More and more people around the globe turning to online services: customers use online banking to manage their financial activities and do their transactions via a mobile app, patients share their health data, users share bank accounts while subscribing to the streaming platforms and buyers fill in personal contacts to make a purchase.

We all share our data every day. Due to this technological progress, the number of cybercrimes, frauds, hackers attacks, threats, and vulnerabilities of organizations has increased. Thus, not only financial institutions, but every industry must apply comprehensive fraud prevention techniques to protect their customers’ personal data.

An average attack may cost an organization millions. In this article, we are discussing security measures and how business has to conduct fraud management.

- The Challenge of Financial Fraud

- Importance of Fraud Monitoring Analytics with Big Data Analytics and Machine Learning

- Benefits of fraud monitoring analytics

- Methods of Fraud Monitoring Analytics

- Ad-Hoc

- Sampling

- Competitive or repetitive analysis

- Analytic techniques

- Gaps

- How to Use Big Data and Machine Learning for Fraud Prevention and Monitoring Analytics

- Strategy

- Ecosystem

- ML models and solutions

- Tools to visualize results

- Consider Inoxoft Your Trusted Partner

- Big Data Analytics Techniques to Combat Financial Fraud

- Anomaly detection

- Machine learning models

- Link analysis

- Identity verification

- Adaptive security measures

- Text mining and sentiment analysis

- Final Thoughts

The Challenge of Financial Fraud

Financial fraud poses a significant challenge in modern digital world. It involves the use of deception to gain an unfair or unlawful financial advantage. Various forms of financial fraud exist, ranging from traditional methods to sophisticated cybercrimes. Here are some key challenges associated with financial fraud:

- Technological advancements: As technology evolves, so do the methods used by fraudsters. Cybercriminals employ sophisticated techniques such as phishing, malware to target individuals, businesses, and financial institutions.

- Globalization: The interconnected global economy provides both opportunities and challenges. Fraudsters now exploit cross-border transactions and differences in regulatory environments, making it challenging to investigate and prosecute financial crimes that span multiple jurisdictions.

- Data breaches: The increasing frequency and scale of data breaches expose individuals and organizations to the risk of identity theft and financial fraud. Stolen personal information, such as credit card details or social security numbers, can be used to carry out various types of fraudulent activities.

- Regulatory challenges: The regulatory landscape is complex, and adapting regulations to keep up with rapidly changing technology can be challenging. Implementing and enforcing effective regulations to prevent financial fraud without stifling innovation is a delicate balance.

Importance of Fraud Monitoring Analytics with Big Data Analytics and Machine Learning

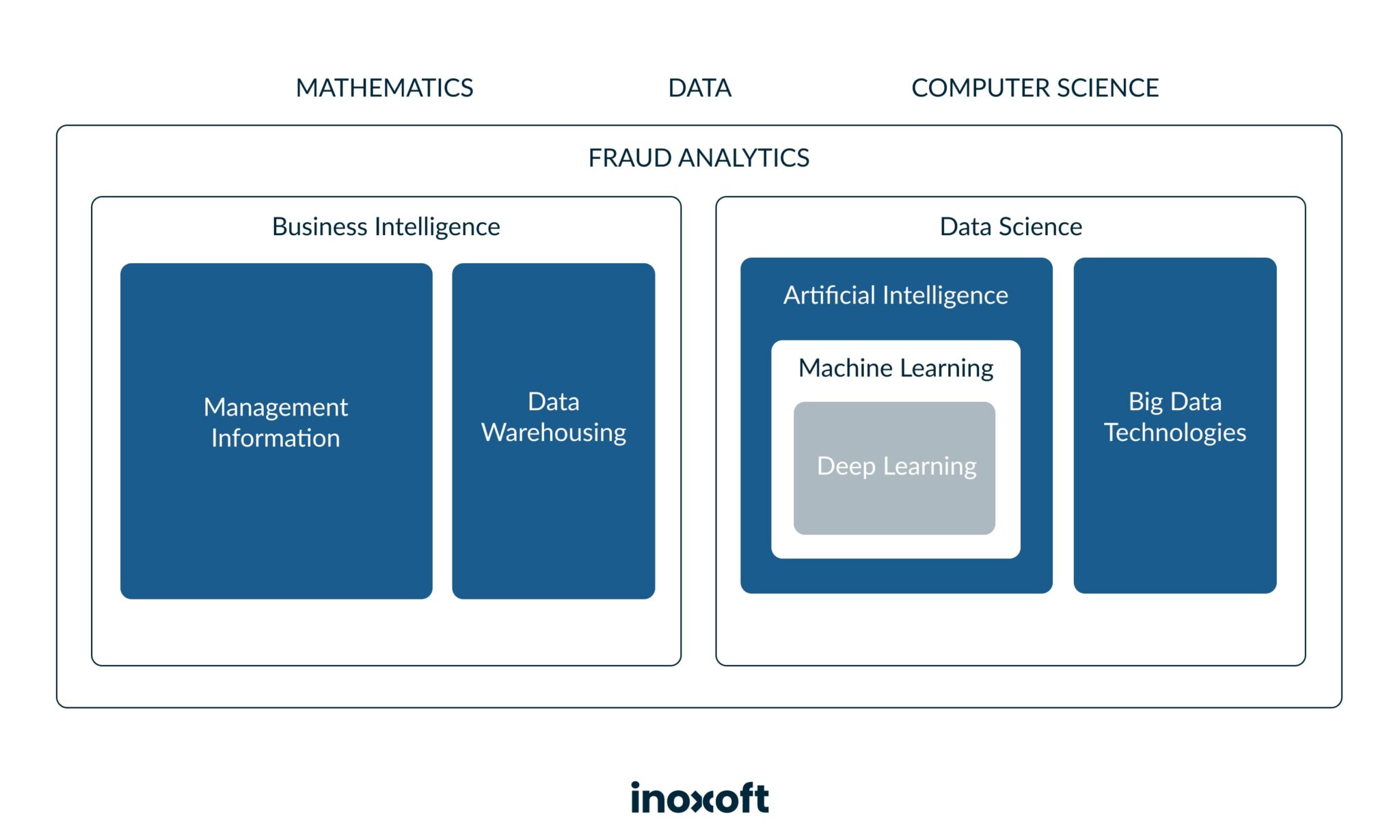

Fraud data analytics is a multidisciplinary approach that combines quantitative sciences to predict and prevent online frauds. Including the use of big data analysis techniques, business intelligence, data mining, machine learning, and AI. This can help organizations in different industries detect suspicious behavior, and apply mitigation of fraudulent activity in real-time.

The process of fraud prevention analytics includes gathering and storing relevant data and mining it for discrepancies. Gained insights that can allow managing potential threats before they occur as well as develop a proactive fraud detection and prevention environment.

There are a couple of reasons why the level of fraud is growing.

- Businesses don’t pay proper attention to security while moving to the public cloud and increasing IoT devices usage.

- After the Pandemic started and companies switched to remote mode, people started using their personal devices (laptops, phones) to access corporate information.

- A Home Wi-Fi network can’t ensure the same level of cybersecurity as an office environment. But also, employees often neglect antivirus, use weak passwords, apply dangerous online tools, etc.

Companies all across the world use data analytics to detect fraud. Deutsche Bank uses big data to identify money laundering, prevent credit card fraud, etc. UK mobile virtual network operator Lebara identified a scam and block SIM cards that were used by fraudsters to call their victims. A healthcare insurance company Santéclair also applies anti-fraud systems and advanced algorithms to detect scams three times more effectively.

Benefits of fraud monitoring analytics

The advantage of using fraud detection analytics is that it can handle a huge amount of data at once. And also it

- helps you identify the area that can be affected by the fraud the most

- fixes weaknesses in the system or business flow

- saves time by automating the repetitive tests

- searches all transactions automatically for fraud indicators

- merges and compares data from different systems

- calculates the impact of fraud

- uncovers new patterns, trends, fraudulent schemes, and scenarios that traditional approaches can’t detect

- speed up analysis and eliminates manual work

Methods of Fraud Monitoring Analytics

To create a very powerful fraud detection system, use the combination of the following methods.

Ad-Hoc

Ad-Hoc is the process of discovering fraud by using a hypothesis. You can test software to find out if it’s capable of resizing dangerous actions e.g. fraudulent transactions.

Sampling

It’s one of the mandatory methods of fraud detection. It is most effective where there is a lot of data population involved. On the other hand, sampling may not be able to fully control fraud detection as it takes only a few populations into consideration. Fraudulent transactions do not occur randomly therefore an organization need to test all the transactions to effectively detect fraud.

Competitive or repetitive analysis

This method creates and sets up scripts that use Big Data to run against the big volume of data to identify the frauds over a specified time period. Analysis helps to improve the efficiency of companys’ fraud detection processes.

Analytic techniques

These usually identify abnormal frauds by using statistical parameters and classifying the data and transactions. Look at high and low values and find out the anomalies that are most of the time the indicators of scams.

Gaps

This method finds out the missing sequential data. For example, if you have purchase orders which are issued by the company in sequential order and if anything is missing you can easily find out. This is an easy method and it will work out great if used correctly.

Check how we can assist you with secure banking solutions!

How to Use Big Data and Machine Learning for Fraud Prevention and Monitoring Analytics

Strategy

The first thing you need to do, before analyzing data, is to think through conditions when big data analytics and ml would be advantageous to your business, in terms of fraud detection. Validate your ideas and consider the following questions:

- what results in you want to achieve

- how many resources do you need to allocate

- what will be your ROI

Ecosystem

You can build your data warehouse solutions easier and start big data analysis faster by creating the Big Data ecosystem. That will allow your engineers to collect, store, and integrate immense amounts of data from multiple data sources. Tools like Dataflow, AWS Glue, Apache Beam, and Spark were created to ensure these processes will be smooth.

ML models and solutions

There are two types of ML approaches that are mostly applied to detect and prevent fraud:

- Unsupervised machine learning when the data is not labeled. You only have input data and no corresponding output variables.т

- Supervised machine learning when machines are trained using “labeled” training data, and on the basis of that data, machines predict the output.

Another important step is to apply an ML solution. There is no universal solution that will suit all business cases. Here you are free to choose: to develop a custom scalable machine learning solution or use tools of third-party machine learning software as a service solution (e.g. Amazon ML, Azure Machine Learning Studio, Google Cloud AI Platform, or IBM Watson Machine Learning)

Tools to visualize results

Any data-driven organization that wants to use data analytics to detect fraud efficiently, apply BI tools to be able to make well-informed decisions. Interactive dashboards let you access and analyze data easily and react to unexpected events if they occur.

Consider Inoxoft Your Trusted Partner

Inoxoft’s experts have solid expertise in AI and machine learning services, Data Science, and Big Data Analytics services for logistics, healthcare, Fintech, Education Real Estate, and other industries.

To extract valuable insights from data and apply efficient solutions on a strategic and operational level, take advantage of Inoxoft expertise in:

- Natural Language Processing

- Computer Vision

- Predictive Analytics

- Sales prediction

- Pricing analytics

- Marketing optimization

Big Data Analytics Techniques to Combat Financial Fraud

Big Data analytics plays a crucial role in combating financial fraud. The technology provides the capability to process and analyze vast amounts of data quickly. Here are some key big data analytics techniques and strategies employed in the fight against financial fraud:

Anomaly detection

- Behavioral analysis: Big data analytics can analyze historical transaction data to create a baseline of normal behavior for individuals or entities. Any deviations from this baseline can be flagged as potential anomalies.

- Pattern recognition: Detecting unusual patterns in transaction data, such as sudden spikes in activity or unexpected changes in transaction types, can help identify potentially fraudulent behavior.

Machine learning models

- Predictive modeling: Machine learning algorithms can be trained on historical data to predict and identify potential instances of fraud. These models can continuously learn and adapt to new fraud patterns.

- Supervised learning: machine learning models can be trained to recognize known fraud patterns and then apply that knowledge to detect similar patterns in real-time data

Link analysis

- Network analysis: Big data analytics help identify relationships and connections between different entities, such as individuals, accounts, or businesses. Uncovering complex networks of transactions can reveal fraudulent activities.

Identity verification

- Biometric data analysis: Big data analytics can analyze biometric data, such as fingerprints or facial recognition, for identity verification, making it more difficult for fraudsters to use stolen credentials.

Adaptive security measures

- Dynamic rule-based systems: Big data analytics create dynamic rule-based systems that can adapt and evolve in response to emerging fraud patterns, providing a more proactive defense.

Text mining and sentiment analysis

- Social media monitoring: Big data analytics analyze social media and other text-based sources to identify potential indicators of fraudulent activities or sentiments that may be associated with fraud.

Final Thoughts

In the digital world of today, you can always find vulnerabilities in software, thus fraud continues to grow, whether that is in finance, insurance, or the healthcare industry. Security is not only important for the users, who’d like to keep their data safe, but for every institution that needs to deploy comprehensive fraud protection to minimize online attacks. Fraud analytics solutions based on AI and machine learning techniques are effective in preventing these risks.

If you’d like to know more about how to achieve the max level of protection, contact our team to get valuable insights!

Frequently Asked Questions

What is fraud data analytics?

Fraud data analytics is a multidisciplinary approach that combines quantitative sciences to predict and prevent online fraud. Technologies like big data analysis, business intelligence, data mining, ML, and A help detect suspicious behavior and prevent potential threats

Which data analysis techniques are used for fraud prevention analytics?

Fraud analytics combines different analytic techniques like Big data analysis, BI, data mining, ML, and AI with human interaction to help detect suspicious behavior and potential scams.

How big data is used in fraud monitoring analytics?

All fraud analytics solutions are based on Big Data uses techniques (e.g. AI or ML). They are capable of detecting threats, preventing risks, and minimizing online attacks. Discover more in the article.