather analytics you can learn from.

Who can help you out with personalized banking software?

Consider Inoxoft, we have more than 7 years of experience in Fintech. And, our clients recommend us all the time.