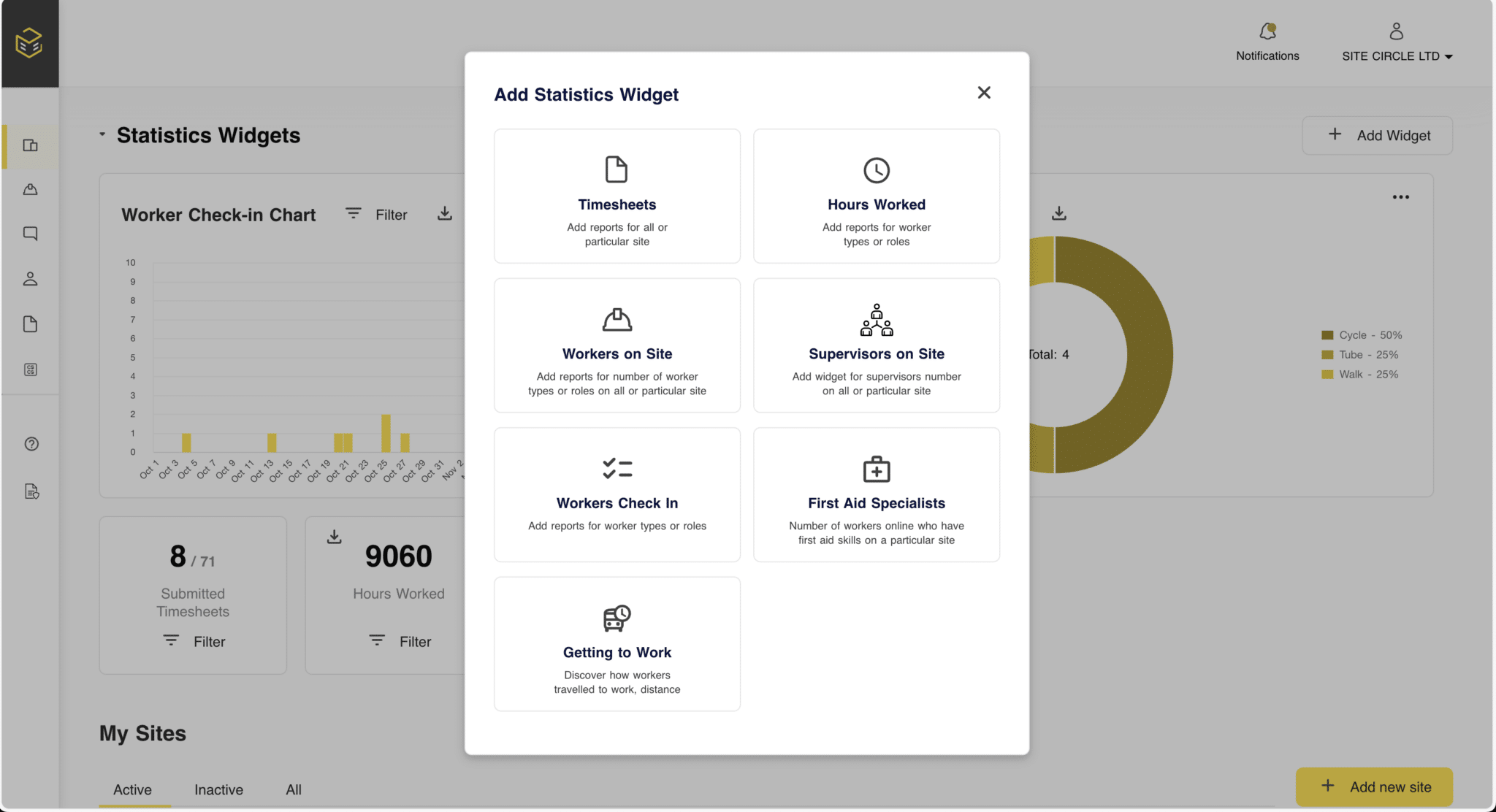

In banking, CRM software manages customer interactions, tracks customer behavior and preferences, and automates certain marketing and sales processes. CRM tools also provide analytical capabilities that allow banks to identify trends, spot opportunities for growth, and make data-driven decisions. Using one improves customer engagement, positively influences retention rates, and drives revenue thanks to offering more personalized services.

Why do banks or financial institutions opt for custom banking customer relationship management software development? They want a more personalized set of instruments, broader and more precise algorithms for gathering client data, and a chance to scale the system whenever needed. Having worked for over eight years in fintech and software development, Inoxoft engineers have

all the necessary experience to deliver a scalable custom CRM for your business professionally.