Artificial Intelligence and Machine Learning revolutionized the way financial services are delivered, transforming the landscape and opening up new possibilities for innovation. Fintech companies are leveraging AI and ML to enhance customer experiences, automate processes, improve risk management, and drive business growth.

In the article, we discover how machine learning and fintech are related, the benefits technologies bring to the industry.

- AI and Machine Learning in Fintech

- Benefits of Machine Learning for Fintech

- Improved Fraud Detection and Prevention

- Efficient Risk Management

- Enhanced Credit Scoring

- Advanced Investment Analysis

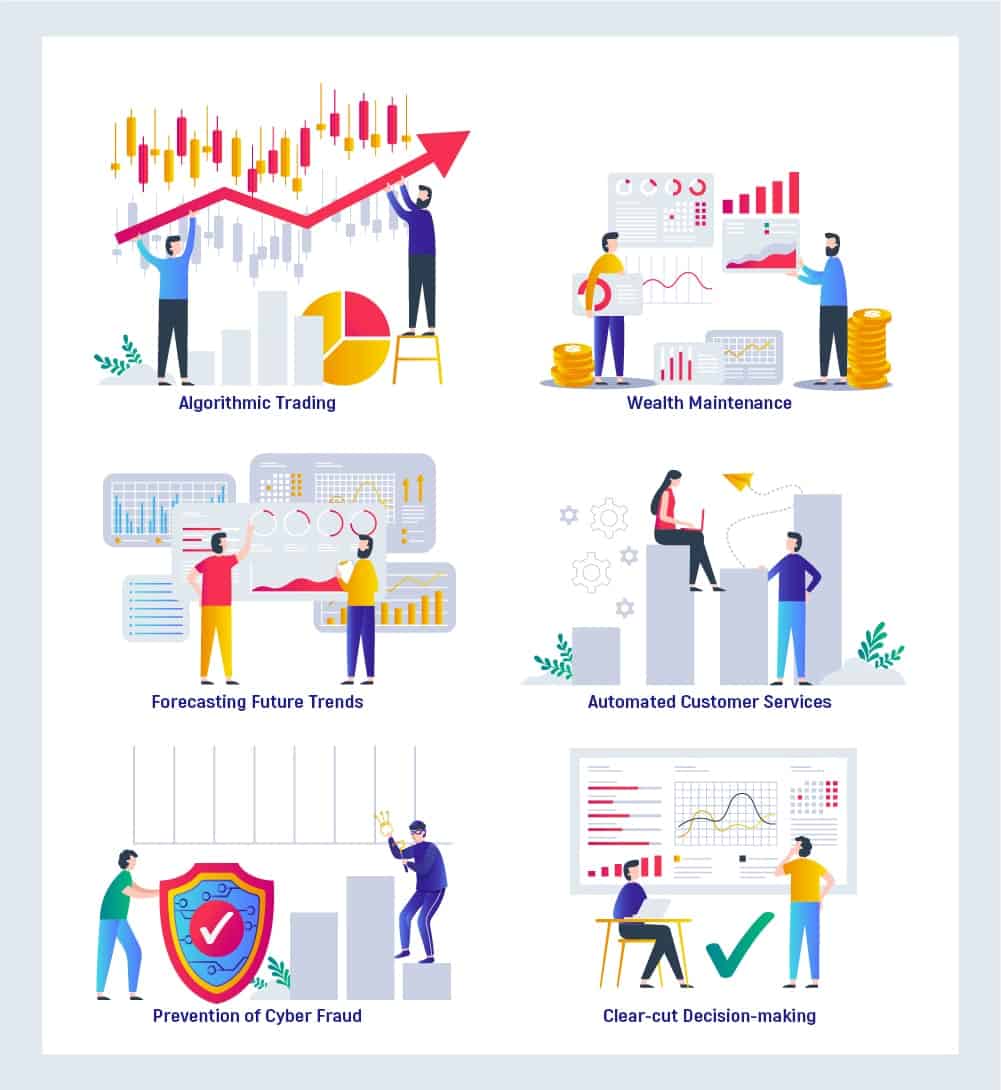

- Machine Learning Use Cases in Fintech

- Algorithmic Trading and Wealth Maintenance

- Forecasting Future Trends

- Automated Customer Services

- Prevention of Cyber Frauds

- Customer’s Risk Profile

- Clear-Cut Decision-Making

- Our Expertise

- Final Thoughts

AI and Machine Learning in Fintech

Machine Learning (ML) is a subset of Artificial Intelligence that uses algorithms and various techniques to teach computers to act on data. It learns from an amount of information, understands specific data patterns, and builds predictions based on these patterns.

One of the important areas where AI and ML have made an impact is in fraud detection and prevention. Traditional rule-based systems were limited in their ability to identify and adapt to evolving fraud patterns. However, ML algorithms can analyze vast amounts of data, detect anomalies, and recognize patterns that may indicate fraudulent activity. By continuously learning from new data, these systems become more accurate and efficient over time.

Personalized customer experiences have become a key focus for fintech companies, and AI plays a crucial role in achieving this. AI-powered chatbots and virtual assistants enable financial institutions to deliver personalized, 24/7 customer support, resolve queries, and provide assistance in real-time.

Another example of AI and ML that have transformed fintech is in credit scoring and underwriting. AI algorithms leverage alternative data sources and advanced analytics and can assess creditworthiness more accurately than traditional credit scoring models.

ML is similar to human learning to some extent. Human learning also requires data input and certain requirements to let the person identify what is being searched for. In the computer, data sets are fed into the system to adjust and optimize algorithms that will carry out the work further. Hence, it requires human help to put rules into the computer. Then, the system will recognize patterns according to these rules and perform the specified task. After completing the recognition pattern data input into the computer, ML can independently carry out such commands as:

- find/extract/summarize the data needed

- predict the course of action based on the data analysis

- calculate the probability of this data appearance while searching for it

- adapt to the search processes and changes in patterns on its own

- optimize the processes based on patterns it recognized

Today, ML is being applied in several industries and machine learning in Fintech is no exception here! Why and how exactly is explained below. Do read on!

Benefits of Machine Learning for Fintech

Fintech is an industry still being “under construction”. With the technological pace and daily innovations, Fintech sets goals that require specific solutions. Hence, ML being the core of AI is the exact disruptive technology that can meet the goals of the financial industry. How? By increasing the level of accuracy, accelerating the existing financial processes, and applying different methodologies to escalate positive results. Some of the needs of machine learning for the fintech industry are:

- to increase customer experience

- to propose cost-effective solutions

- to have the ability of data integration within the real-time frames, and

- to enhance security levels

Artificial Intelligence and Machine Learning in fintech empower organizations to make data-driven decisions, enhance operational efficiency, and provide better services to clients. Here is a list of key benefits of AI and Machine Learning technologies for the fintech industry:

Improved Fraud Detection and Prevention

ML algorithms analyze large volumes of data in real-time, and detect patterns and anomalies that may indicate fraudulent activity. ML models learn from new data and then adapt to evolving fraud patterns and enhance fraud detection capabilities, reducing financial losses and increasing security.

Efficient Risk Management

Machine learning algorithms in fintech assess risk more accurately by analyzing vast amounts of data and identifying complex relationships. This enables financial institutions to improve risk management strategies, optimize capital allocation, and mitigate potential losses. ML algorithms can also assist in stress testing, portfolio optimization, and compliance monitoring, enabling proactive risk management.

Enhanced Credit Scoring

ML in the fintech sector enables the assessment of creditworthiness using a wide range of data sources, including non-traditional ones. By incorporating alternative data points, such as social media profiles and online behavior, ML models can provide more accurate credit scoring and underwriting decisions, expanding access to credit and improving risk management.

Advanced Investment Analysis

AI and Machine learning in Fintech analyze market trends, economic indicators, and historical data to generate investment insights and predictions. This assists in portfolio management, asset allocation, and investment decision-making, improving investment performance and providing valuable guidance to investors.

Machine Learning Use Cases in Fintech

As machine learning penetrates fintech with great speed, it proposes newer and newer features to help the financial industry get ahead of time. Machine learning use cases in finance are:

Algorithmic Trading and Wealth Maintenance

Strategic or algorithmic trading and wealth management are some of the most important elements of financial literacy and machine learning projects in finance. Being able to maintain profits and save money as well as making strategic investments that can blossom twofold in the future is great knowledge to have.

One of the best examples of financial intelligence is the electronic wallet, which aims at tracking your expenses and analyzing your shopping behavior. Hence, by receiving information according to your spending, the wallet predicts your future expenses and shows sectors, where you overspend. Quite a smart way of teaching financial literacy and a convenient handy app!

The other example, which belongs to algorithmic trading is an app that helps predict successful investment deals. Here, Citi Private Bank (USA) is promoting machine learning investment banking and shares its investors’ profiles among its customers. Anonymously, of course. And it works, as fresh investments and business deals are always on the way!

Forecasting Future Trends

With the help of machine learning algorithms that analyze financial patterns, learn data, and create knowledge based on this data, sales may be improved, resource usage optimized, and operations should become more efficient. Any business can thrive by gathering huge amounts of data to make better financial trend predictions and promote customer satisfaction. According to Harvard University, by analyzing historical data over a certain period, ML learns about the customer’s budget based on particular economic indicators. It also creates better solutions for business performance improvement. Having complete knowledge of the financial market business beforehand makes forecasting potentially cost-effective!

Automated Customer Services

Before automating customer financial services and applying machine learning to financial data, all of them were done manually. Hence, it took longer to respond and resolve customer issues. Besides, in the hectic environment that required fast solutions the probability of human error was higher. Thus, a big need to customize fintech, make it safer and better to meet customer satisfaction and introduced such AI and ML technologies as chatbots and AI interfaces.

These AI/ML-supported features help by giving specific advice online and, this way, decrease the costs spent on staff augmentation. AI aims at automating processes done by humans and making them outstanding. Automation of customer services saves costs and time as well as reduces human errors. No more ambiguous pieces of advice, only better support and higher demands for it! What is more, by making a manual helpline automated, we can cut $1 trillion of operating costs with the help of machine learning applications in finance.

Also, we use machine learning in banking to optimize communication with customers. This is done with the help of natural language processing (deep learning algorithms). The Swedbank has created “Nina”, the natural language processing (NLP) chatbot to solve contact center overloads – the issue of 2 million customer calls annually.

Prevention of Cyber Frauds

Fintech has to be convenient for its users and at high speed. However, whenever there is talk about money and personal information, there is always a place for fraud. To decrease the level of fraud and eliminate it, the fintech industry invests in AI and ML immensely to stop transactions using fraudulent methods. The benefit here lies in ML’s ability to react faster and analyze large scopes of data.

If there are strange patterns and suspicious activity, ML can recognize them and learn that such behavior will do only harm. AI and ML block unnatural behavior and warn customers about potential hazards. So, software development companies are more than eager to build secured fintech apps using machine learning technology and artificial intelligence in banking. With the help of these two technologies, financial services become safer every day!

Customer’s Risk Profile

Profiling customers and understanding their needs is one of the machine learning projects in finance and in great demand now. However, detecting risky profiles isn’t just about customer needs. It’s rather about banking security and wise, predicted decision-making. Risk profile detection and segmentation are also done based on customer banking activity. They ensure the person is trustworthy, and the history of loans is successful. This way, the bank can approve loan applications of any customer, whose banking history is “crystal-clear”.

The patterns of the services customers choose or the financial activity they do online can be traced in real time with the help of AI and ML. What’s more, banks might even trace the patterns of social media usage, web browser history, geo-location pins on maps, and other metrics used when questions of trust arise. Thus, the fintech industry tries to automate customer risk evaluation techniques with AI/ML tools and detect creditworthy customers effectively.

Clear-Cut Decision-Making

Management decisions can be crucial both for the employees and the customers. That’s why the right decision-making in the financial sector is very important. By implementing AI-powered technologies and machine learning projects in finance, fintech benefits right away. ML has the potential to effectively analyze numerous data sets and propose the best-predicted outcomes to cut costs and save money. It makes organizations decision-solving effective enterprises.

I predict that, because of artificial intelligence and its ability to automate certain tasks that in the past were impossible to automate, not only will we have a much wealthier civilization, but the quality of work will go up very significantly and a higher fraction of people will have callings and careers relative to today. — Jeff Bezos on AI for CNBC

Our Expertise

What tasks have software development teams dealt with while building a web application for the fintech industry? Firstly, the main goal is to substitute manual work with automatic optimization. It can be an automatic generalization of sheets with exchange rate data or automated analysis of fluctuations in cryptocurrency prices. Second, the development team has to implement financial strategy within code and make hourly updates as soon as world major stocks update info about rates. Thirdly, it is the most critical task to build logic for forming orders or arranging deals with investors or brokers. The faster the deal management goes, the more chances to get a bargain.

Besides, engineers should have a profound understanding of trading, stocks, currency diagrams, and financial operations. With a particular background knowledge, the team doubles success to carry out the project without overworking and stressing about it. You can see the scope of responsibilities, tasks, and challenges that teams face during delivering a high-level trading platform in the case study. Discover how Trading Automatization Platforms are built by experts.

Read more on machine learning outsource possibilities and the latest fintech industry trends in the USA!

Final Thoughts

To conclude, artificial intelligence in finance and banking and machine learning are the bright future of fintech services. They will not only put the financial industry one step ahead of the other industries but will polish fintech algorithms and techniques to achieve even better automated processes.

Fintech should, by no means use AI and ML as they make banking and trading faster, easier, predictable, and more efficient. Artificial intelligence and Machine learning are the technologies of tomorrow being used in fintech and advanced with cutting-edge solutions today! If you want to reap all the benefits of it, contact our machine learning app development company to start your journey.