A Digital Solution for Primary Capital Markets

The idea was to create a digital solution that would connect underwriters, issuers, and institutional investors in Debt Capital Markets. It is supposed to become an integral part of primary capital markets, offering uniquely designed, secure, digital tools that transform the way business is conducted.

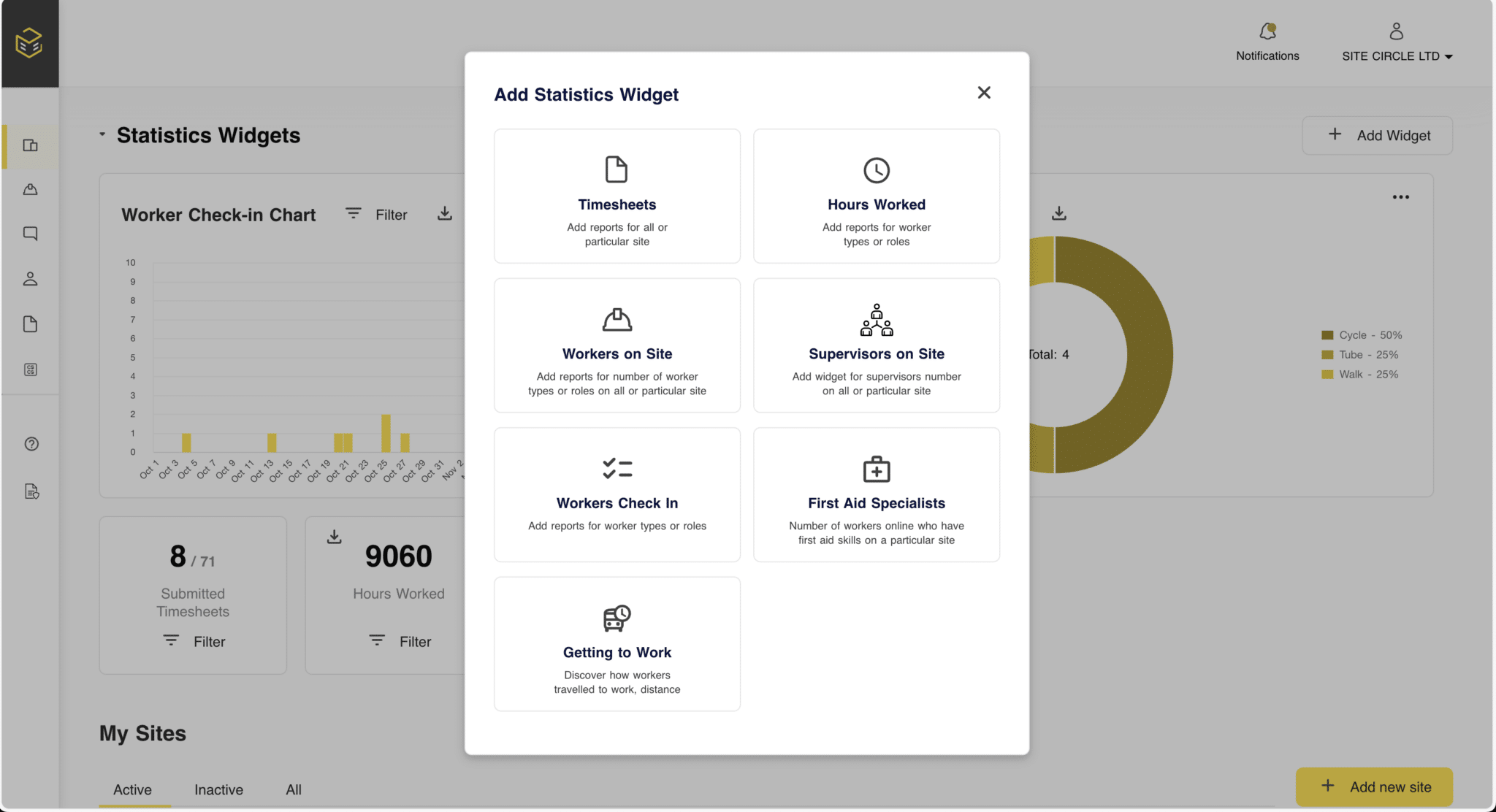

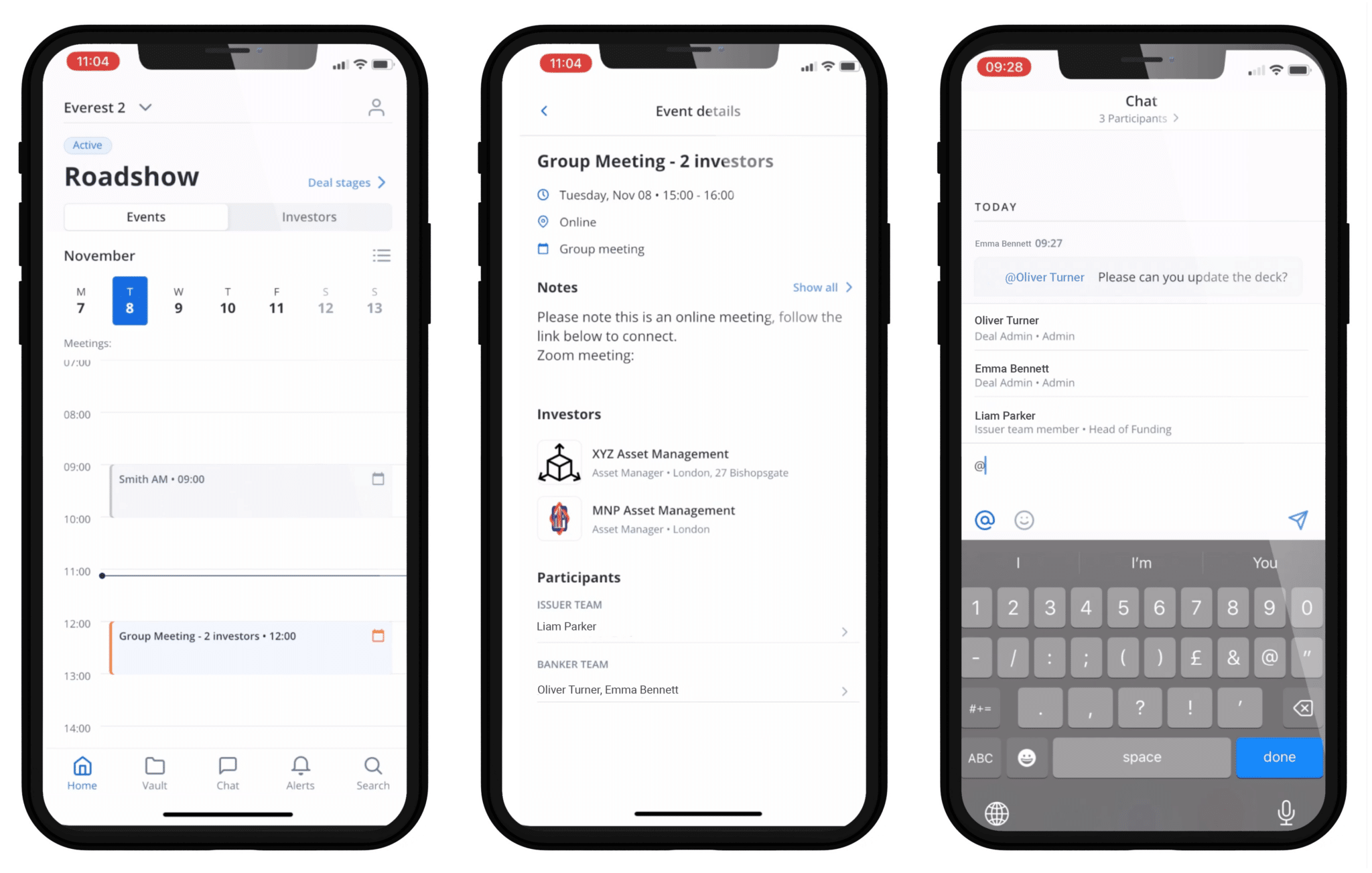

After conducting a Discovery Phase, Inoxoft delivered an industry-first digital solution ( Admin Portal for Bank Admins, Web App, and Cross-platform Mobile App for deal stakeholders (issuer and bank teams) for end-to-end management of deal execution. A tool that digitalizes deal management, addressing the principal market pain points across primary debt issuance.

Access to all relevant information, securely, in real-time in one place, delivers significant value across Debt Capital Markets creating cost efficiencies and competitive advantage for all stakeholders. With a focus on the relationship between an issuer and its bond underwriters, it fills a gap that wasn’t previously addressed by others.

- Real-time logistical support

- Secure Document Vault

- Chat

- Customisable Alerts

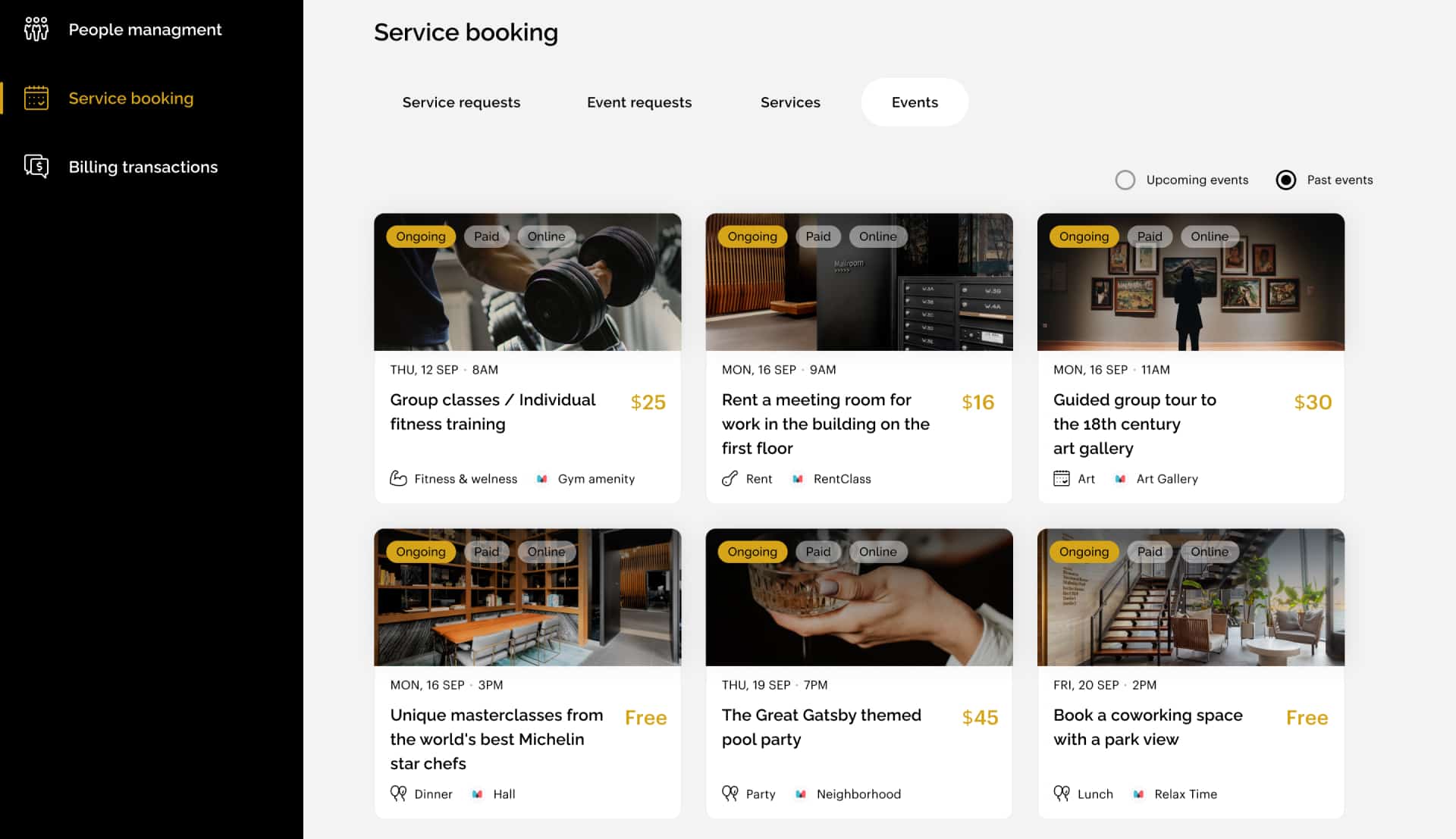

- Live / Historical analytics

- Real-time transaction information

Full Story

Inoxoft solution

At a time when trading has never been more digitalized, primary deals remain old-fashioned. The fundamental processes have not changed for decades. Manually intensive and costly processes increase risk from human error, fragmented data, and friction with regulators all cost time and money.

The industry-first application addresses these ongoing challenges. The app is designed to allow intelligent data management and mining such as roadshow logistics, investor feedback, real-time book-building data, AI-based analytics, and contextual insights.

With the help of the tailor-made secure app, underwriters can dynamically input data, track, manage and monitor the deal delivering a better client experience. The electronification of these processes is expected to increase efficiency, reduce operational risk, and greater transparency.

The analytical tool is accessed via cloud technology to support data segregation for each client:

- For institutional investors, it ensures secure engagement and communication through an integrated platform.

- For underwriters, it becomes the primary deal hub, the centralized digital communication channel with their clients.

- For issuers, it is the one-stop shop for managing transactions.

Results

Inoxoft delivered digital application that give banks a big productivity boost and help issuers by conveniently displaying relevant data in real time. Also, it enables secure access on desktop and mobile to relevant data creating cost efficiencies and competitive advantage for stakeholders. We’ve also successfully managed to achieve the following results:

- Collate everything into one place

- Streamline workflows, boost deal execution

- Decrease deal execution costs

- Reduce operational risk

- Access to deal critical information through secure document vaults;