It’s not a secret that the world is constantly changing and developing. Now artificial intelligence and data-driven services are in high demand. Modern solutions help you execute basically every process, say, store all the important data or monitor cash flow. Obviously, the finance industry has faced multiple changes as well, therefore methods of coping with various issues have also improved.

Predictive analytics in finance is a top-notch solution for your finance team. The tendency shows that the predictive analytics market will only grow each year. In fact, predictive analytics becomes inevitable, as it is embedded in the software applications of the team. Predictive analytics in finance and accounting is actually really beneficial for the business, as it can give you some important foresight and enhance financial performance.

This guide will tell you everything you need to know about predictive analytics in corporate finance, how to use predictive analytics in finance and why it is important for your business. So if you feel you want to know more about the subject, scroll down!

- What is Predictive Analytics in Finance?

- Why Predictive Analytics in Finance is Important?

- Top 3 Predictive Analytics Methodologies in Finance

- Advantages of Implementing Predictive Analytics in Finance

- Predictive Analytics in Finance and Accounting

- Predictive Analytics Applications in Finance

- Predicting buying behavior

- Content recommendation

- Personalization

- Virtual assistants

- Are there Any Disadvantages of Predictive Analytics Applications in Finance?

- Future Trends of Predictive Analytics in Financial Services

- Final Thoughts

- Consider Inoxoft's Team of Experts to Empower Your Financial Business

What is Predictive Analytics in Finance?

Predictive analytics is a digital procedure that involves interpreting financial data, progressing from descriptive and diagnostic analysis to the calculation of potential future outcomes. The practice of analyzing data to foresee future events is not a novel concept in the finance sector: financial institutions and businesses have historically sought to estimate probabilities by scrutinizing past occurrences.

The significance of predictive analytics in finance lies in streamlining and expediting this task while enhancing the accuracy of forecasts. Thanks to recent advancements in the speed and precision of predictive analytics, financial companies can expand the application of this technology across various strategic and tactical facets of their operations. Such an improvement enables a broader and more efficient implementation of predictive analytics, contributing to its increased value in the finance industry.

Why Predictive Analytics in Finance is Important?

In today’s world, financial situations can be unpredictable, but there are always ways to secure yourself. It has already been mentioned that predictive analytics in the finance industry can give you a whole new perspective on financial processes and situations in the market. By using predictive analytics in finance, you can forecast future demand for certain products, and predict customer behavior and important financial operations.

Moreover, it can improve supply chain management and help you avoid drains on profit. You can monitor not only what you gain but also identify all your losses. Hence, it is easier to detect potential fraud for finance leaders. As you can see, the use of predictive analytics in finance is highly beneficial for your business if you want to keep everything in check.

Top 3 Predictive Analytics Methodologies in Finance

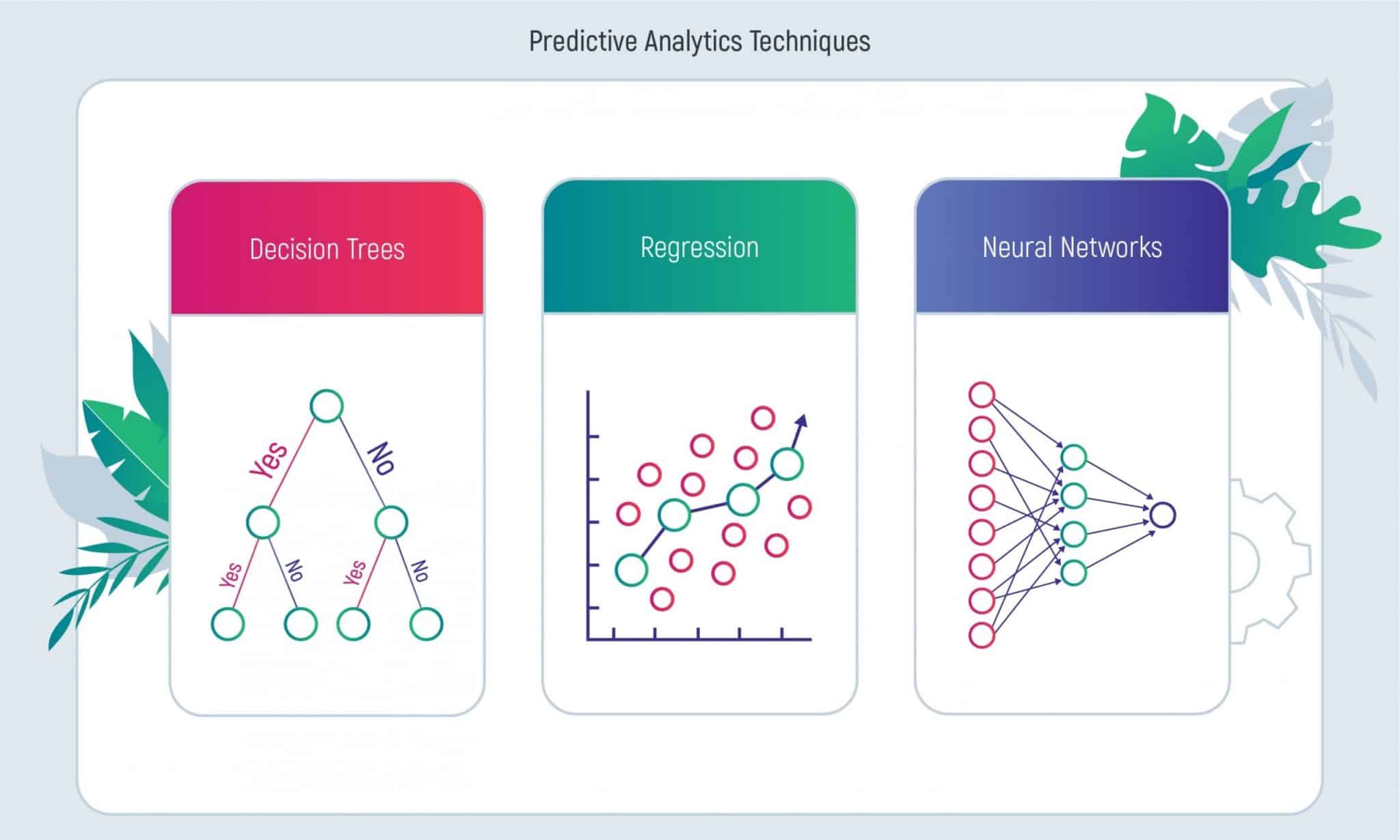

Now that you know about the importance of predictive analytics, it is important to implement them in your business. To analyze all the necessary data, you should use one of the three predictive analytics methodologies (it is also called the predictive model). Predictive analytics modeling analyzes big data and patterns and helps predict future trends and possible economic risks.

- Decision trees. The main principle of this methodology is to divide data into branches, making it much easier to predict more outcomes and possible decisions. This technique is really popular, as it is quite easy to interpret.

- Logistic regression. This technique assesses relationships among variables. Observation of a data set helps to predict data value.

- Neural networks. This model is probably the most complex one, as it imitates the work processes of a human brain. Various AI processes are included in this technology.

Advantages of Implementing Predictive Analytics in Finance

Implementing predictive analytics in finance offers several advantages that can significantly enhance decision-making processes and overall operational efficiency:

- Risk mitigation. With the analysis of historical data and patterns, organizations can predict and mitigate risks associated with loans, investments, and other financial activities.

- Cost reduction. By incorporating financial predictive analytics into budgeting and risk modeling, financial firms gain enhanced insights into daily cash flows, which leads to increased operational cost-effectiveness.

- Fraud detection and prevention. Institutions use predictive analytics for finance to analyze transaction patterns and identify anomalies, suspicious activities, which helps minimizing financial losses due to fraud.

- Revenue growth. Predictive financial analytics powered by machine learning empower investment professionals to make data-driven and more profitable decisions in the dynamic market.

- Customer retention. Predictive analytics can be used to predict customer churn by identifying patterns that indicate potential attrition, which allows institutions to implement targeted retention strategies and enhance customer loyalty.

Predictive Analytics in Finance and Accounting

The use of predictive analytics in finance eases all your financial tasks. They can be ordinary daily issues, or they can be more complex corporate ones. In fact, examples of predictive analytics in finance can be seen here and there, proving that this technique is quite popular nowadays. Here are some processes that benefit from using predictive analytics.

- Supply chain improvement. As the supply chain is the most visible side of the company, it is extremely important to keep its longevity and sustainability at a high level. Predictive analytics, in this case, allows companies to prevent all possible risks.

- Cash flow prediction. You can easily manage debt repayments, and monitor cash turnover and other financial operations with the help of cash flow prediction. Thus, it gives you more sense of security and certainty.

- Fraud detection. Security is the main demand for a financial institution. Predictive analytics helps you to expose criminals and prevent their attacks. Therefore, if some suspicious patterns are being caught, the system quickly examines all the fresh data.

- Risk management. The company heavily relies on its trustworthiness. It’s essential

to be able to predict all the possible risks and handle them if necessary, for example, checking if the client is reliable.

Predictive Analytics Applications in Finance

The financial industry heavily benefits from predictive analytics. There are some top-notch predictive analytics use cases in finance and applications of predictive analytics in finance you should know if you are interested in developing your business. For instance:

Predicting buying behavior

One of the most important predictive analytics applications in finance is the prediction of customer behavior. It is also easier to get an idea of a client’s preferences based on previous purchases.

Content recommendation

Similarly to the previous use case, content recommendation makes you know your customer better and shows them the content that interests them specifically. This way, it is easier for a client to prioritize their needs.

Personalization

A personalized experience is important in any sphere of business, and finance is no exception. If the client has all the personalized information gathered in one place, the user experience will be much more pleasant.

Virtual assistants

One finance predictive analytics example is incorporating virtual assistants. This is predictive analytics combined with deep learning. A virtual assistant can guide you and show you all the possibilities available.

Are there Any Disadvantages of Predictive Analytics Applications in Finance?

We have already figured out that applications of predictive analytics in finance are quite beneficial for you. It saves you from possible risks and saves your time and costs. However, are there any downsides to predictive analytics use in finance? If there are, what should you know about them, and how to prevent them?

- Costly implementation. The main disadvantage of implementing predictive analytics is its cost. Maintenance and data collection require huge investments. It’s crucial to figure out what you need the most to save some costs.

- Lack of data security. Data safety is a top priority, but sometimes it becomes really difficult to keep it away from hackers, especially when the amount of data is huge. Evaluating the data security framework is a factor that protects important information.

- Violation of user privacy. On the one hand, it’s really convenient to have personalized services, but on the other, user privacy suffers from constant invasion. In this way, organizations need to constantly keep user data in safety to avoid such situations.

- Data integrity. When the data is received from the user, it can sometimes be not so qualitative. To keep the processes in check, make sure the data is accurate.

Future Trends of Predictive Analytics in Financial Services

It goes without saying that predictive analytics is in high demand now, and the finance industry definitely benefits from it. The tendency shows that predictive analytics will be even more popular in the future. PA will develop in many finance areas. Of course, customer service is the main one. With the help of predictive analytics, it will be easier to figure out what interests a particular client, what services should be provided, and so on. This way all the possible risks for banks will be reduced.

In fact, it is also beneficial for the company’s relationship with customers. Clients are really sophisticated, so they expect to have the best user experience. Predictive analytics also gives you the possibility to retain customers and predict who is going to return or not. Cross-selling works really well in the marketing field and helps the company stay compatible on the market among others. Summing it up, it’s safe to say that predictive analytics will only become more popular in financial services.

Final Thoughts

The main aspects of predictive analytics in financial services are safety and stability. In today’s world, some things are hard to predict, but it’s possible to keep all the important processes in check. Predictive analytics positively influences the finance sphere. With its help of it, you can forecast customer behavior and some crucial financial operations. You can avoid fraud and keep all the data in safety.

There are three main methodologies in predictive analytics, which can be used according to your wishes and demands. Of course, there are also some disadvantages to predictive analytics, but they don’t outweigh the pluses. But if you want to stay compatible with the market and improve the quality of your work, using predictive analytics is the best decision you can make.

Consider Inoxoft’s Team of Experts to Empower Your Financial Business

Inoxoft is a software development company that provides top-notch software services all around the world. You can meet all your business needs with the help of our dedicated team. Our top priority is our clients’ safety and content. You will receive top-notch customer-centric solutions. Even if you are a newcomer, with the help of our company it will be easier for you to launch your idea.

Inoxoft provides predictive analytics in retail, data science, and big data services, data analytics companies in the USA, big data in finance industry and fraud detection using big data analytics. We will help you choose the best predictive analytics methodology in finance and will tell you everything you need to know about it.

If you want to make your financial business thrive, Inoxoft is the ultimate choice for you. Contact us and we will help you make all of your plans come true!

Frequently Asked Questions

What is predictive modeling in finance?

The process of developing, processing, and validating a model that can be used to predict future outcomes is known as predictive modeling in finance.

Why is prescriptive analytics important in business?

While predictive analytics helps you forecast potential outcomes, with the help of prescriptive analytics you can draw specific recommendations. Prescriptive analytics is the final stage of business analytics, that's why its role is hard to overestimate.

What are some examples of predictive analytics in finance?

Predictive analytics in finance is used to improve supply chain, predict cash flow, detect frauds and manage possible risks. If you want to know more about predictive analytics in finance, scroll up!