Fintech technology belongs to the type of innovative solutions that allow humanity to automate and modernize traditional processes within the financial sector. That’s one of the main ways an industry grows and advances. By now, Fintech stands for a huge sector of financial operations, which has the potential to increase its revenue from €92 billion in 2018 to an estimated €96 billion in 2024.

About 30% of financial institutions were using fintech APIs last year. But, at least, banks have thought about the true importance of fintech APIs. This allowed them to prioritize and invest in APIs from 35% up to 47%. Let’s hope, the tendency stays as well as the sector keeps on developing via application APIs.

Besides discussing the pros and cons of fintech APIs and their significant impact on the banking sector, in this article, we will talk about best practices to achieve progress in the finance sector. Discover Inoxoft’s custom fintech software development services and how our projects like Integrating Online Payment Services With CBS streamline financial operations and facilitate business growth.

- What are Fintech APIs?

- How Do Fintech APIs Work?

- Who Uses Fintech APIs and Why?

- Blockchain

- Banks

- Investments

- Payment processing

- Peer-to-peer (P2P) programs

- What Types of Fintech APIs are Used for Application Development?

- Financial data providers/accumulators

- KYC and RegTech tools

- Payment processors

- Security management tools

- Investment brokers

- Advantages of Using Fintech APIs

- Advantage #1. Faster development/time to market

- Advantage #2. Reduction of development costs

- Advantage #3. Reuse of components

- Advantage #4. Time/resources to focus on innovations

- Advantage #5.Improved user experience

- Advantage #6.Security and compliance

- Cons and Risks of Fintech APIs

- Security vulnerabilities

- Dependency on third-party providers

- API limitations and updates

- Vendor lock-in

- How to Choose the Best Fintech API for Your Business?

- Identify your business needs

- Research the market

- Evaluate API support

- Security and compliance

- Test the API functionality

- Check integration options

- Seek references

- Consider Inoxoft as a Reliable Partner for the Development of Your Project

- Integrating Online Payment Services With CBS

What are Fintech APIs?

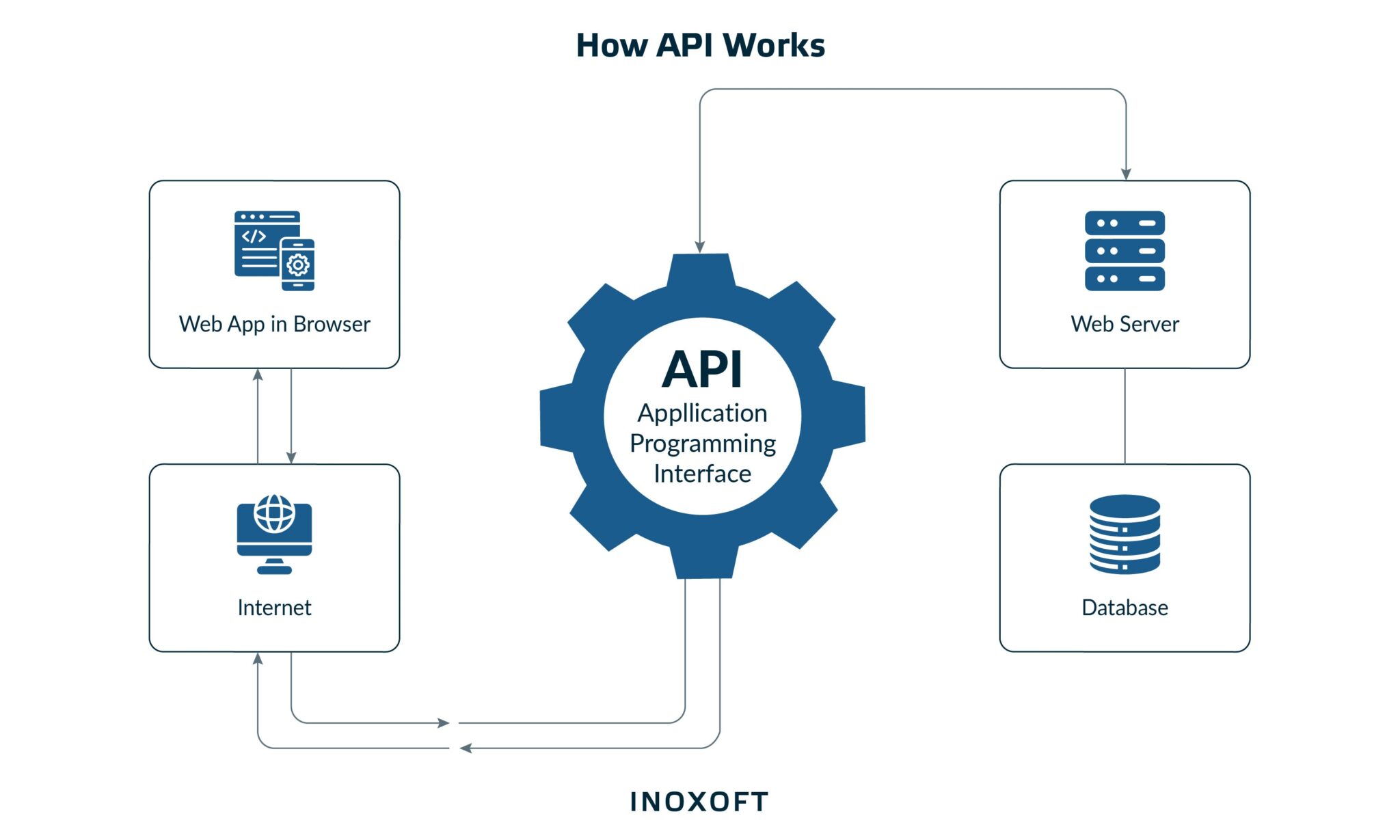

Fintech API integration systems serve as bridges enabling diverse software systems to interact and share data. They connect systems and enhance their smooth communication in the financial industry. APIs in financial services carry out the mission of better data access to all the parties involved in financial transactions: banks, third-party providers, websites, and customers.

One practical example of use cases is a peer-to-peer lending platform with a credit scoring API. By integrating this API into their platform, the lending company can instantly assess the creditworthiness of loan applicants, retrieve relevant financial data, and make informed lending decisions based on the provided information.

How Do Fintech APIs Work?

Say you use a personal finance app and want to sync all your bank transactions automatically. After clicking the ‘Connect your bank account’, the app utilizes a fintech API integration to establish a connection and transmit the request. The API communicates with a specific endpoint on the bank’s server to initiate an authentication process.

Then, you provide your authentication details and submit them through the app. The API securely forwards this information to the bank’s server, where it undergoes verification against the bank’s database. And finally, if the provided details are accurate, the server approves the access request — that’s how any new financial transaction that occurs in your bank account will be automatically transmitted to the personal finance app.

We can see that APIs establish a clear separation between the application and the third-party system. With fintech APIs integration, personal finance apps and other fintech platforms can offer seamless cooperation with bank accounts, providing users with real-time access to their financial data within the app’s interface.

Who Uses Fintech APIs and Why?

APIs usage in fintech is popular among various stakeholders within the industry for diverse purposes. Here’s a brief overview of the areas in fintech where fintech APIs are commonly utilized:

Blockchain

While interacting with blockchain in fintech, fintech APIs enable secure and transparent transactions, smart contract functionality, and decentralized applications (dApps) development.

Banks

Account management, transaction processing, customer authentication, and data retrieval — APIs facilitate seamless integration with third-party applications and create innovative online banking services and solutions for a better user experience.

Read more: How to build a neobank?

Investments

By providing access to real-time market data, portfolio management tools, trade execution, and risk assessment capabilities, fintech APIs enable investment and fintech companies to offer comprehensive and efficient services to their clients.

Payment processing

Fintech APIs can facilitate secure and efficient transactions since they enable integration with various payment gateways, e-wallets, and digital payment solutions. It enhances the speed and convenience of financial transactions.

Peer-to-peer (P2P) programs

Financial technology APIs provide various functionalities: borrower verification, credit scoring, fund transfers, and investor management, enabling efficient and transparent lending or investment processes.

What Types of Fintech APIs are Used for Application Development?

There are various available types of APIs in the fintech industry that can enhance its functionality and provide valuable features. Here are some types of APIs commonly used in fintech apps and their potential benefits:

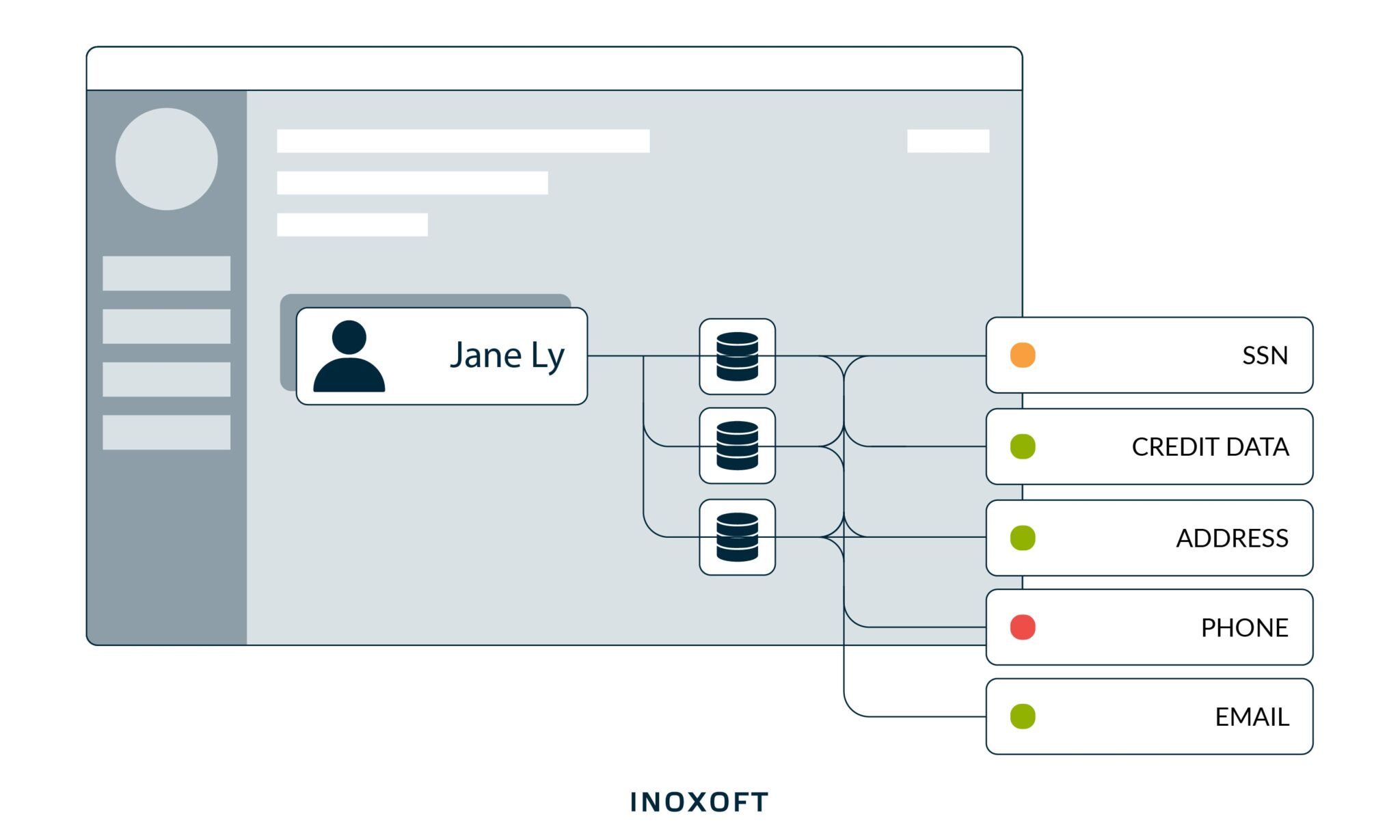

Financial data providers/accumulators

These APIs for fintech make third-party applications easily access bank account and card balance information. These APIs also empower apps to offer financial services to their users. Additionally, major banks provide APIs that grant access to accounts, payments, and security functions.

KYC and RegTech tools

KYC (Know Your Customer) and RegTech (Regulatory Technology) tools are instrumental in ensuring compliance with regulations in various countries, despite the inherent challenges involved. Their integration can significantly contribute to making compliance more manageable for businesses.

Payment processors

Payment processors serve as crucial APIs underpinning fintech and the broader internet economy. These intermediaries accept, validate, and process payments for online transactions. Leading payment processor APIs like Stripe, PayPal, and MangoPay have become integral to facilitating seamless financial transactions.

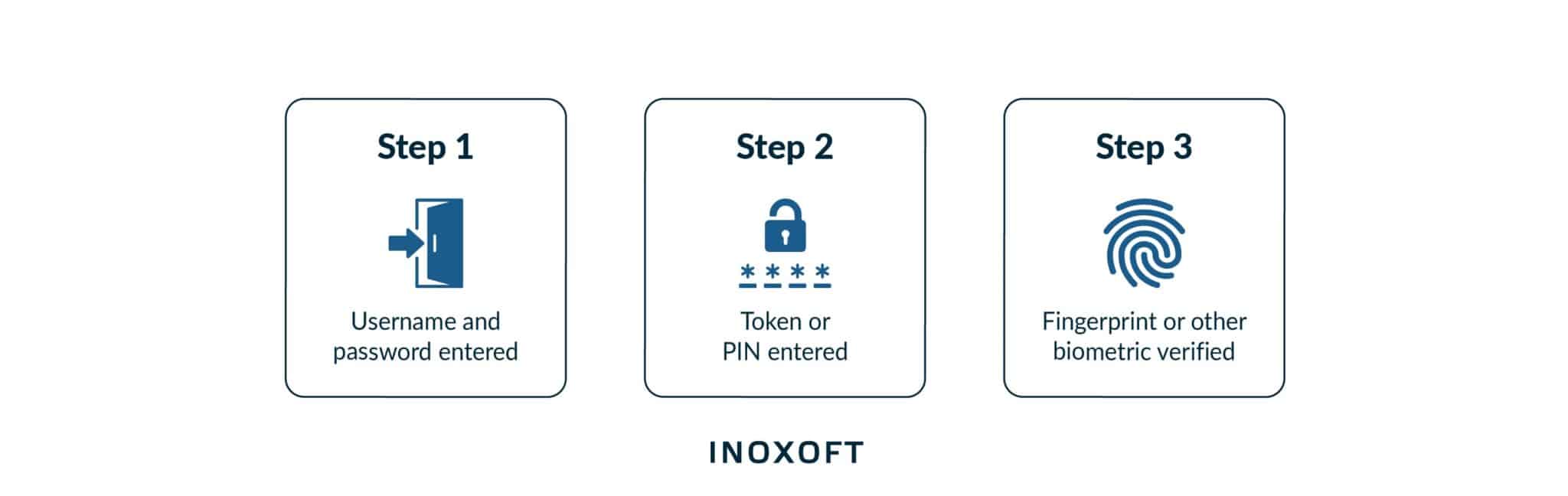

Security management tools

Such authentication and authorization API for fintech alleviate the burden of implementing security measures from scratch, allowing developers to focus on core functionalities. That includes entering usernames with passwords, tokens or PINs, and biometric verification, where you can leverage native solutions like Apple’s Face ID or the Android Biometric Library — they provide secure and convenient biometric authentication methods: facial recognition or fingerprint scanning to enhance user security.

Investment brokers

Broker APIs function similarly to human brokers by executing asset trades on behalf of users – they handle buying and selling assets in the market, relieving developers from the need to build trading algorithms from scratch. One example of a broker API is Binance, which facilitates trading in cryptocurrencies.

This flexibility allows you to extend investment functionalities to other fintech app types, such as personal finance or digital banking. Whether you aim to provide comprehensive trading capabilities or access to specific market data, broker APIs offer a straightforward solution for enhancing your app with investment-related functionalities.

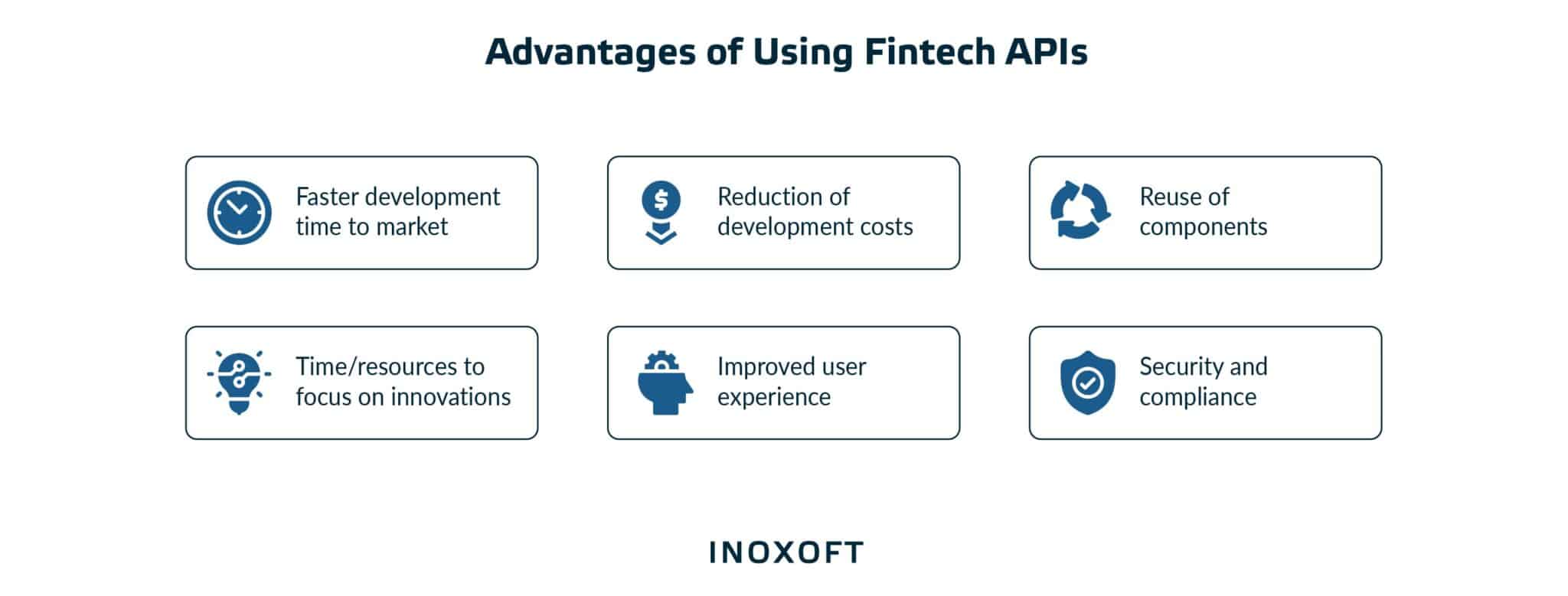

Advantages of Using Fintech APIs

Advantage #1. Faster development/time to market

One of the most significant pros of fintech API is the ability to accelerate your software development. With pre-built or open APIs, developers can tap into a wealth of existing functionality and services, and leave aside building everything from scratch. This saves considerable time and effort in coding, testing, and debugging complex functionalities, and allows businesses to bring their solutions to market faster.

Advantage #2. Reduction of development costs

Besides shortening the development time, you can save up a valuable budget and resources. Using APIs allows developers to leverage existing functionality and services, eliminating the need to build complex features from scratch. Despite the cost associated with API usage, the overall cost savings achieved through reduced development time and increased efficiency can still make fintech APIs a cost-effective solution for businesses.

Advantage #3. Reuse of components

Fintech APIs provide a set of pre-built reusable components that can be easily integrated into different applications — you can utilize them across multiple projects and applications without the need for redevelopment. This reduces the development effort, as developers can build upon the existing functionality provided by the API rather than starting from scratch.

Advantage #4. Time/resources to focus on innovations

Businesses can free up their valuable time and resources, and focus on innovation or core areas of their business. Fintech APIs accelerate the development process and enhance scalability. As enterprises leverage these APIs, they can quickly scale their operations without substantial investments in infrastructure or additional development efforts.

Discover more: How fintech is changing banking

Advantage #5.Improved user experience

Integrating third-party APIs in fintech applications significantly enhances the user experience. By supporting popular payment methods or financial services, you can cater to users’ preferences and provide a seamless and convenient experience. And naturally, an improved user experience leads to higher product satisfaction, increased engagement, and greater customer loyalty.

Advantage #6.Security and compliance

In general, APIs abstract the underlying functionality of the called program — they restrict the variables and functions that developers can access. And that ensures controlled and secure access to data and functionalities.

Fintech APIs often come with built-in compliance and security measures, reducing the burden on businesses to ensure regulatory compliance and data protection. Compliance with strict regulations like GDPR (General Data Protection Regulation) and PSD2 (Revised Payment Service Directive) allows secure information sharing with government agencies and regulators.

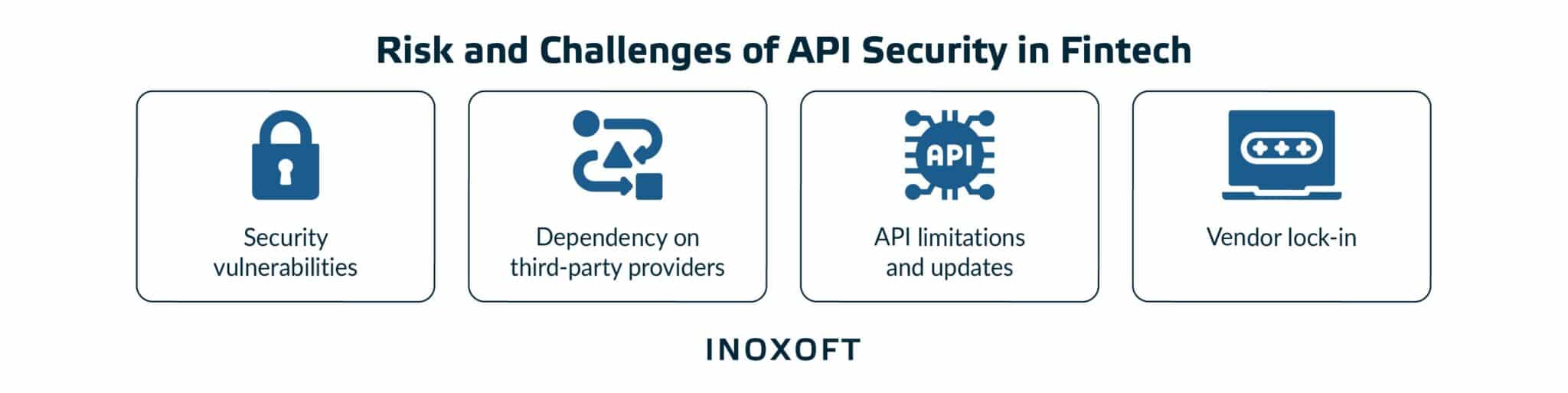

Cons and Risks of Fintech APIs

Even though fintech APIs offer numerous advantages, it’s essential to be aware of potential risks associated with their usage. The rapid growth of APIs in recent years has posed challenges for API management tools, leading to concerns about their ability to effectively handle the increasing number of APIs. Here are some cons of fintech APIs:

Security vulnerabilities

Vulnerabilities can arise if API developers do not meticulously follow established fintech API standards. Authorization errors, broken authentication or access control, SQL injections, security misconfiguration, and components with known vulnerabilities are potential exploits that can be introduced if API security practices are not adequately implemented. Developers must prioritize robust security practices, including encryption, authentication mechanisms, and regular security audits.

Dependency on third-party providers

Relying on external providers for critical functionalities might be a significant risk. If the API provider experiences downtime or performance issues or discontinues the service, it can directly impact the functionality of the integrated service. Carefully evaluate the reliability and stability of API providers before integration.

API limitations and updates

API providers may offer specific features or services that meet the needs of most users. Yet, they might not cover all use cases. Plus, updates or changes to the APIs can impact the functionality and compatibility of integrated applications. Businesses must monitor API updates closely, stay informed about any changes, and assess the impact on their existing integrations.

Vendor lock-in

Once you integrate with a specific API, you may face challenges when transitioning to a different provider or modifying its systems. Vendor lock-in can limit flexibility and make adapting to changing needs or exploring new partnerships challenging. Businesses should consider API design strategies that minimize vendor lock-in and provide flexibility for future changes.

How to Choose the Best Fintech API for Your Business?

When choosing a fintech API for your business, several important steps help you make an informed decision:

Identify your business needs

Determine the specific finance software or functionalities you require from an API. Consider whether you need payment processing, account aggregation, risk assessment, identity verification, or other financial services.

Research the market

Explore the fintech API market and identify the options that align with your business needs. Look for APIs that specialize in the areas relevant to your business. Consider the challenges of using fintech APIs and the factors like reliability, API security, scalability, documentation, and ease of API integration.

Evaluate API support

Reliable API documentation is crucial for seamless integration and API development. Ensure that the API provider offers comprehensive and up-to-date documentation, including sample code and clear explanations.

Discover more about: API testing frameworks

Security and compliance

Again, security is important when it comes to financial data. Evaluate the security measures implemented by the API provider, and compliance with relevant data protection regulations (e.g., GDPR, PCI DSS). Consider the reputation and track record of the API provider in terms of security incidents.

Test the API functionality

Before committing to an API, request access to the API testing environment. This will allow you to evaluate the API’s functionality, ease of use, and performance. Test different scenarios and assess whether the API meets your business requirements and provides the desired outcomes.

Check integration options

Evaluate the available integration options and developer resources provided by the API provider. Look for client libraries, SDKs, and code samples that facilitate integration. Consider the programming languages and frameworks supported by the API, as well as any developer communities or forums that can offer assistance.

Seek references

Research reviews, testimonials from other businesses that have used the API you are considering. Ask for feedback from industry experts who may have experience with the API provider to get insights into the API’s performance, reliability, and overall experience of working with the provider.

Consider Inoxoft as a Reliable Partner for the Development of Your Project

Inoxoft is an absolute expert in fintech software development services — we build top tailored banking solutions that will enhance your business processes. Our certified engineers understand the value and benefits of fintech API and implement them for clients at our best.

With our help, you can present the greatest fintech experience for millions of your consumers using fintech API. By partnering with Inoxoft, you will have a digital opportunity to innovate businesses and help them become extra recognizable in the fintech sector.

Contact Inoxoft to experience all the advantages of using the benefits of fintech API. Our team will make sure you get only the best solution and disrupt the market of digital finances.

Integrating Online Payment Services With CBS

Our specialists integrate online payment systems with custom business software to enable one-time, recurring, and subscription payments. By adopting ‘PayPal-like’ online payment services to your business requirements, Inoxoft streamlines your financial transaction operations. We aim to automate all procedures and actions that require human interaction to enhance user experience and facilitate business financial tracking.

Frequently Asked Questions

Why is API important for fintech?

The tendency to use APIs in fintech makes a single bank sort of a modular platform. And, due to this transformation, different third-party businesses may offer their financial services.

How can using fintech APIs improve your product?

With seamless integration of technologies between the bank and a third party, any business chooses some of the bank services it wishes to offer its clients and does not require to have a banking license to do so.

Will fintech API be used for product development in the future?

By all means! APIs make all the processes easier and faster.

How can using fintech APIs improve your product?

With seamless fintech API integration, any business chooses some of the bank services it wishes to offer its clients and does not require to have a banking license to do so.