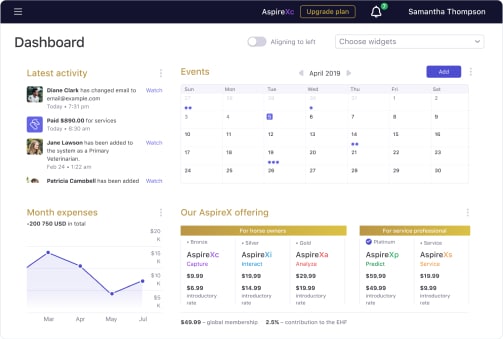

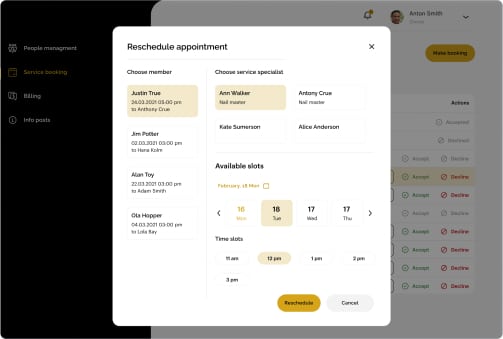

Automated Loan Processing Software is a computer program that automates the loan application and decision-making process. Banks, lending institutions, and financial advisors commonly use it to increase productivity and reduce errors.

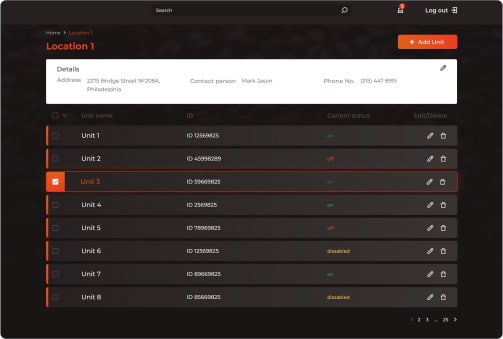

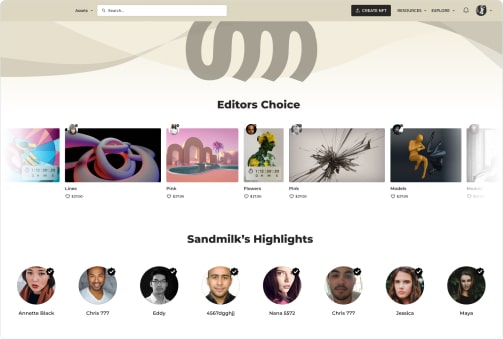

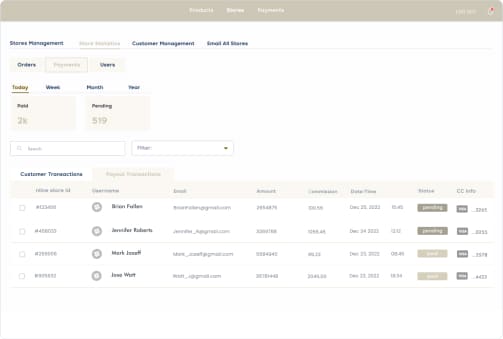

Digital solutions can replace time-consuming and error-prone manual loan processes, as well as assist loan officers in their daily job. Inoxoft develops such systems that include robotic process automation (RPA), optical character recognition (OCR), artificial intelligence (AI), and other cutting-edge technologies.

Development of custom loan workflow automation solutions eliminates manual tasks involved in loan processing and replaces them with a digital, streamlined process. The software developed by Inoxoft uses algorithms and data analysis to evaluate loan applications and make lending decisions, allowing for faster and more efficient loan processing.

So why would a business need the software for loan processing automation?