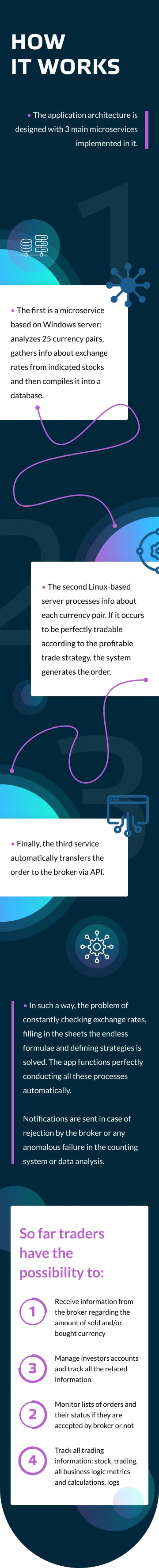

Currency trading is a narrow spectrum industry that encompasses mechanisms of capital gain due to price movements in currencies. Rapid fluctuation in the currency market made a group of traders cooperate to launch their own business, develop unique strategies and increase revenue.

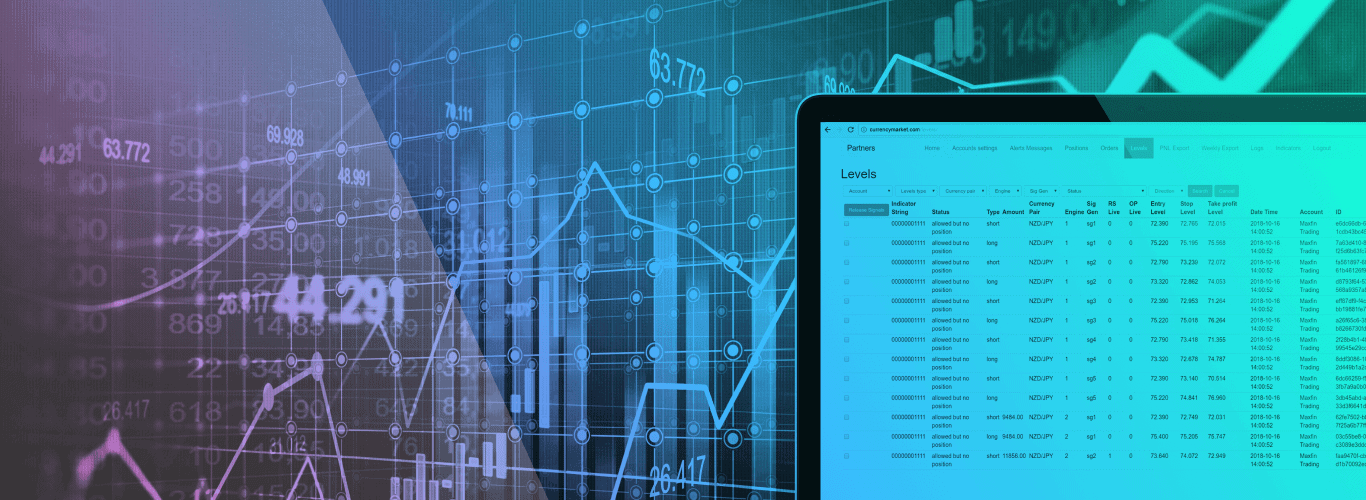

They trade at the world’s 3 major stock exchanges, namely at London, New York and Tokyo and involve investors on the basis of requested proposals. Already having a considerable experience, the traders elaborated unique financial strategies and mathematical formulas to maximize profit from trading. However, the whole process of currency data analysis, price monitoring and deal arranging was done manually and proved itself to be time inefficient.