Leading an online business in eCommerce requires a lot of time and effort. Besides having an CMS to manage customers of your online store, it is also vital to make sure these customers can easily pay for the services you provide. Therefore, unlocking the gateway to seamless transactions is vital for businesses navigating the vast landscape of the United States market.

With a myriad of payment gateway providers vying for attention, selecting the right one becomes a strategic imperative. Dive into this guide to explore the top 10 payment gateway providers in the USA, each offering unique features to elevate your business transactions and propel growth in today's dynamic eCommerce landscape.

- 10 Payment Gateways in the USA

- Square

- Payment Depot

- Stripe

- Helcim

- Stax

- National Processing

- Merchant One

- PayPal

- Clover

- QuickBooks

- How to choose the USA payment gateway provider?

- 1. Figure out your unique needs

- 2. Listen to your customers

- 3. Take into account your monthly sales volume

- Our Valuable Experience

- Final Thoughts

10 Payment Gateways in the USA

The USA is such a big market full of possibilities. No wonder it has dozens of payment gateway companies that can be of service. But, the reason for this variety lies in the fact that each USA payment gateway provider is suitable only in specific situations. What does that mean? As many businesses there are as many requirements for customer payment systems as they can have. And an eCommerce shop cannot have the same needs as a pizza shop, for example.

So, we have prepared a list of the 10 best website payment gateway for the U.S. you might want to have a look at. According to Forbes, the best payment gateway providers in the USA are:

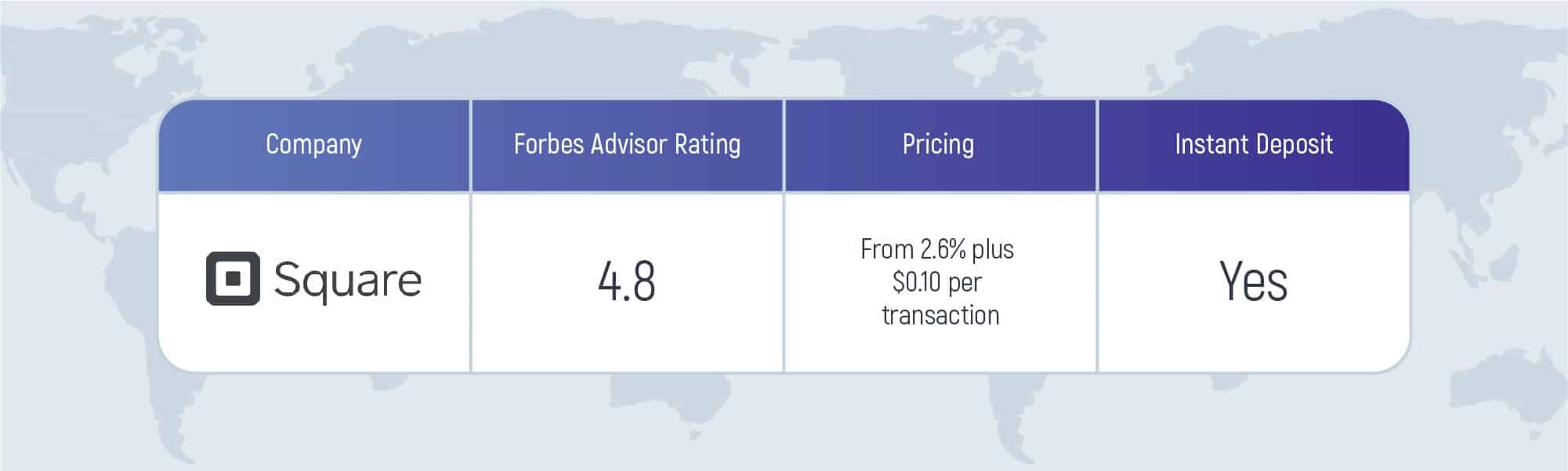

Square

Square is a POS platform. Businesses of any size can use it, no matter if you’re a startup or an enterprise with hundreds of operations. Square has an affordable, appealing user-friendly package for businesses with unstable monthly profits. And their fees depend on business turnover per month.

Pros:

- Free Start

- Free Basic Plan

- Hardware variety

- Offline mode

Cons:

- Permanent activity is required for the account not to be frozen

- High-volume transactions make it less cost-efficient

- Does not support phones

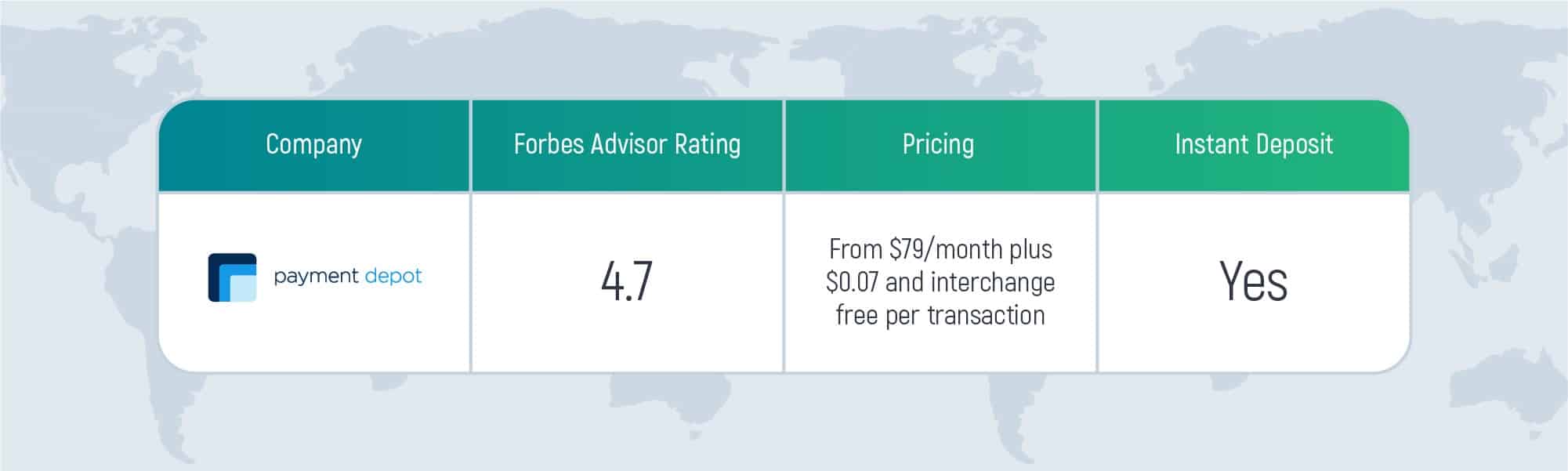

Payment Depot

Payment Depot has an amiable business model. Its customers are charged with a membership fee and, also, there is a flat rate per transaction. It doesn’t matter how many items you will sell, the cost is more or less the same. Payment Depot has three payment options. The membership fee starts from $79 per month plus an interchange fee per transaction, which is $0.07. And the price ranges up to $199 with an interchange fee of $0.15. But, there is a difference. Each package can process $50, 000, $150,000 and $300,000 a month. The first option has no benefits, but the second and the third offer breach protection features. Also, the third package allows you to have a dedicated account manager. So, if you are a business with numerous sales, it’s better to pay a flat rate than a percentage from your sales. And, there’s quick access to funding.

Pros:

- Membership pricing model is great for businesses with large sales

- 24/7 support

Cons:

- Has no CRM or analytics features

- No support for industries that are at high risk

Stripe

Stripe is the best payment gateway in the USA. It is rich in features. Payments can be accepted online and offline and managed via a dashboard. Among the features, one can notice tools dedicated to invoicing, billing, sales terminals, banking services, sales tax, VAT, report generators, etc.

What’s more, Stripe can be customized by developers to meet any business purpose. Also, it is possible to integrate Stripe almost anywhere as it supports 135 currencies.

In eCommerce, Stripe can be super reliable. The price starts at 2.9% and a $0.30 transaction fee. Stripe supports instant transfers at 1% cost, and two-day transfers are free. It suits best for businesses with large sales.

Pros:

- Detection of fraud using AI

- Extra customizable

- Can be integrated everywhere

- Supports 135+ currencies

Cons:

- High pricing

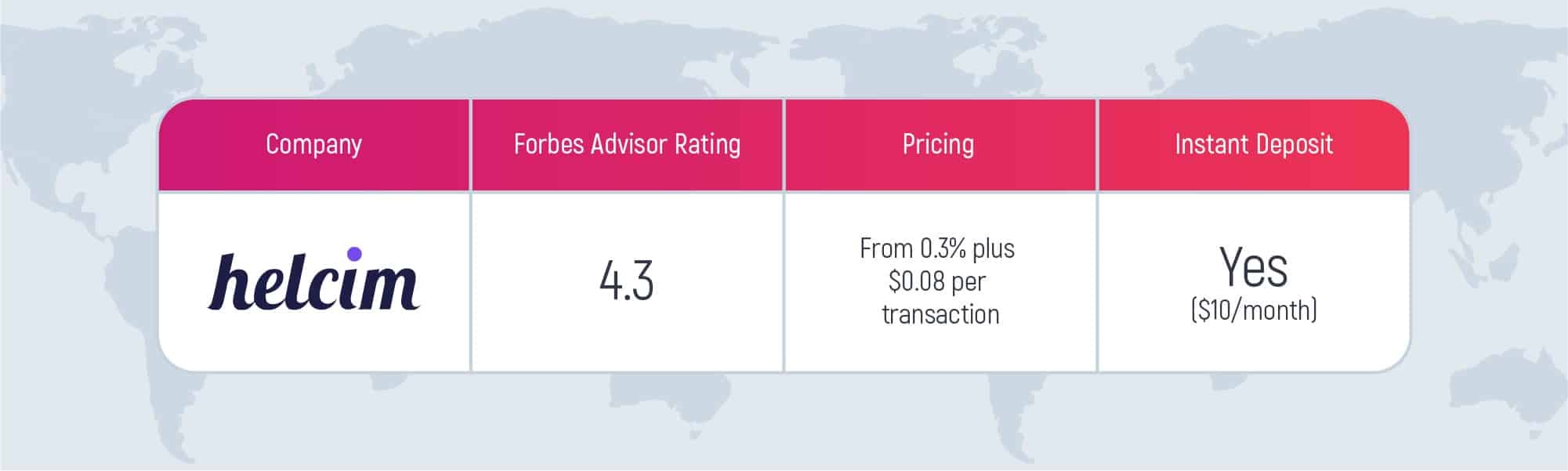

Helcim

Helcim works according to an interchange-plus pricing model. Here, customers aren’t used to paying a flat-rate fee, but rather a consistent, modest markup on the transaction interchange fee. So, businesses have an opportunity not to overpay on transactions with the interchange rate lower than the flat rate. There will be no monthly fees with Helcim and you might get a discount.

With Helcim, customers can create online stores and hosted payment pages. All the processes such as invoicing can be automated. The platform is secure and stores customer information appropriately. Also, there is a CRM system to track potential customers and your inventory. Just like Stripe, Helcim is customizable and can be integrated via API to make your customized payment solution. So, it suits businesses with large monthly sales. And, also, for those, who need a customizable and API integrated solution.

Pros:

- Low pricing for businesses with large monthly sales

- Customizable

- API integration available

Cons:

- Instant deposit fee

- Interchange plus pricing cannot be predicted

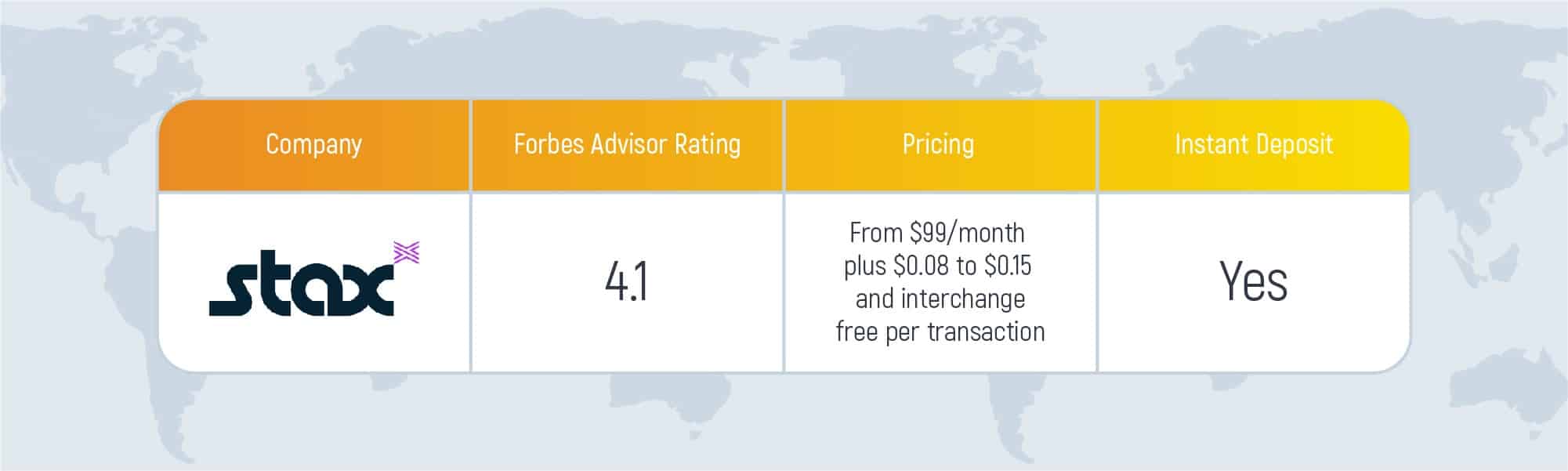

Stax

Stax is among the American best gateways for being both low-cost and scalable. Here, you have to pay a monthly fee and a per-transaction fee. But there are no markups on interchange fees. Stax values its cooperation with businesses and offers the latter to choose a package and add-ons that give access to additional payment channels, a dashboard, numerous reporting tools, web-hosted payment ability, scheduled payment support, and more.

Businesses with large sales that focus on future growth should use Stax. As, even when you start small, with predictably low prices, there is a chance to add functionality whenever your business has a chance to and needs to grow.

Pros:

- Pricing for businesses with large sales

Cons:

- Subscription fee per every terminal

- Expensive for small businesses

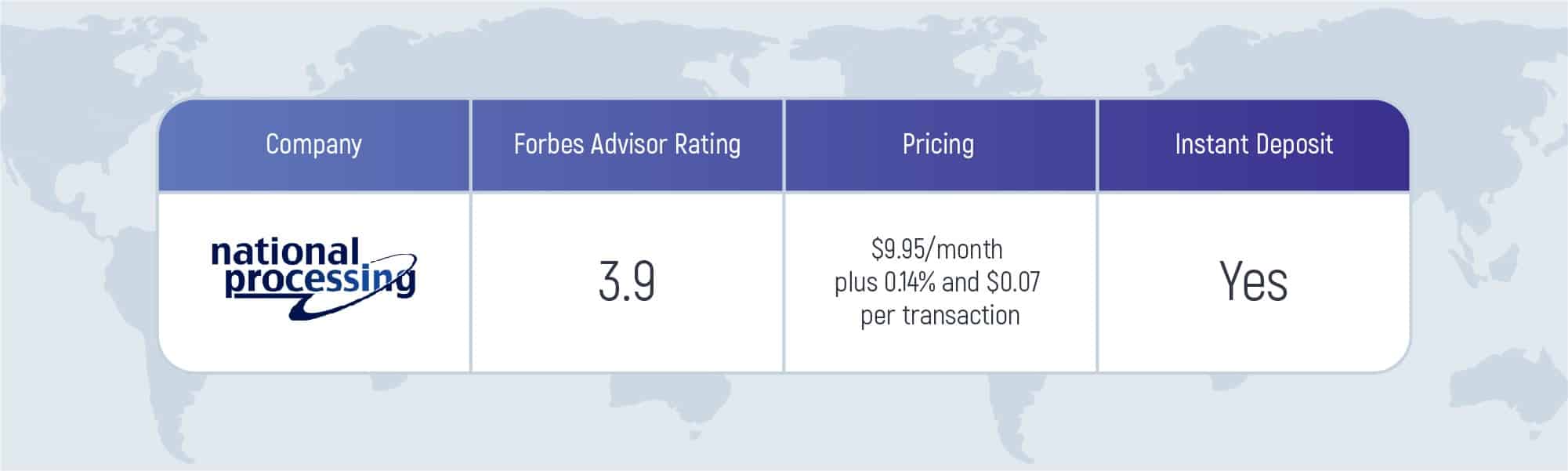

National Processing

National Pricing is a simple and affordable payment gateway for the USA. Personal, mobile, and web-based payments are all available via this solution. Three plans cost under $10 a month, and transaction fees are quite low and with free equipment. Users of this gateway can reprogram the existing equipment. So, small and middle-size businesses like restaurants and retail spaces can use National Processing.

Pros:

- Free equipment plus reprogramming possibility

- Affordable for restaurants and retailers

- Transparent pricing model

Cons:

- Not many features are available

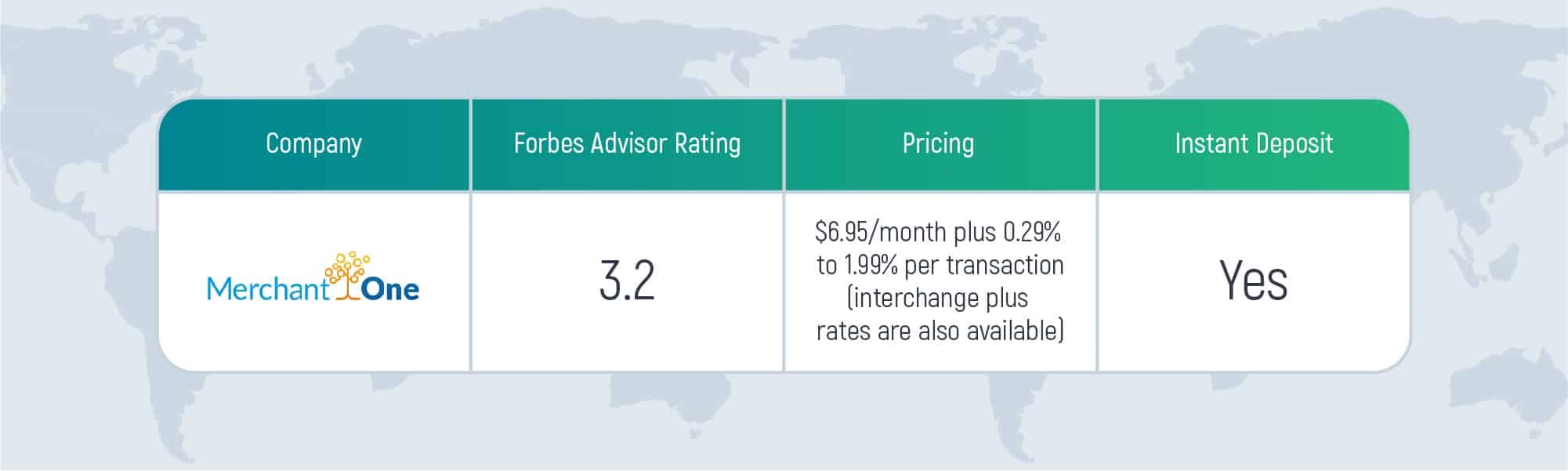

Merchant One

Merchant One is on the USA payment gateway list because it is affordable, can be integrated and customized. If to choose plans, there are both monthly and interchange plus ones. Users, who wish to terminate a plan can cancel any time without paying the fee. Merchant One has lots of physical equipment to offer, i.e. mobile, POS terminals, virtual terminals, etc. This gateway is also developer-friendly as software engineers can use its APIs to enhance online, offline, and mobile experiences. All sizes of businesses are welcome to use Merchant One.

Pros:

- Integrates with many solutions

- 24/7 support

Cons:

- Not feature-rich

PayPal

PayPal is one of the most popular payment processors in America. It has over 300 million users, and the others only wish to have such a great number of end-users. PayPal is a friend to any business operations and offers a lot of corresponding services. You can even buy the service now and pay for it later using PayPal. This is flexible and quite convenient to raise sales. PayPal also allows connecting businesses with the much-needed funding. And, also, if a business has a debt, a percentage of its sales can pay the debt step by step. Among the services the gateway technology provides is the data analytics tools, which significantly help in decision-making based on the right data. PayPal can be used by anyone, but if your business has a low transaction volume – it’s a 100% match.

Pros:

- Great pricing for low transaction volumes

- Supports “buy now and pay later” option

- Popular among consumers worldwide

Cons:

- Bad customer service

- Inactive account freezing

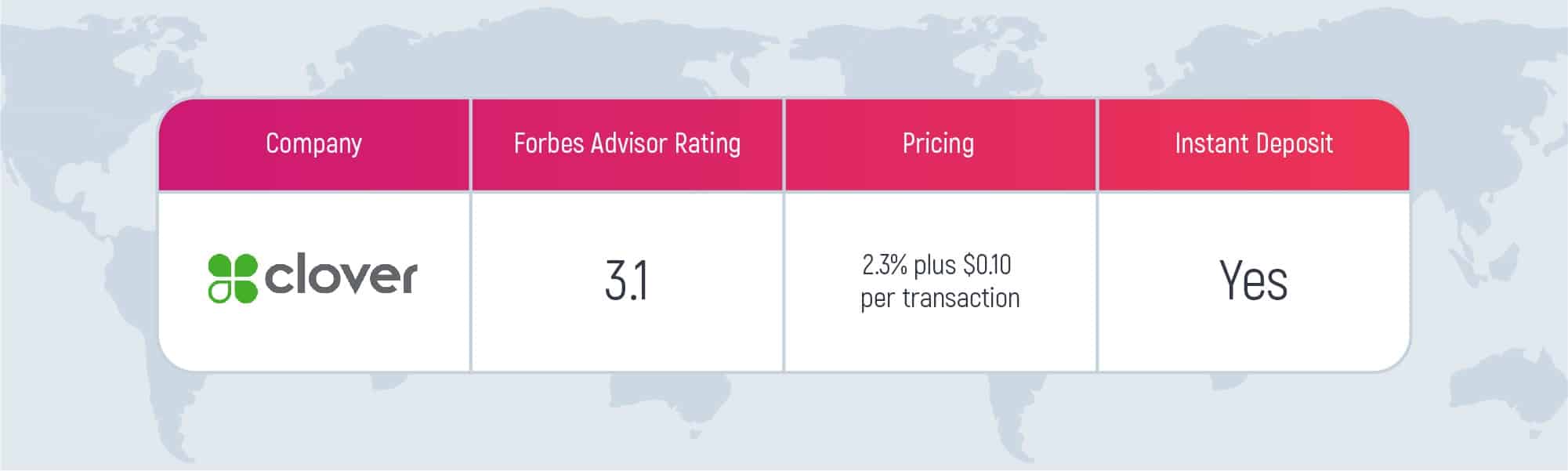

Clover

Clover is also the best payment gateway for websites in the USA. It allows making payments both online and offline. Clover offers POS terminals and other useful payment devices. Clover’s apps are free and easily downloadable by the end-users. Also, you can integrate these with the POS terminal to handle money operations better.

The gateway suits the best for brick-and-mortar retailers, mainly, due to POC terminals and adjustable apps.

Pros:

- Feature-rich

- Lots of payment equipment

- Rich app ecosystem

Cons:

- Isn’t BBB accredited

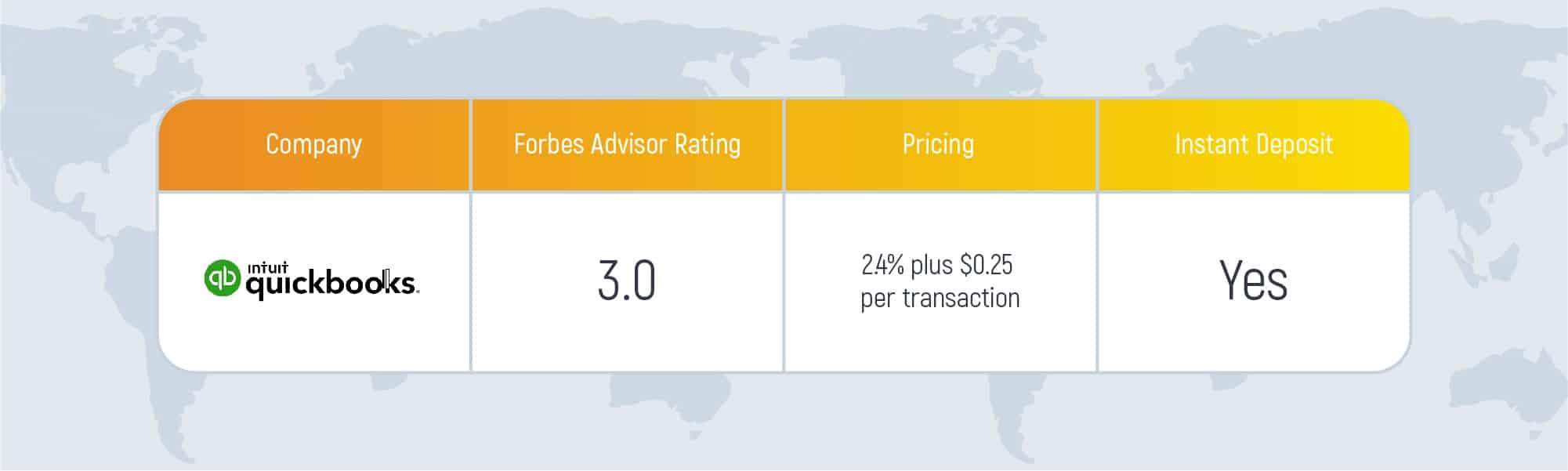

QuickBooks

QuickBooks is the best payment gateway for eCommerce in the USA. It can offer you instant invoicing, payment processing, scheduled payments, online and offline payments. What’s more, the invoice templates are free-of-charge with smart invoicing support.

When customers tend to pay via this gateway, it automatically matches with a transaction. This solution would be good for businesses already working with Quickbooks services.

Pros:

- Great set of features

- Low prices for businesses with large sales

- 24/7 support

Cons:

- Customer support has lots of minuses

- There is no BBB accreditation

How to choose the USA payment gateway provider?

Now that you have seen the U.S. payment gateway comparison, it is vital to understand the criteria to choose the gateway provider for your business.

1. Figure out your unique needs

First and foremost, your journey to a potential gateway provider starts with acknowledging your business needs. What are they? Are you a big, medium, or small size business? Do you need flexible pricing models or a popular gateway service? Or a rich-feature platform? Think twice about what you intend to get afterward and then make a decision.

2. Listen to your customers

Your customers are the ones who will pay for your services and products. So, it is great to ask them. Where do they like to shop? Online, offline, or both? And, what payment methods do they use most of the time? Cash, credit card, online transactions? This is important to understand to be user-friendly.

3. Take into account your monthly sales volume

A payment gateway option also requires knowledge about your monthly sales or transaction volume. Why does it matter? Mainly, because some of the providers suit best for businesses with large transaction volumes, and others suit best for low sales volumes. Choose your option as you will pay extra for selecting a gateway that will make you pay more than you earn.

Our Valuable Experience

Inoxoft is an international software development company providing payment gateway integration services and more. We are experts in software development for the U.S. market. Our competencies include:

Also, Inoxoft is among the best countries to outsource software development.

If you’d like to integrate a payment gateway provider into your digital business processes, Inoxoft might help you with that. With us, you will get:

Choosing Inoxoft you choose the best software development team on the market with the most forward-thinking solutions! Contact us and book a consultation!

Final Thoughts

In this article, we have analyzed 10 different payment gateway providers in the United States market. These 10 payment platforms are considered to be the best transaction technologies of today. But, if you are a business in search of a payment gateway, be sure to understand your business needs, customers, and volume of business transactions first. There are the core features that might put you on the right track in your search.

Frequently Asked Questions

What are the best payment gateways in the USA?

- Square

- Payment Depot

- Stripe

- Helcim

- Stax

- National Processing

- Merchant One

- PayPal

- Clover

- QuickBooks

What is the best payment gateway for website in the USA?

Almost every payment gateway can be integrated into a web app, mobile, and desktop one. By so far, Stripe is considered to be the most popular payment method.