With the evolution of the Real Estate industry and the trendy advancements, it became essential to use software development technology in the domain as well. What is the industry implementing to stay competitive in the market? Mainly, automation of Real Estate processes, personalization, customization, and security. Here the latter shifted towards blockchain. What does blockchain in Real Estate do? What are the benefits of blockchain technology in Real Estate? Let’s explore!

- What is Blockchain in Real Estate?

- Blockchain Tokenizes Real Estate

- What are the Benefits of Blockchain in Real Estate?

- 1. Easier search of property

- 2. Faster pre-purchase

- 3. No intermediaries are needed

- 4. Provision of smart contracts

- 5. Safe property transactions

- 6. Low entrance to Real Estate Investing

- 7. Real Estate becomes a liquid asset

- Blockchain Use in Real Estate

- Tokenization of real estate assets

- Property management

- Smart contracts for property transactions

- Payments and leasing

- Title management and land registries

- Supply chain and construction management

- Tenant management and lease agreements

- Cross-border transactions

- Mortgage and loan processing

- Tools to Consider

- Blockchain platforms

- Smart contract development tools

- Token standards

- Development frameworks

- Existing Challenges to Blockchain in Real Estate

- Regulatory hurdles

- Standardization

- Security concerns

- Integration with legacy systems

- Scalability

- Future Impact: How Will Blockchain Transform Real Estate?

- Consider Inoxoft Your Trusted Partner in Real Estate Development

- Make data-driven decisions

- Use advanced analytics

- Constantly monitor risks

- Use our tech-driven competitive potential

- Are up for optimization and customization

- Final Thoughts

What is Blockchain in Real Estate?

Have you heard about blockchain? Where did blockchain come from?

The first to introduce blockchain technology was Satoshi Nakamoto in 2008. It aimed to transfer cryptocurrencies (bitcoin, ether, etc.) among the public. Using blockchain in Real Estate became possible starting from 2016. Blockchain started initial coin offerings (ICOs) and security token offerings (STOs), also sometimes called digital security offerings (DSOs). So,

Blockchain is the system that works with transmitting digital information. It records data to make it impossible to hack it, change it or compromise the system itself. So, most of the global transactions are made using blockchain technology. Especially, the ones involving finances (cryptocurrencies). Most of the Real Estate transactions have always been made offline, i.e. face-to-face. But, recently, and with all the Covid-19 pandemic, online transactions became a priority. So, the industry was introduced with smart contracts. What did these contracts change? Perhaps, Real Estate became a token that is now transferred online like cryptocurrencies. And, on top of it, these transactions are extremely secure.

Traditionally, Real Estate has been all about making buyers and sellers connect via listings. But, with the introduction of blockchain platforms, this aim became easier to achieve. Also, brokers, lawyers, and banks that belong to the industry can soon be gone. But would they? Can humanity experience listings, payments, and legal documents on a blockchain platform? So, there is a possibility intermediary might no longer exist. What does that make the Real Estate transaction like? No fees, or commissions, and a faster process in the end. Is it our Real Estate future?

Where does blockchain in the Real Estate sector change the industry?

- In money transfers

- In property, transaction, and title ledgers

- In smart contracts

- In voting

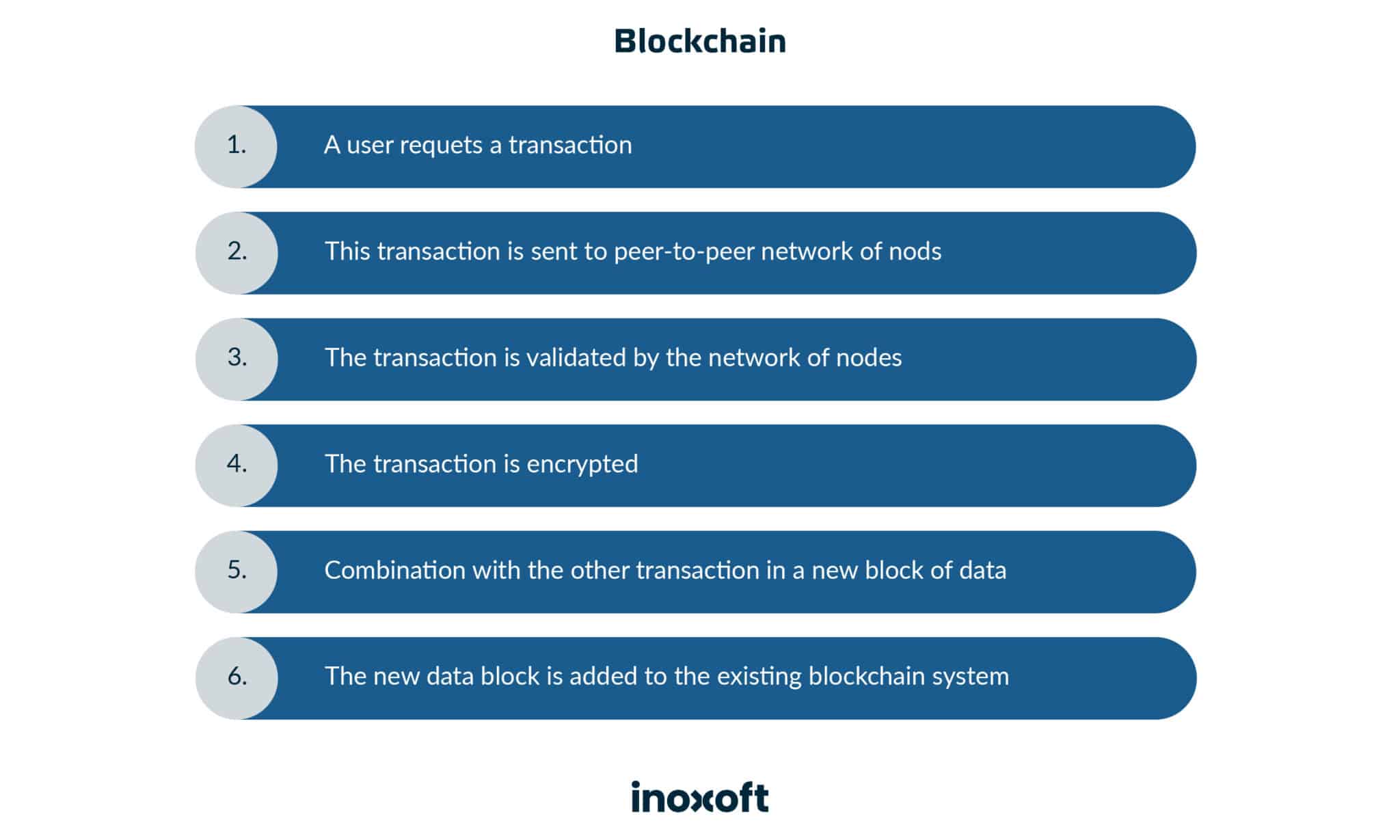

The way any transaction is being carried out is precisely explained below:

Discover more about real estate mobile application development!

Users request transactions, which are later sent to a peer-to-peer network of nods. The nods validate transactions and encrypt them. Then these transactions combine with the other ones in the new block of data. And this newly created block forms the blockchain system by adding it. Sounds easy and innovative!

Read more about ERP for real estate business

Blockchain Tokenizes Real Estate

The tokenization of real estate is the process of converting rights to an asset into a digital token on a blockchain. This makes real estate investments more accessible, liquid, and efficient. Here’s how the process usually works:

- Asset Identification and Legal Compliance: identify the real estate asset that will be tokenized and ensure legal compliance with relevant regulations.

- Smart Contracts: self-executing contracts with the terms of the agreement directly written into code. Smart contracts automate some aspects of the investment process (e.g. dividends and voting rights)

- Token Creation: they represent ownership or shares in the real estate asset.

- Transparency and Security: blockchain records all transactions on a distributed ledger. This helps reduce fraud and ensures that ownership records are secure and immutable.

What are the Benefits of Blockchain in Real Estate?

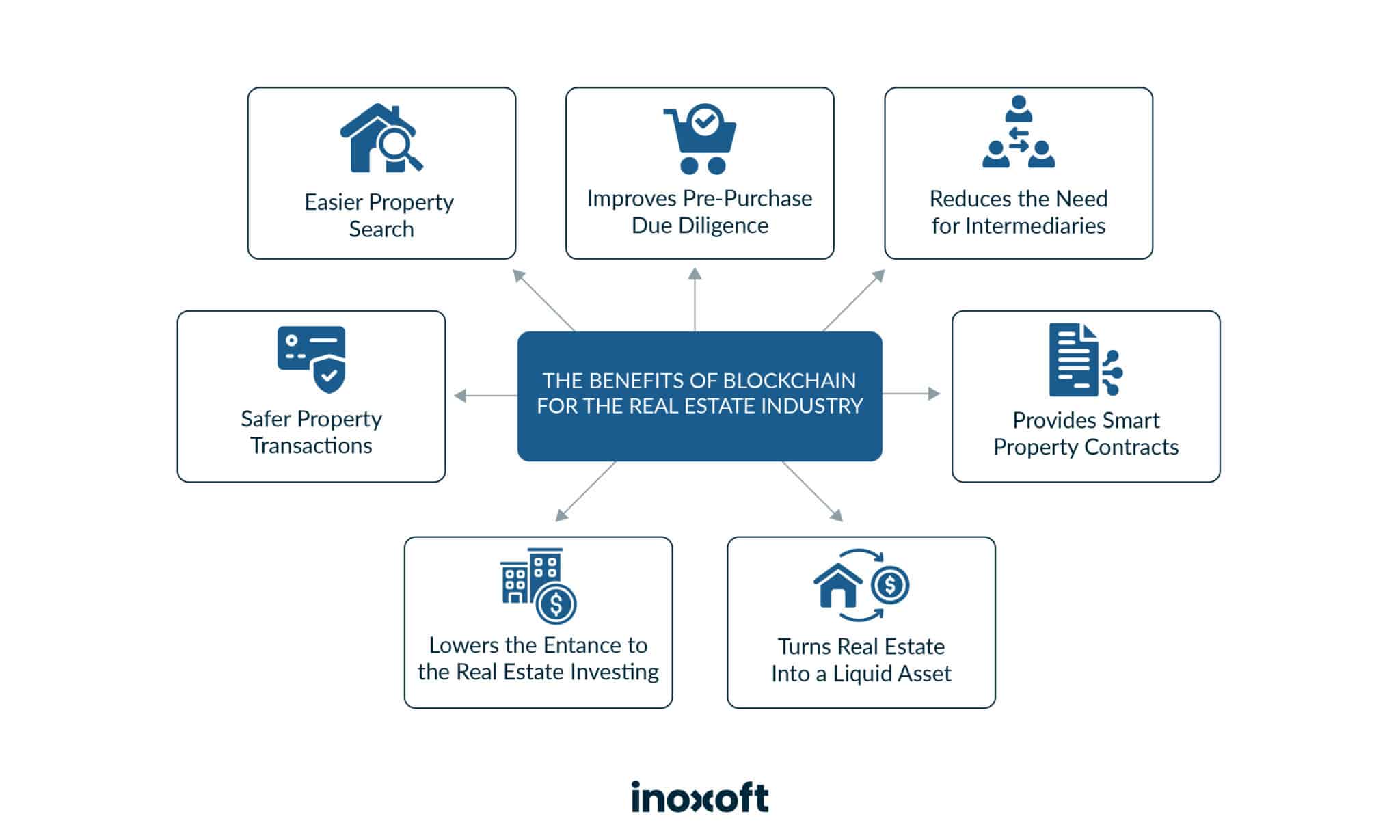

Giving extra security, the easiness of digital asset transfer, and many other features are not the only benefits of blockchain in Real Estate. There are also the following advantages:

1. Easier search of property

With blockchain, you can say no to third-party property listing platforms! Some of the platforms require a subscription fee on a monthly basis. Also, the platforms poorly update each other on the availability of property and can disinform users. Which extremely undermines property values.

Blockchain has a single decentralized database with property listings. And, this data is accessible to brokers, more efficient and reliable. Of course, there is a fee, but a lot lower than the one on the third-party platforms.

2. Faster pre-purchase

Automation of transactions reduces the risks of any digital fraud completely. How? By promoting the speed and safety of transactions. And it sounds perfect. The simplicity of data transmission and time reduction between signing the pre-purchase contract and the deed of sale before the notary is a perfect innovation.

3. No intermediaries are needed

For those, who think that brokers, lawyers, and banks will soon be out of the Real Estate selling and buying process – stay calm! These intermediaries will last as there is still demand on the market. Besides, some of the users trust brokers and banks more. But, it should be noted that blockchain applications in Real Estate allow buying and selling property directly. This makes the process faster and reduces lots of human factor-based risks.

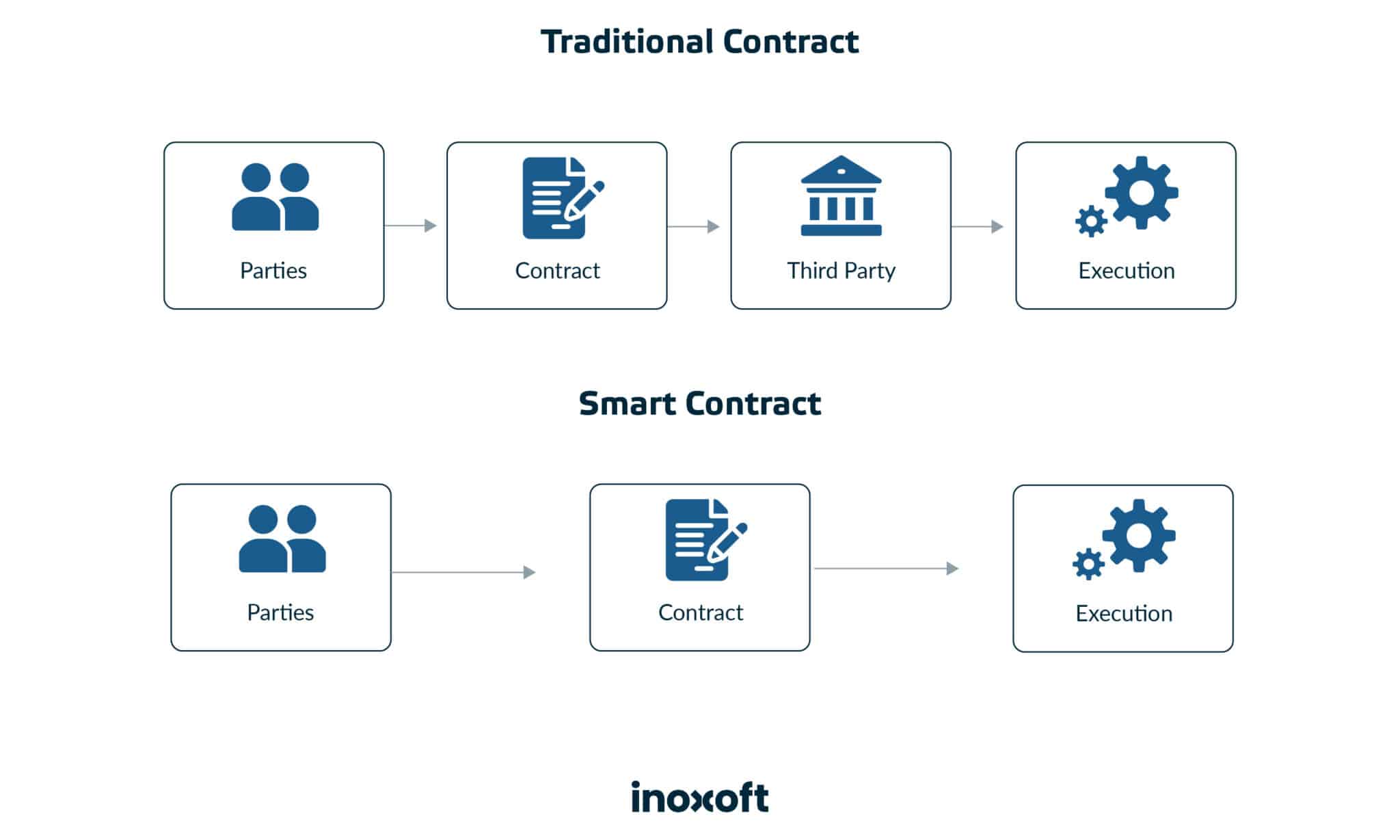

4. Provision of smart contracts

Smart contracts are recorded and verified contracts with the smart code embedded in the blockchain. This allows you to automatically withdraw payments. These contracts can be signed with the buyers/sellers directly. The process looks like this:

Smart contracts require fewer steps to take and are considered to be really innovative in Real Estate.

5. Safe property transactions

Safety is always a priority when it comes to transactions. Blockchain in the Real Estate industry aims primarily at transaction encryption, so nobody can alter it, change it or commit fraud. When the record is being made in blockchain, there is no way you can manage to change something.

6. Low entrance to Real Estate Investing

Blockchain increases transparency due to the fact that there is a record of the public ledger that nobody can alter. This is a transparent transaction seen by the two parties. It promotes secure contract signs and allows to see the benefits of decentralization. You can verify it at any time.

7. Real Estate becomes a liquid asset

It is easier and faster to sell and buy securities representing physical assets as compared to the traditional buying and selling processes in Real Estate. The industry market becomes “liquid” when the process of selling is quick and at its market value or close to it.

Turn to blockchain technology! Experience the quality of Inoxoft’s property management software development service.

Blockchain Use in Real Estate

There are different use cases of blockchain for the Real Estate, eCommerce, and Retail sectors. For example,

Tokenization of real estate assets

Tokenization represents ownership of real estate assets as digital tokens on a blockchain. This allows for fractional ownership, increased liquidity, and easier transfer of ownership.

Property management

If you are an enterprise the best way to enhance your property management is to go for blockchain technology.

Blockchain makes it easier to

- secure data sharing

- streamline rental collections to property owners

- carry out payments to property owners

- provide premium due diligence everywhere

The company gets an increased operational efficiency, which leads to fewer risks, less time spent on property management (property inspection), and lots of saved costs.

Smart contracts for property transactions

Smart contracts automate and enforce the terms of real estate transactions. These contracts can facilitate and streamline processes such as property transfers, lease agreements, and payment distributions, reducing the need for intermediaries.

Find out more about real estate development technology!

Payments and leasing

The technology of distributed ledger makes it possible for leases to be signed/paid on-chain. This allows

- decreasing manual work

- automating rental and other payments to owners

Using smart contracts allows to automation of different payments and promotes cooperation between tenants, landlords, and service providers.

Title management and land registries

Blockchain creates tamper-resistant and transparent land registries. Storing land titles and ownership records on a blockchain reduces the risk of fraud, ensures transparency, and simplifies the process of verifying property ownership.

Supply chain and construction management

Blockchain improves the transparency and traceability of the construction process. This includes tracking the origin of building materials, verifying certifications, and maintaining a secure and immutable record of the construction timeline.

Tenant management and lease agreements

Smart contracts can be used to automate lease agreements, ensuring that terms and conditions are executed automatically. This includes rent payments, maintenance requests, and other aspects of tenant-landlord relationships.

Cross-border transactions

Blockchain streamlines cross-border real estate transactions by providing a transparent and secure platform for exchanging assets and funds. This can reduce the complexity and time involved in international property transactions.

Mortgage and loan processing

Blockchain can improve the efficiency and transparency of mortgage and loan processes by creating a secure and accessible platform for storing and verifying borrower information, reducing the risk of fraud.

Tools to Consider

If you are interested in exploring or implementing blockchain solutions in the real estate industry, there are various tools you should consider. Here’s a list to help you get started:

Blockchain platforms

Explore blockchain platforms like Ethereum, Binance Smart Chain, Hyperledger, and others. Choose a platform that aligns with your project requirements in terms of scalability, smart contract capabilities, and consensus mechanisms.

Smart contract development tools

Familiarize yourself with smart contract development tools and languages. Engineers commonly use tools like Solidity for Ethereum and development frameworks like Truffle.

Token standards

Learn about token standards such as ERC-20 and ERC-721 (for non-fungible tokens). These standards define the rules and functionalities of tokens on the Ethereum blockchain, which is also used for real estate tokenization.

Development frameworks

Use development frameworks and libraries that can streamline the blockchain development process. For instance, tools like OpenZeppelin provide pre-built smart contract components.

Existing Challenges to Blockchain in Real Estate

While the potential benefits of blockchain in real estate are significant, there are several challenges and obstacles that need to be addressed for widespread adoption.

Regulatory hurdles

Regulatory environments vary globally, and sometimes there is a lack of clear guidelines for blockchain applications in real estate. Legal and regulatory frameworks need to catch up with the technology to ensure compliance and investor protection.

Standardization

Lack of standardized protocols among different blockchain platforms can hinder the seamless exchange of data and assets. Establishing industry standards would facilitate a more cohesive and efficient ecosystem.

Security concerns

Blockchain is known for its security features, but vulnerabilities can still exist in the implementation of blockchain protocols. Ensuring robust security measures is crucial to prevent potential fraud.

Integration with legacy systems

Many real estate processes are still paper-based or use legacy technologies. Integrating blockchain solutions with existing systems poses a challenge and requires significant coordination and investment.

Scalability

As blockchain networks become more widely adopted, scalability becomes a concern. The capacity to handle a large number of transactions per second need improvement for blockchain to accommodate the scale of the real estate market.

Future Impact: How Will Blockchain Transform Real Estate?

Global Real Estate is in the middle of growth. But, right now, it is more accessible to enterprises than it was before. With blockchain use in Real Estate, more people will receive access to transactions. And not just simple transactions, but peer-to-peer ones without an intermediary. And, they can count on transparency, security, and equitability here.

Real Estate transactions are actively shifting towards peer-to-peer activity. And, blockchain platforms are the means allowing this to happen. The blockchain platform is a breakthrough for simple people to be involved directly. How great is that?

Look at how quickly NFT became the top trend on the market. And, it is also blockchain. Inoxoft is happy to partner with Sandmilk, who creates brilliant NFT collections using blockchain and token technology. The same will surely happen to blockchain development in Real Estate. The market is ready and the future is promising! It’s time for blockchain in Real Estate startups to come forward with new ideas. With their innovative decisions, the Real Estate industry will have a bright future ahead.

Main things to know about NFT marketplace app development!

Consider Inoxoft Your Trusted Partner in Real Estate Development

Inoxoft is a Real Estate development company that offers a variety of services on the market these days. Our developers, designers, and managers are skilled, informed about the newest trends, and ready to implement your wildest ideas.

We can successfully work on your project and develop:

- Real Estate CRM software

- Property rental management software

- Property management software features

- Real Estate IDX technology integration

- MLS software development services

Contact us to receive a top-notch consultation from our certified experts! Enhance your business with Inoxoft, get the Real Estate app of your dreams!

Stop thinking about your project on your own. Let us do all the work! If you’re asking yourself, how do we work, we:

Make data-driven decisions

Using business intelligence to convert unstructured data into structured one, generate and visualize lots of industry insights.

Use advanced analytics

Using part of our data science expertise to help you track potential clients/investors and transform user feedback into a pleasant experience.

Constantly monitor risks

This allows companies to analyze their target markets (audiences) and forecast future results (either problems or trends).

Use our tech-driven competitive potential

It is vital to implement innovation and new Real Estate trends.

Are up for optimization and customization

Custom Real Estate solutions are developed at key, enhancing your business, security, sales, saving time and costs.

Final Thoughts

The article has explored the advantages and disadvantages of blockchain in Real Estate. So, to summarize, blockchain is not a new technology in the world, but it is definitely the new one in the Real Estate sector. And, the major blockchain impact is disrupting the industry for the better. For example, it promotes

- Real Estate tokenization

- Great ways to improve cybersecurity

- Real-time knowledge about the status of properties

- Growth of blockchain infrastructure

- Easier Real Estate transactions

- Development of blockchain-based solution

And these enlisted features are not even the limit yet! Blockchain in Real Estate has a vast field to cover. The future is in the blockchain.

Frequently Asked Questions

What are the most common blockchain use cases in real estate?

- Property tokenization

- Smart contracts for transactions

- Transparent and secure title management

- Streamlined property valuation

- Decentralized property listings and marketplaces

How to use blockchain in real estate?

What is the blockchain in real estate investment in the US?

Blockchain in real estate investment in the USA involves using distributed ledger technology to enhance transparency, security, and efficiency in property transactions. Examples include:

-

Tokenization of real estate assets

-

Smart contracts for transactions

-

Immutable property records

-

Decentralized finance in real estate