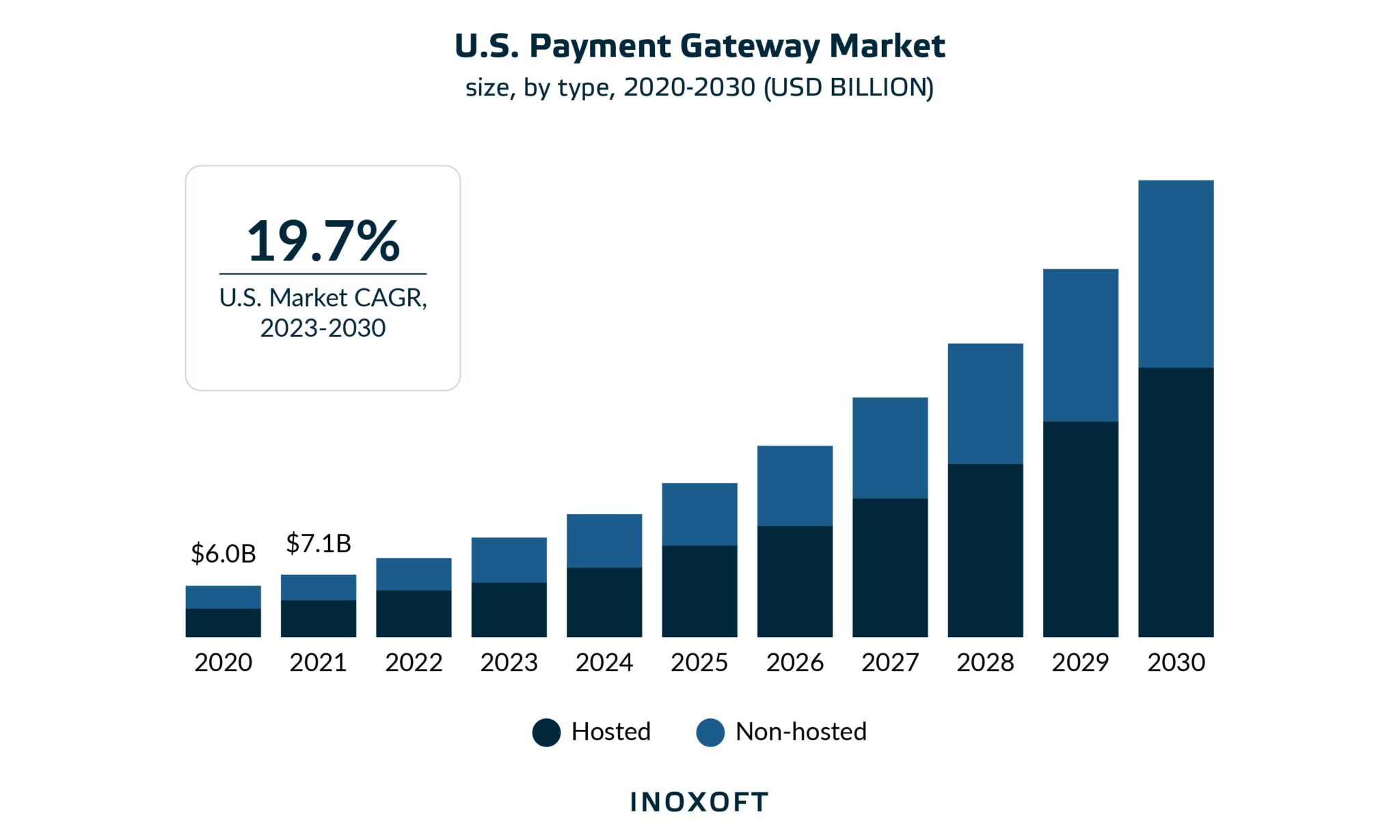

According to Statista eCommerce Report, the global eCommerce market surpassed USD 2 trillion last year. Making purchases on the Internet would be impossible without online payment processing. Therefore, the payment gateway market grows with increased eCommerce sales, rising global demand for mobile-based payments, and internet penetration internationally.

The size of the global payment gateway market was estimated at USD 26.79 billion in 2022, and it is anticipated to increase at a CAGR of 22.2 percent from 2023 to 2030. Integration of a payment gateway is one of the most critical steps in online marketplace development as it facilitates receiving online payments from customers.

So, how to integrate payment gateways into an application?

This article will discuss the benefits of a payment gateway for a web application, explain how it works, introduce five top payment solutions, and describe how to integrate payment gateway in web app. Finally, we will present an international development company Inoxoft with proven expertise in online payment gateway integration and custom development.

- Benefits of Payment Gateway for a Web Application

- Reaching Global Customers

- Ensuring Secure Transactions

- Saving Customers’ Time

- Providing Convenience

- Improving User Experience

- How Does an Online Payment Gateway Work in the Web App?

- 5 Top Payment Gateways for Web Apps

- PayPal

- Stripe

- Shop Pay Installments

- Amazon Pay

- Afterpay

- How to Integrate a Payment Gateway in a Web Application

- Issue a merchant account

- Select an appropriate payment gateway

- Ensure transparency to protect your customers from data breaches and fraud

- Consider Our Company Your Trusted Partner

Benefits of Payment Gateway for a Web Application

Internet payment options are incredibly advantageous for customers and businesses. That’s why it is a great idea to think about how to integrate payment system into an app. Payment gateways allow merchants to contact clients worldwide, offer payment security, save customers’ time, offer convenience, and provide a better user experience. Let’s review the benefits of a payment gateway for your web application in detail.

Reaching Global Customers

Your company will gain access to new markets using a payment gateway. eCommerce is expanding to become a global industry as people feel more at ease with online purchases. As a result, customers worldwide can easily access your business and make secure purchases.

Developments like payment gateways enable consumers to look for the best or cheapest items from wherever they are. Many payment gateways also provide affiliate marketing alliances as an additional service to generate more leads for your business.

Ensuring Secure Transactions

All payment transactions made through a gateway are highly encrypted to protect the data. It will assist your company in fulfilling GDPR obligations as well as industry standards like PCI DSS compliance (Payment Card Industry Data Security Standard).

Via secure payment procedures, consumers and organizations are safeguarded against potential fraud. Payment gateway security will help you earn clients’ trust to buy from your business. It has to be your top priority, as consumers typically choose the most secure payment methods.

Saving Customers’ Time

The fastest way to accept card payments is through payment gateways. After setting up your payment gateway, you can typically receive payments within 24 hours. This process is far faster than manual processing. Successful digital transactions and eCommerce depend on quick payments. Making sure your consumers don’t have to wait to make a purchase can be the difference between making a sale and not.

Providing Convenience

With payment gateways, your company can accept payments 24/7. You may therefore be sure that your website will always be able to take payments. Both a merchant and buyers benefit from this.

This feature allows online shoppers, who regularly make impulsive purchases, to do so whenever they choose, day or night. Moreover, instant access provides users with a hospitable experience, especially those who wouldn’t typically be able to reach a physical business during its established hours.

Improving User Experience

Additional functionalities of payment channels enhance the real-time user experience. Such payment gateway features typically include adding things directly to a shopping cart and saving bundles and favorite items. Users can quickly create a profile and securely preserve their payment details, enabling one-click immediate transactions.

Payment gateways frequently provide merchants complete control and the ability to detect if any issues emerge.

How Does an Online Payment Gateway Work in the Web App?

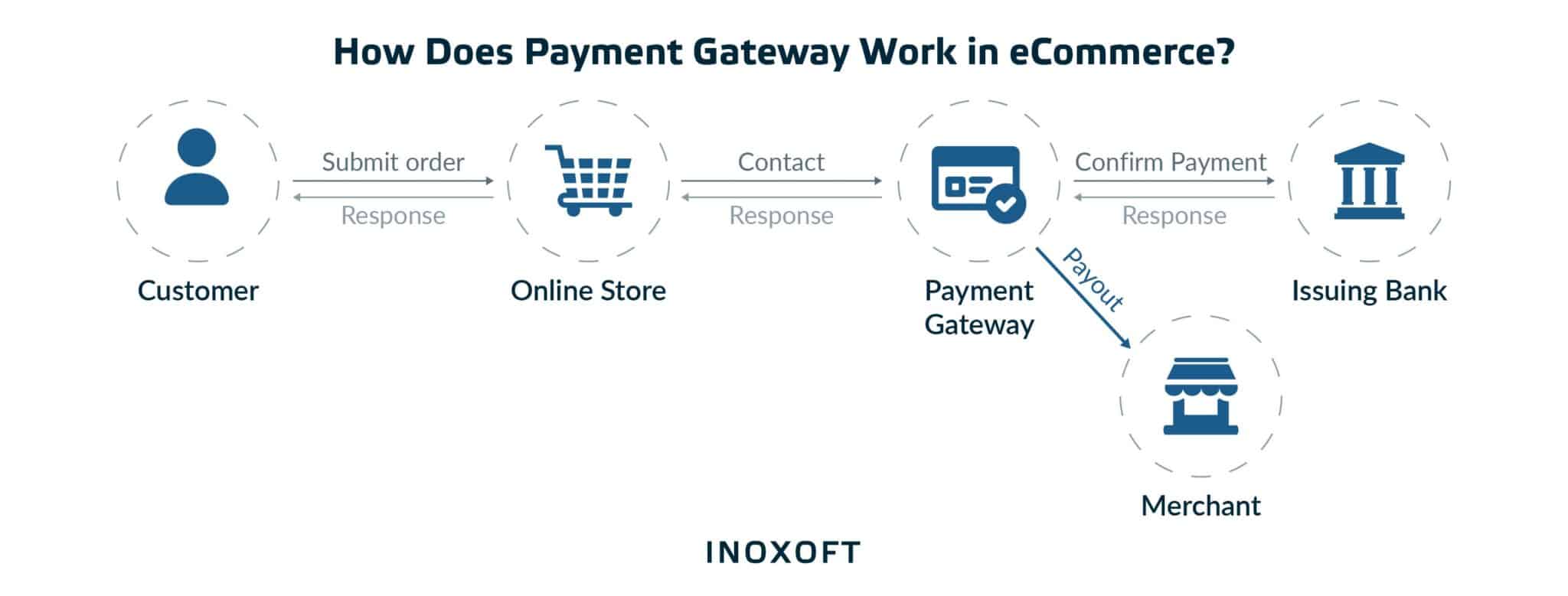

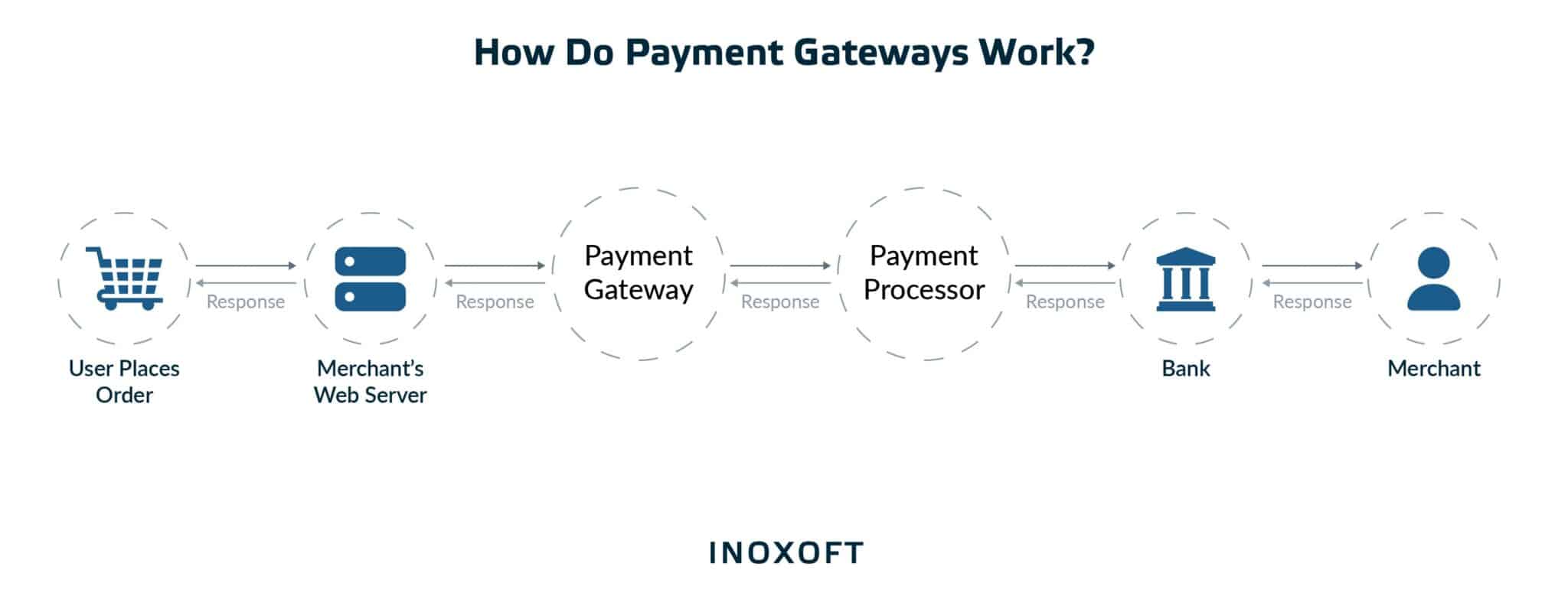

Before discussing how to integrate a web application with a payment gateway, let’s see how they work in the app. When you add payment gateway in an app, it acts as an intermediary between online shoppers (and their mobile devices) and financial institutions. In-app purchases would be practically impossible without them. Look at the step-by-step work process.

- A user opens a cart to buy selected items.

- They enter bank card details on the payment page.

- The buyer’s bank card details are sent to a payment gateway.

- The payment system encrypts user data and sends them to a payment processor.

- The processor that initiates the transaction process verifies the data and sends the information to the bank or other financial institution.

- The bank or other financial institution verifies the request.

- The processor sends the answer from the bank to the payment gateway.

- If the transaction is approved, the amount of money equivalent to the purchase is withdrawn from the customer’s card and sent to the merchant’s account.

Read our definitive guide on how to build a payment gateway 101 for more details.

5 Top Payment Gateways for Web Apps

There is a wide variety of payment gateway solutions on the market. However, some market-dominating solutions capture the lion’s share of the market. Here are the top 5 payment gateways for web applications, according to Datanyze

- PayPal – market share 40.87%

- Stripe – market share 20.10%

- Shop Pay Installments – market share 13.66%

- Amazon Pay – market share 4.92%

- Afterpay – market share 1.73%

PayPal

People can use the PayPal website and mobile app to send payments online to each other and businesses. First, you need to create an account to send and transfer money using PayPal. Anyone can set up a PayPal account for free with just an email address and some basic information. It enables you to send and receive money from anyone with a PayPal account.

While sending money to relatives and friends is free through PayPal, sending money to businesses or stores incurs a modest processing fee. PayPal offers several options for business owners. In a nutshell, PayPal enables you to take payments on a website, like an e-commerce store. For a retail establishment or a booth at a Christmas fair, you can also utilize PayPal to receive payments in person.

Venmo, pay later options, all major credit cards, and cryptocurrencies are all accepted by PayPal merchants. The charges change depending on the transactions. Here is a breakdown of the fees:

- Digital payments (including cryptocurrencies, PayPal, and Venmo) are subject to a transaction fee of 3.49% + 49 cents

- PayPal QR code payments in person: 2.4% plus 5 cents for every transaction; 1.90% additional $0.10 for every transaction over $10; $10 or less

- Internet credit and debit card transactions cost 2.59% plus 49 cents each

- Card payments made in-person cost 2.29% plus 9 cents per transaction.

Stripe

Stripe is a pay-as-you-go payment processing service that charges flat, transaction-based fees. With good reason, it is one of the most well-liked payment processing providers for small businesses. With Stripe, small business owners can take credit card payments without having to meet a minimum monthly revenue requirement and process payments quickly.

It provides a wide range of point-of-sale (POS) solutions, supports over 135 different currencies, and lets companies personalize the checkout process for their customers. The company does not impose monthly or yearly fees for its services. Instead, Stripe has transparent pricing costs and charges per transaction.

- Businesses incur a 2.9% + 30 cents per transaction expense from online sales

- There is an extra 1% charge for international and currency conversion transactions

- In-person transactions have a 2.7% fee plus an additional 5 cents per transaction, plus an additional 1% for any currency conversion or use of an international card

These charges are automatic, and the amount is taken from the merchant’s total payment.

Shop Pay Installments

Customers can pay for orders from 50 USD to 17,500 USD in installments or pay the entire amount at checkout with Shop Pay Installments. By allowing customers to split the sum, Shop Pay Installments helps increase conversion rates and average order value.

The following information about Shop Pay Installments is visible when a consumer views your products:

- Amounts of the installment payments

- Additional information about Shop Pay Installments

- Most recent regulatory and compliance data

Upon checkout, your clients have the following alternatives for installment payments:

- For purchases between $50 and $999.99, there are four interest-free monthly installments

- Monthly payments for purchases between 150 and 17,500 dollars. Depending on the purchase amount, monthly installment orders with interest rates ranging from 10 to 36% APR can be paid off in three, six, or twelve months.

Amazon Pay

Amazon Pay is an online payment processing business. It takes advantage of the customer base of Amazon.com and focuses on allowing users to utilize their Amazon accounts to make purchases at external merchant websites. Customers of Amazon can use the service by selecting the Amazon Pay button during checkout at their preferred online retailers or by managing their payment options in their Amazon accounts.

There are no further sign-ups or sign-ins required. Also, there are no additional fees for your transaction with the merchant if you use Amazon Pay. No membership charge, transaction fee, currency conversion fee, foreign transaction fee, or other fees are applied to your purchase.

Afterpay

A “Buy Now Pay Later” (BNPL) online service named AfterPay was established in Australia in 2014. The concept behind the platform is to divide the purchase cost into four payments, with the first installment being 25%. A consumer can spend $1,500 with Afterpay in a single transaction. Moreover, consumers have a $2,000 maximum outstanding balance per Afterpay account.

As long as you make your payments on time, there are no fees associated with any Afterpay loan. If you make a late payment, it will be fixed, capped, and won’t keep happening over time. Consumers must pay an additional $7 if their payment is not current after seven days, in addition to the $10 late fee.

How to Integrate a Payment Gateway in a Web Application

The steps of payment gateway integration in an application depend on your chosen payment gate. However, there are some basic steps of how to integrate a payment system into an app. In any case, you must link your website to a global payment provider to enable direct users’ payments from your website. These are the initial three integration steps.

Issue a merchant account

The money from credit transactions is held in a merchant account until it can be validated, at which point it is paid straight to your account. When requesting a merchant account from a global payment service, consider that not all providers are the same. Reliability, usability, and security are the critical factors for picking the best online merchant account.

Select an appropriate payment gateway

There are countless payment gateways available. But you must consider a few aspects before selecting an appropriate payment gateway for your website. Customers must provide their credit card information, so you must ensure your payment gateway is reliable and authentic. It must offer your consumers a secure checkout method. The suitability and accessibility of various payment options are further considerations.

Ensure transparency to protect your customers from data breaches and fraud

When operating an online business, you must incorporate a secure payment gateway into your website to accept credit card payments. Several payment gateways have created a safe way to move money internationally by preventing data breaches, theft, and unauthorized payment transfers.

A worldwide payment service must handle every aspect of payments relating to eCommerce. It should effectively provide merchants with tailored payment solutions to address any payment issue, from handling restricted payment methods to risk management.

Consider Our Company Your Trusted Partner

Inoxoft is a software development company offering clients first-rate custom iOS app development services and Android application development services worldwide. We operate in a variety of sectors, including fintech and real estate. Our team provides the most modern solutions to assist you in achieving all of your company objectives.

We offer services for developing fintech software, cloud computing in banking, and customization in banking. Moreover, our company can assist you in developing the best payment gateway and maximizing its revenue. We provide payment integration services for companies of all sizes. To streamline the processes involved in financial transactions, we adapt ‘PayPal-like’ online payment services to your company’s needs.

Inoxoft payment software allows for one-time, recurring, and subscription payments by integrating internet payment services. Our solutions enhance user experience and streamline financial tracking for enterprises, ensuring the safety of your money transfers across other currencies, client data storage, and many other operations.

If you want to add a payment gateway to web application or create your own payment gateway, contact us to consult deeper on the topic!

Frequently Asked Questions

Why is payment gateway integration important?

A payment gateway integration in a web app verifies the cardholder or customer to ensure a secure transfer of funds from their account to the merchant's or e-commerce platform's account. A payment gateway is used to secure the complete payment flow.

How do payment integrations work?

Integrated payment systems function by automating the payment acceptance process and incorporating it. They function by doing away with time-consuming conventional procedures such as manually compiling and storing transaction information.

How do you integrate a payment gateway into an application?

The steps for integration depend on the payment gate you choose. There are, nevertheless, a few fundamental stages in integrating a payment system into an app. They establish a merchant account, choose an appropriate payment gateway, and safeguard your clients from data breaches and fraud.