Going mobile is one of the most prevalent business trends, including the banking and finance sector. According to Statista, there are currently over two billion users of online banking services worldwide. And this number will increase to 2.5 billion by 2024.

The growing number of mobile users has set the ground for a lucrative online banking market. As a result, banks with user-friendly websites and mobile apps have a competitive advantage over those without. An online presence will help your financial institution work more efficiently, improve client retention, raise overall revenue, and lower service costs.

This article will review mobile banking application development, why you need it, and the steps and challenges you may encounter while building your app. We will share Inoxoft's expertise in mobile app development services by exploring our success cases, such as a Trading Automation Platform and Integrating Online Payment Services with CBS.

- What Does Mobile Banking Mean?

- Key Reasons for Developing Your Own Mobile Banking App

- Fostering competitiveness

- Boosting сustomer value

- Cutting costs

- Improving client communication and feedback

- 7 Steps to Develop a Mobile Banking App

- 1. Conducting Research

- 2. Prototyping

- 3. Establishing security

- 4. Designing UI and UX

- 5. Developing and integrating the app

- 6. Marketing and releasing

- 7. Maintaining and updating

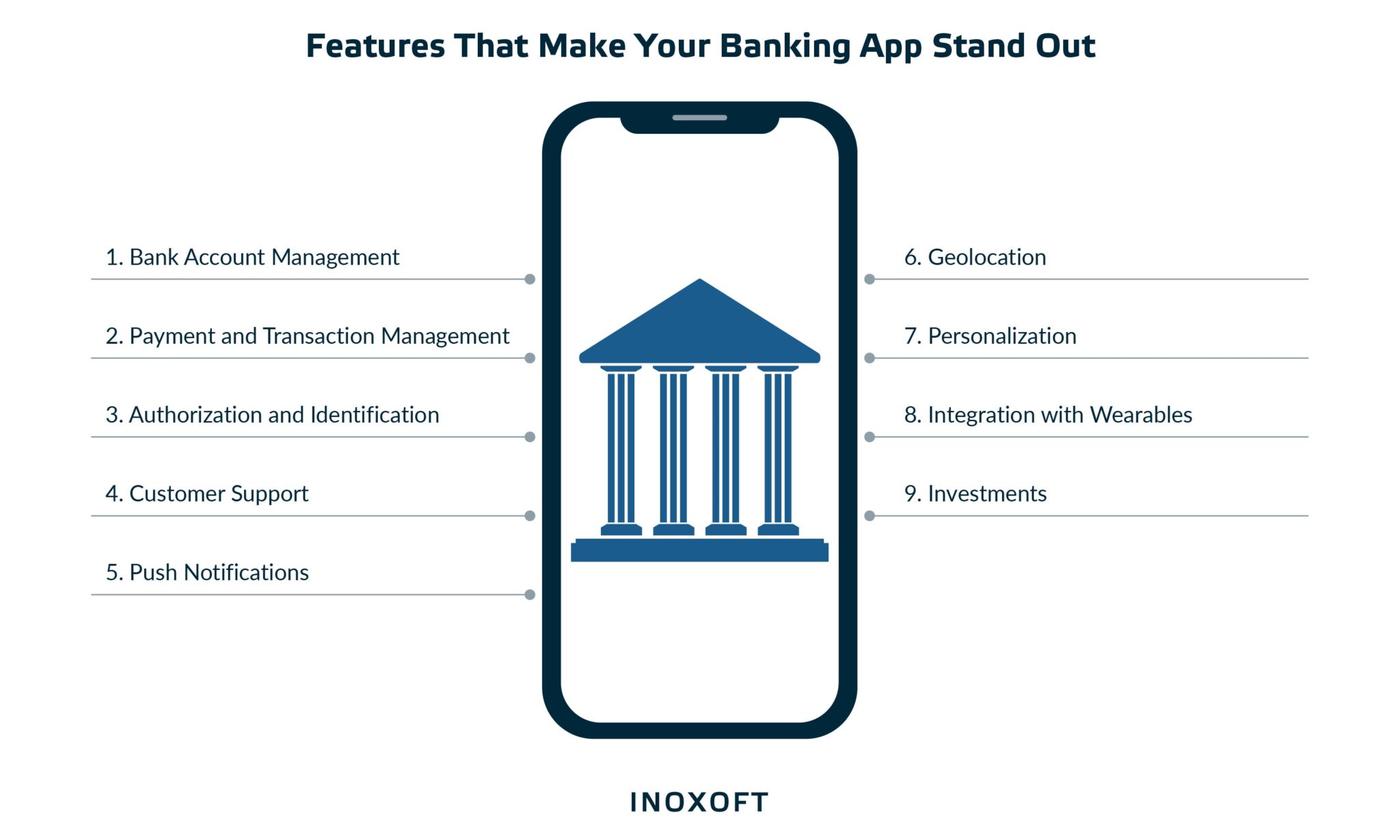

- Features That Make Your Banking App Stand Out

- Bank account management

- Payment and transaction management

- Authorization and identification

- Customer support

- Push notifications

- Geolocation

- Personalization

- Integration with wearables

- Investments

- Difficulties You Can Encounter During Development & Their Solutions

- Regulatory compliance

- Security concerns

- User-friendliness

- Choose Inoxoft for Expert Mobile Banking App Development

- Trading automatization platform

- Integrating Online Payment Services with CBS

What Does Mobile Banking Mean?

Mobile banking is a financial institution’s service that enables conducting financial transactions remotely via a mobile device, such as a smartphone or tablet. In a nutshell, mobile banking is an application you can use to perform nearly all of the tasks you’d perform in a traditional bank, only you always have it on hand.

Now that we understand the concept, let’s discuss why you should turn to banking mobile app development.

Key Reasons for Developing Your Own Mobile Banking App

Your company will gain a lot of advantages from a well-designed mobile banking app, helping you to stand out among other financial institutions. Find the key perks of mobile banking application development below.

Fostering competitiveness

Competition is the key driver behind developing a mobile banking app. Given the popularity of developing mobile banking software as a service, practically every modern bank has its app. To maintain your competitive edge, you must build a banking app immediately or upgrade the one you have. Moreover, a mobile app launch represents a high status of the bank.

Boosting сustomer value

Personal communication with a customer is always a focus of a mobile banking application. It suggests that users will feel valuable and important each time they use the software. Banks increase lifetime value (LTV) by delivering a top-notch in-app user experience that encourages clients to become more involved in managing their money.

Cutting costs

Thanks to banking mobile app development, banks have become paperless. As a result, they save time, money, and resources. Additionally, it’s an opportunity to lower operating and maintenance costs for physical branches. Last but not least, transactions made through mobile apps are ten times more affordable than those made through ATMs.

Improving client communication and feedback

The mobile app provides an additional channel for communication with consumers, which helps them with their financial transactions. On the other hand, it increases your profits. The app also provides prompt feedback, processing client requests much faster than any bank’s physical offices and contact centers.

Now that you know why banks go digital, let’s review how to create a mobile banking app step-by-step.

7 Steps to Develop a Mobile Banking App

Mobile application development for banking requires more attention to security than when creating any other digital product. Below are the seven stages explaining how to build a banking app. Take a look at them.

1. Conducting Research

So, how to create a banking app? Research is the first thing to do in the development of mobile banking. Before beginning the creation of the mobile banking app, it is crucial to conduct market research to identify the market’s leaders and outsiders and their strengths and limitations. It aids you in creating a list of requirements for your application that will benefit all parties involved going ahead.

To maximize this phase, you can employ SWOT analysis to determine and evaluate the project’s strengths and weaknesses, opportunities, and potential threats. Opportunities allow a project to gain new clients, introduce new technology, or reorganize company operations. In contrast, threats can harm the project and deprive it of its current advantages, such as the emergence of new rivals and substitute goods.

2. Prototyping

The number of interactions is critical to the product’s success. One of them is creating a prototype. Consider the prototype as a more streamlined form of the finished item. It should contain app structure, logic, and design. The prototype is still far from the finished item regarding usefulness, stability, and aesthetics.

A prototype enables you to test your hypothesis. Simply deliver it to users, get their feedback, determine what works and doesn’t, and make the necessary improvements. Building a prototype is the best way to test your mobile banking app’s usability, design, and functionality.

3. Establishing security

You should know that developing mobile banking software is about handling sensitive user data. Here is the security base you should be aware of before the development begins: secure authentication, secure card information, secure password, auto-logout, and data privacy.

Compared to other types of applications, banking software must adhere to a much longer set of security regulations, such as GDPR, PSD2, PCI DSS, CCPA, etc. It’s critical to check that the intended functionality conforms with all of these guidelines before beginning development on a product. Hiring an experienced development team will help you to ensure proper compliance.

4. Designing UI and UX

Designing a mobile banking application enables showing clients a minimally functional product version before implementing business logic and functions. The design team starts working using the data we acquired during the research stage, user interviews, and comments on the prototype.

A user-friendly UI layout is one of the advantages of the mobile app. That is why you need to ensure a straightforward, understandable, and welcoming design. Mobile banking applications must support web accessibility, which is governed by the law in some nations. Most web accessibility laws are based on the WCAG 2.0 guidelines.

5. Developing and integrating the app

At the beginning of the development phase, engineers choose a tech stack, considering the client’s business objectives and budget. The functionality of the application and the mobile OS of choice will determine which software tools developers use. For example, how to create a banking application in Android? If you’re making a banking app for Android or iOS, it is better to opt for Native app development as it is safer.

After the final approval, developers start implementing the app’s functionality, testing it often when they finish each development phase. There is one more thing to complete before a mobile banking app can be released, and that is third-party integration. Using third-party services improves an app’s usability and maximizes client attention.

6. Marketing and releasing

Before the scheduled release, you should perform extensive marketing and advertising campaigns to attract as many people as possible and gather sufficient feedback. You can carry out the campaign with the aid of well-known journalists and bloggers, search advertising, email distribution, and via social media. Marketing is an obligatory expense in your budget.

After successful integrations and testing, the product is released under developers’ guidance to ensure that any arising issues are fixed quickly. Depending on the OS for which they were developed, public programs are uploaded to Google Play and the App Store.

7. Maintaining and updating

It is crucial to remember that expenses continue after the application is made available to the general public. For example, you will occasionally need to pay for server space, support for specific technologies, integration with payment gateways, etc.

As users interact with your app, new needs arise, and you must add new features. So be prepared for a potential change to your original mobile banking app. You can enhance the app with new features as the client’s business expands and market demands change. You can learn which app components can be optimized using new market research. So, think of the entire software development process as a cycle.

Features That Make Your Banking App Stand Out

In this section, we will highlight the core features required for all mobile banking apps and several extras that will set your app apart from the competition. Let’s start with the standard set for mobile banking application development.

Bank account management

Managing accounts is a must-to-have-feature of any mobile banking app. Debit and credit card monitoring, checking account balances, viewing transaction history, and smooth money transfers between accounts should all be possible through the app. To help your clients achieve saving goals, you may go one step further and automate the transfer of tiny sums into consumer savings accounts.

Payment and transaction management

Viewing the balance, sending one-time and regular payments, displaying the transaction history, and other features are all part of this functionality. Make sure your mobile banking software includes capabilities for safe and efficient transactions. Peer-to-peer payments should be simple to use. It’s a good idea to enable scanning QR codes to finish transactions, depositing checks with a photo, and exchanging currencies without visiting a branch office.

Authorization and identification

Whenever sensitive information is involved, clients demand and anticipate a high level of security. To securely protect your clients’ banking information, include speedy authentication features while giving people a sense of security. For instance, you can offer your consumers multi-factor authentication as an option.

Compared to static passwords and single-factor authentication, multi-factor authentication offers more security. It specifically enables banks to follow industry rules. Alternately, use biometric authentication technology, which instantly confirms a person’s identity using their voice, face, or other physical characteristics.

Customer support

In the modern world, you must offer your clients round-the-clock customer service. People want their financial issues to be resolved as soon as possible. In addition to 24/7 contact centers and chat options, consider including intelligent chatbots in your mobile banking application. They can quickly respond to straightforward questions, saving your managers’ time while delivering outstanding customer service with a high level of personalization.

Push notifications

As the app is not always open on the user’s device, you need to incorporate push notifications to provide urgent and recurring alerts about transactions, updates, etc. Push notifications inform users and offer a positive user experience. So, ensure your solution can deliver notifications for account updates, transaction confirmations, and other pertinent events. Additionally, you can add alerts of potential client account fraud to your current security system.

Geolocation

Most bank-provided mobile services include geolocation API integration, which enables users to find ATMs, terminals, and bank branches nearby. You must include ATM and branch office locator features to make your client’s life easier and have your app remembered as an efficient solution. It should highlight the services offered at nearby locations, the hours of operation, and the best routes there.

Personalization

It is an excellent idea to allow users to customize the application’s theme, avatar, and other options. Additionally, customers prefer and are more likely to interact with personally designed experiences. Consider including tailored services in your mobile banking app, such as discounts, ticket sales, vehicle booking services, and reservations for restaurants and hotels, to meet customer needs for personalized recommendations and stand out from the competition.

Integration with wearables

Wearable technology and other smart devices are gaining popularity on a global scale. It will be beneficial to transfer some of the application’s features to wearable gadgets. In the era of smartwatches, your mobile banking app should be able to interface with wearables and provide a seamless user experience through alerts, balance checks, and payment options.

Investments

Depending on if your bank accepts investment activities, you also want to consider including these features in the mobile app. Allow your customers to buy gold and silver, manage their stock portfolio, or trade cryptocurrency. As long as you offer things that your clients use and genuinely value, the possibilities are endless.

Difficulties You Can Encounter During Development & Their Solutions

Now that you know the core and nice-to-have features for developing banking applications, it is time to discuss some of the challenges you can face and how to handle them.

Regulatory compliance

Your banking app should comply with Know Your Customer (KYC) requirements and all applicable legal requirements set forth by the relevant authorities. Your financial institution must adhere to several regulations depending on where it operates. PCI DSS, CCPA, GDPR, PSD2, and SEPA are the most popular.

There may be more or fewer rules for your online banking application to follow, depending on where you do business. An experienced legal and software development team will help you to double-check all the regulations and ensure that your app complies with all relevant regulatory requirements.

Security concerns

Your main objective is to earn your customers’ trust in the security of your mobile banking app. It is a challenge for financial organizations wanting to develop a system that will be used to its fullest potential. You should think about the following to reassure users that their personal information is secure:

- Incorporating encryption systems

- Urging clients to create secure passwords

- Implementing multi-factor authentication

- Complying with security certifications

- Setting up data storage infrastructure with numerous security measures

- Including inactivity timers for automatic logouts

- Blocking payments to prevent money laundering

These security precautions will not only boost the safety of your mobile banking app but also raise consumers’ trust in your service. Therefore, don’t hesitate to inform them about your measures to protect their accounts and data.

User-friendliness

An unclear user interface and challenging navigation make managing finances, which is already stressful, even more difficult. Not just seasoned smartphone users but also individuals who have trouble learning new interfaces will use your app. User-friendliness is, therefore, crucial and something you shouldn’t skimp on. Experienced UI/UX designers will ensure that all parts of your solution have clear element visibility and simple navigation logic.

Choose Inoxoft for Expert Mobile Banking App Development

With over two billion people worldwide using online banking services, going mobile is a must for any bank or other financial institution. A well-designed mobile banking app will help you to stay ahead of the competition, boost customer value, improve communications, increase revenue, and cut service costs. Despite the difficulties of developing a mobile banking app, a skilled vendor will help you overcome them and create a user-friendly next-generation app.

Inoxoft is an international software development company and certified partner specializing in banking software development services. We know how to build a banking app and implement innovative ideas under the expertise of the world’s finest banking software developers. Our products will increase customer satisfaction, automate procedures, and ensure security as you scale.

Our banking software development services ensure the implementation of core and cutting-edge features for your solution. When creating customer journey maps, we adopt an empathic approach. With our help, you can put into practice customer-focused banking software solutions with personal finance management features, including:

- Wealth portfolio and advisory services

- Wealth risk management

- Profile management and personalized notifications

- Management and analysis of expenses

Let’s look at our success cases.

Trading automatization platform

A British group of stock traders engaged Inoxoft to develop an app to automate laborious tasks using algorithms to optimize data. Inoxoft has built a web application that eliminated manual labor, generated automated spreadsheets with information on optimal exchange rates, and gathered all generated orders for lucrative purchases by a predetermined financial plan.

Integrating Online Payment Services with CBS

Inoxoft is a pioneer in integrating online payment services with enterprise software for businesses of all sizes. We adopt ‘PayPal-like’ online payment services to your company’s requirements to accelerate the procedures associated with financial transactions. We add value to your business by updating and modernizing it.

If you are thinking about how to start a banking app, contact us to discuss your solution and get an estimate.

Frequently Asked Questions

What technology is used in mobile banking?

If you wonder how to make a banking app, you should know that technologies like AI, blockchain, cloud computing, and IoT will shape the competitive environment in the banking industry. AI customization, an instant P2P payment gateway, robotic process automation (RPA), wearable technology, and API platforms for open banking are examples of modern tools and technologies for mobile banking.

What makes a good mobile banking app?

An excellent mobile banking app should cater to clients’ demands and anticipations and offer solutions to mobile banking application development challenges. It should provide robust security, ensure data privacy, comply with all relevant regulatory requirements, and have a clear and straightforward user interface.

What are the core features of mobile banking?

The core features of a mobile banking app are the must-have functionalities every digital financial institution should provide. They include bank account management, authentication and authorization, payments and transactions, and 24/7 customer support. To wow your clients, add extra features like push notifications, geolocation, personalization, integration with wearables, and investments.