Our clients

FINTECH DEVELOPMENT SERVICES WE OFFER

Banking software development

Modernize Fintech development services with advanced web and e-banking solutions

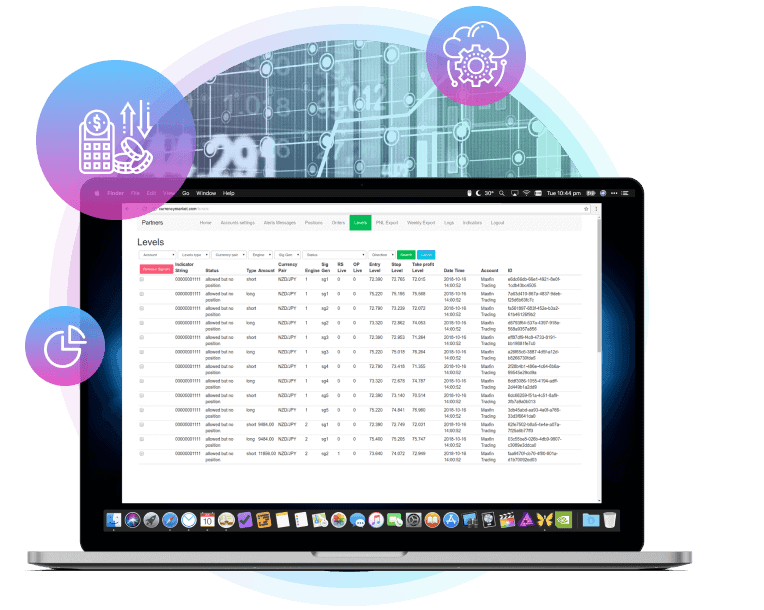

Trading software development

Build automated trading systems under the technological and domain expertise of our teams

Loan Processing Automation Platform Development

Your financial business can bring more profits when embracing digital benefits.

Banking CRM Software Development Services

Banking CRM software development can help you improve your lead capture, and increase your client.

Lending Software Development

Streamline lending operations, reduce manual work, and improve the efficiency of your lending processes.

FINTECH SOFTWARE SOLUTIONS WE PROVIDE

FINTECH SOFTWARE FEATURES WE BUILD

WHY INOXOFT FOR CUSTOM FINTECH SOFTWARE DEVELOPMENT?

Start building your fintech software and revolutionize your company with Inoxoft

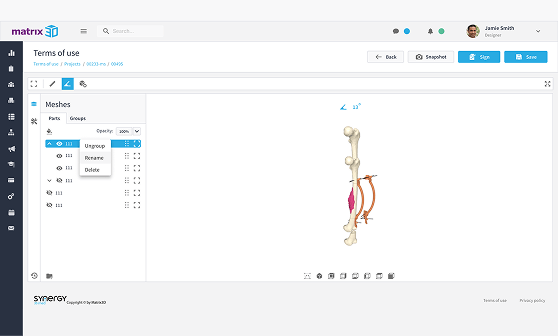

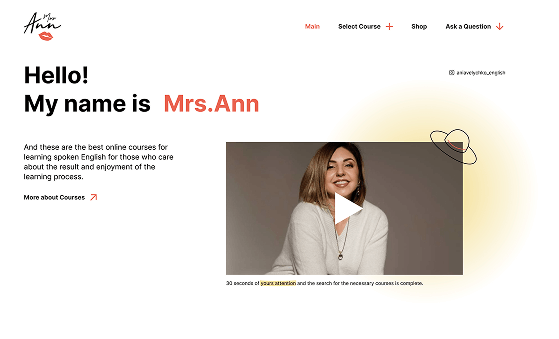

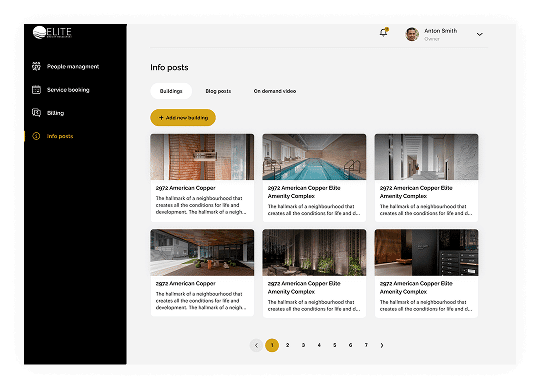

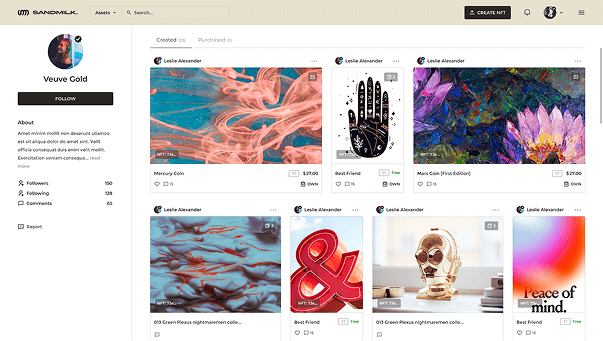

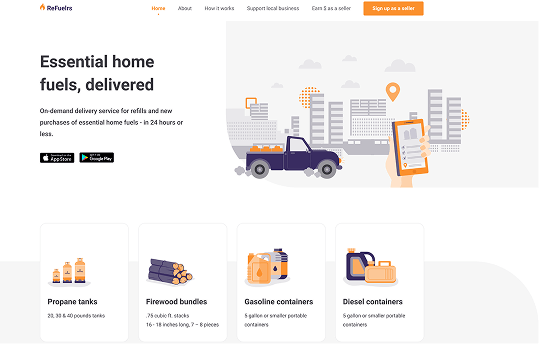

SUCCESS CASES

OUR CUSTOM FINTECH SOFTWARE DEVELOPMENT PROCESS

OUR COLLABORATION MODELS

Frequently Asked Questions

How much does custom fintech software development cost?

Costs vary based on project complexity, features, and development team location. Expect a range of $50,000 to $300,000+ for basic to highly secure and feature-rich solutions.

Inoxoft offers free consultations to estimate your project cost — don't hesitate to contact our team

How can I ensure the security of my custom fintech software?

Ensuring the security of your custom fintech software requires a multi-pronged approach:

- Look for a company with a proven track record of secure development practices.

- Work with your developer to enforce secure coding practices and data encryption methods throughout the software development lifecycle.

- Ensure compliance with relevant financial regulations (PCI DSS, KYC/AML).

- Regularly apply security patches and fixes to your software to address any vulnerabilities discovered.

- Conduct penetration testing to proactively identify and address potential security weaknesses before they can be exploited.

What are some of the challenges associated with fintech software development?

- Ensuring robust security measures to protect sensitive financial data.

- Navigating the complex and evolving regulatory landscape of the financial industry.

- Integrating seamlessly with existing financial systems and APIs.

- Creating a user-friendly and intuitive experience for financial transactions.

- Building software that can handle large volumes of transactions and users.

How can I find a reputable fintech software development company?

Here's how to ensure you find the perfect fit:

- Experience: Look for a company with a proven track record in developing similar fintech solutions. Their experience translates to a deeper understanding of your industry's unique needs.

- Success stories: Review client testimonials and case studies. These insights provide valuable evidence of the developer's capabilities and past successes.

- Security: Evaluate their security certifications (like SOC 2) and development processes. Financial data requires robust security measures, so choose a partner prioritizing this aspect.

- Communication: Ensure clear communication and a collaborative development approach. Look for a company that actively engages with you throughout the process.

Finding the right partner can empower you to build a secure and successful fintech solution. Inoxoft, with our extensive experience and commitment to security, is delighted to be your trusted guide in this journey.