In today’s world, where everything is functioning remotely, there are different ways to manage your buying and selling. It became extremely convenient to buy things via the Internet, using an app or a site. You don’t have to leave your house to conduct main financial operations. Now you can even pay taxes online and avoid standing in queues. All these options have significantly improved people’s lives, allowing them to save more time.

Online trading is everywhere nowadays. This is a great way to earn money and get clients from different corners of the world. However, the main issue of online trading is safety. That’s why it is essential to create a custom payment gateway that is safe and secure. There are many benefits in building a payment gateway. It helps merchants to reduce payment service fees, online companies that started out with white label service need support, etc. It may seem that building a payment gateway from scratch is easy. However, there are a couple of nuances that need to be taken into account.

This guide will tell you everything you need to know about creating a payment gateway and payment gateway development. If you feel that you are interested in the topic, scroll down to learn more!

- What Is a Payment Gateway?

- How Does Payment Gateway Function?

- Customer Initiates Payment

- Payment Information Entry

- Data Encryption

- Transaction Request

- Authorization Request

- Authorization Response

- Transaction Processing

- Settlement

- Payment Gateway Fee

- Why Do You Need To Create Custom Payment Gateway

- What is the Difference Between Payment Gateway and Payment Provider

- The Main Components of Developing a Payment Gateway

- Why Payment Gateway Development is Better than Better Ready-Made Solutions

- So How to Create a Gateway For Payment

- Choose the right company

- Start coding your payment solution

- Release your product

- Maintain and support your product

- Extra Tips for Building a Payment Gateway

- Final Thoughts

- Consider Inoxoft’s Team of Experts to Build Your Own Payment Gateway

What Is a Payment Gateway?

A payment gateway is a technology and financial service that allows electronic transactions, particularly online and in-person purchases. It acts as an intermediary between online stores and the financial institutions involved in processing a payment, like banks and credit card companies.

Here are the core features of a payment gateway:

- Data Encryption: Encryption protocols secure sensitive financial data against data breaches and fraud.

- Authorization: When a customer makes a purchase, the payment gateway sends a request to the customer’s issuing bank to verify the payment details and the availability of funds.

- Transaction Processing: After authorization the payment gateway processes the transaction, deducts the payment amount from the customer’s account, and sends the funds to the merchant’s account.

- Payment Methods: Payment gateways support a different payment methods, including credit and debit cards, digital wallets and bank transfers.

- Security: Payment gateways implement security measures (tokenization, fraud detection, and compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements) to protect both merchants and customers from fraud.

- Integration: It also can be integrated with e-commerce platforms and point-of-sale (POS) systems, making it easier for businesses to accept payments online or in-store.

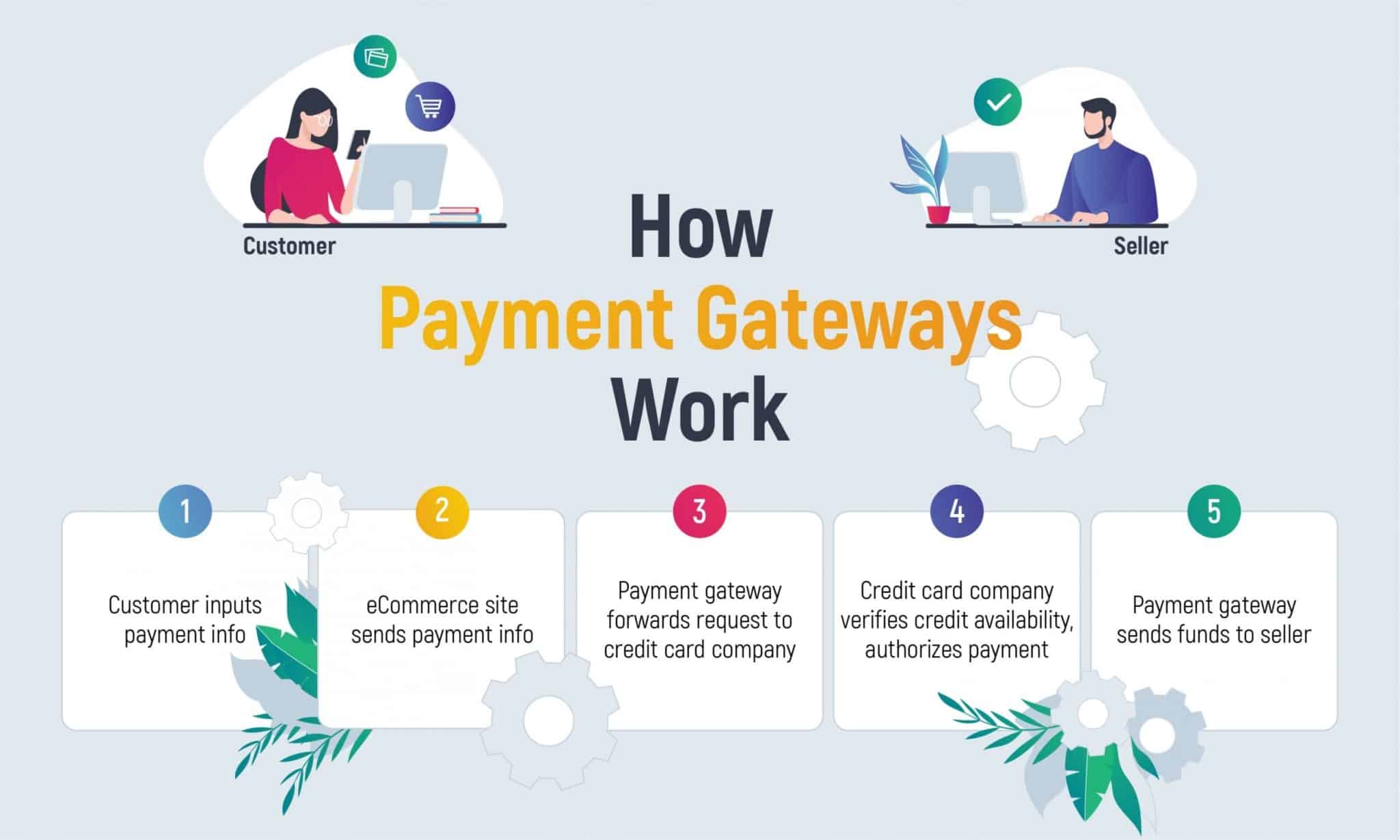

How Does Payment Gateway Function?

Here’s a step-by-step breakdown of how a payment gateway works:

Customer Initiates Payment

The customer selects products or services and proceeds to the checkout page on the merchant’s website or at a physical point of sale.

Payment Information Entry

The customer enters their payment information, which typically includes credit card details (card number, expiration date, CVV), billing address, and any additional required information

Alternatively, the customer can choose other payment methods like digital wallets (e.g., PayPal, Apple Pay), bank transfers, or other payment options.

Data Encryption

The payment gateway encrypts the customer’s payment data to secure it during transmission. This encryption ensures that sensitive information is protected from interception by malicious actors.

Transaction Request

The payment gateway sends the encrypted payment information to the merchant’s payment processor or acquiring bank.

Authorization Request

The payment processor forwards the transaction request to the customer’s issuing bank (the bank that issued the customer’s credit card).

Authorization Response

The issuing bank evaluates the transaction request based on factors such as available credit, account status, and potential fraud indicators.

Transaction Processing

If the transaction is approved, the payment processor, through the payment gateway, deducts the purchase amount from the customer’s account.

Settlement

The payment gateway facilitates the settlement process, transferring the funds from the customer’s bank to the merchant’s acquiring bank.

Payment Gateway Fee

The payment gateway may deduct its transaction fees from the settled funds before transferring the remaining amount to the merchant.

Why Do You Need To Create Custom Payment Gateway

The first and foremost question is: why do you need payment gateway development? How can you benefit from it and how can it influence your business? For sure, you can always use ready-made payment methods and incorporate them into your app. However, the main disadvantage is that such payment methods have a lot of features you might want to fix. If you create your own payment gateway, it will be much more beneficial for you, as in this case, you are in full control.

Developing a payment gateway is useful for many target audiences. It is used by IT companies that serve as a payment platform provider; hi-growth payment providers who are interested in an improved payment system; billing firms that want to upgrade their software. On top of that, custom payment gateways are widely used by influential merchants and acquiring banking systems. Of course, individuals with startups can also benefit if they develop a payment gateway.

What is the Difference Between Payment Gateway and Payment Provider

This can be confusing at first, but really there are a couple of distinctive features that make a difference between payment gateways and payment providers. Mainly, the payment gateway is software, and the payment provider has the ability to use this software. The gateway works as a direct interconnection with customers; the provider facilitates those interactions. What’s more, it exists to make sure that all the financial procedures are done properly.

As you can see, if you create a payment gateway, you can get a lot of pluses from it. Now that you know more about its target audience and why it is used, you need to know about the main elements of custom payment gateways.

The Main Components of Developing a Payment Gateway

As with any project, payment gateway development consists of a couple of elements. It’s important to take them all into consideration for payment gateway developers to know how to create a payment gateway. Here are the main elements you need to know how to create a gateway for payment.

Fraud Protection Systems. The main thing expected from digital payments is security, so that the clients can trust your payment gateway. It is crucial to be able to predict a fraud attack and prevent it. That’s why every payment gateway needs special mechanisms to detect hackers. It’s also important to keep client’s private information in check. That’s why fraud protection systems are a must if you want to get the customer’s trust.

Tokenization. Put simply, sensitive information and IBAN should be displaced with random alphanumeric tokens to make the processor the only capable way to handle the transaction. The main benefit of tokenization is protection from hackers, it’s a guarantee that all the sensitive data will be secure and will not be damaged in any way.

Recurring Payments. This feature can be configured with the help of dashboards, APIs, and virtual terminal commands. If you want to propose a subscription service, this is the ultimate choice for you. On top of that, you should not activate recurring payments by default.

Seamless Payment Gateway Integration. It’s convenient to integrate your payment gateway into different payment processors because it is very user-friendly. You can choose the acquiring bank and develop a settlement account. Moreover, you become able to offer some transaction fees. Payment gateway integration gives you the possibility to choose between many options.

Scalability. The progress of a product is also an important factor. If it’s scalable, then its progress is much more likely. You can set up new features for your project and improve it anytime. The more advanced your payment gateway becomes, the more potential clients you can attract.

Disputes and Arbitration. If your interface is capable of handling bank disputes, then it is also a great bonus. In general, the interface plays a great role basically in any project, and the payment gateway is no exception.

Hosted Payment Gateways. Implementing a hosted payment gateway can set you free from a lot of threats on your way. Again, it’s all about the user’s safety and security.

Virtual Terminal. Looking for a real terminal can sometimes be time-consuming. To avoid all the inconveniences, you can use your computer as a virtual terminal. It can be done with the help of cloud-based services. However, a payment gateway is the ultimate choice if you want to use a mobile device. Really, mobile devices can significantly ease your life. In general, a mobile app payment gateway is really beneficial for your customers.

Working Hours. It is crucial to remember that the more clients around the world you have, the more people from different countries use your app. It’s important to provide everyone with convenient working hours. It means your clients should be able to use your gateway at any time of the day and night. In case your customers need some help or tutorial, they should be provided with it.

Why Payment Gateway Development is Better than Better Ready-Made Solutions

When you start developing your own project, there are times when you compare custom-made products and ready-made solutions. Of course, the latter is already tested and can offer you good results. However, there are many reasons why a custom payment gateway is a better decision for you. The first and foremost reason is that fees for ready-made products are extremely hiked up. Custom payment gateway will not be as expensive as off-the-shelf products. On top of that, ready-made gateways don’t support many currency transactions.

All these restrictions can complicate your user experience. The main advantage of creating your own payment gateway is the ability to add any features you want, and this way choose to pay or not to pay high fees. If you use ready-made payment gateways, you will be obligated to pay for every transaction.

That’s when a custom payment gateway is especially useful: you get a chance to free yourself from extra costs. Furthermore, you can propose your product to other users, making it popular between other users, agents, and ISOs. As you have already guessed, if you are the owner of the app you get extra profits from your clients who have to pay transaction fees to you. This way you establish yourself as a provider.

As you can see, the main advantage of developing your own payment gateway is that you are in full control of all the processes. You reduce your costs and get the possibility to choose all the necessary features you are interested in. If you want to consult an expert before diving into the topic, Inoxoft is the ultimate choice for you! We will tell you how to develop a credit card payment gateway, and how to develop a payment gateway system and will provide you with all the important tips that will help you boost your business.

So How to Create a Gateway For Payment

Now that you know all the benefits of developing your own gateway payment, you may have the most important question: how to build a payment gateway? As with any project, building a payment gateway consists of a couple of steps. All of them are important if you want to get a successful quality product. Here is a basic payment gateway development tutorial you need to follow to create the project of your dreams.

Choose the right company

It’s essential to choose the right staff for your project. If you want your product to be up-to-date and equipped with all the necessary features, you have to choose your partners deliberately. You need someone who could help you develop all the required functions, someone who is professional. Choose your priorities and pay attention to things that are essential and decide which functions are more important.

Start coding your payment solution

To make the process of coding easier, split it into different assignments. This way, you will have more control over each step and a lesser chance of making a mistake. Maybe, you will need some additional help, not only your team’s consultation. Don’t forget that automation increases the productivity of the development team and allows you to pay more attention to details. Automated processes are more likely to detect all the bugs and errors you could have missed.

Release your product

Before putting out your product, you must make sure that all the processes are working properly and without delays. A risk-based analysis is also quite helpful because this way you can detect all the serious issues and determine if they are easy to handle. After all these preparations, you can finally show your product to the world. It’s crucial to have a project that is free of all possible bugs.

Maintain and support your product

This is the final step! After you develop your product, it is important to support its relevance and update and maintain it. In the process of being used, there will be many bugs found in your project. To ease the maintenance process, you can hire specialists outside your team. They can give you some helpful insights and help you improve your project.

Extra Tips for Building a Payment Gateway

Now you know how to develop a payment gateway. These steps are universal for every developer who is going to create his own product. However, there are some extra tips that should also be taken into consideration before you start building your payment gateway. They are important because, with the help of these tips, you can create a compatible and up-to-date project.

First of all, it’s important to link your gateway with many payment processors. This way, you give sellers the possibility to choose among different banks where they can open an operating account. Of course, the important thing is to make your gateway flexible, so it can adapt to the needs of a merchant. To achieve this you need to add accessible customization opportunities. Remember, that the amount of options that the clients can have means higher profit.

It’s crucial to create a convenient interface to attract even more customers because visuals are important! Your payment gateway should also be easy to integrate into the business owner’s store. Since everybody wants a user-friendly mechanism to do it, it’s important to give all the conveniences to your customers. Finally, it’s essential to provide customer support. If your clients have questions, they should have the answer in a short amount of time, and all the bugs should be fixed.

These extra tips are a must if you want to create a quality product and stay relevant in the market. The key to a successful product is taking care of clients’ needs and expectations. That’s why these simple steps can play a huge role in your development process.

Final Thoughts

Online buying and selling play a huge role in people’s lives. Both customers and sellers strive for a safe way to conduct financial transactions. This is the reason why many developers choose to create their own payment gateways. Of course, it is always possible to use ready-made solutions, as they have already stood the test of time. However, building a custom payment gateway has a lot of advantages.

By creating your own payment gateway, you are in full control of all the processes. You don’t need to worry about bugs in ready-made solutions. Moreover, custom payment gateways help you reduce your costs. Many target audiences are interested in payment gateways, from individuals with startups to acquiring banking systems. There are many steps in developing a payment gateway and there are also extra tips that positively influence the final result.

Payment gateways are really in demand nowadays, so it’s important to know the main recommendations concerning their development.

How much fuel delivery app development costs?

Consider Inoxoft’s Team of Experts to Build Your Own Payment Gateway

Inoxoft is a software development company that provides top-notch services for clients all around the world. Our company works within many industries, from fintech to real estate. We offer the most up-to-date solutions to help you achieve all your business goals.

Inoxoft provides fintech software development services, cloud computing in banking, personalization in banking and will answer your questions how to create a money transfer app and how to develop payment gateway in USA. Our company can help you create the best payment gateway and get the most profit out of it. You can count on our devoted team to guide you through the whole development process.

The main priority of Inoxoft is to take care of our customers’ safety and content. If you are looking for a devoted partner, our company is exactly what you need. Contact us and build the best payment gateway!

Frequently Asked Questions

Can I develop my own payment gateway?

You can develop your own payment gateway and get a lot of benefits! Custom payment gateway can be much better than ready-,made solutions. If you want to know more, read the article!

How much does it cost to make a payment gateway?

The price of creating a payment gateway can differ, but in general it's between $200 000 and $250 000. However, many factors influence the final price of the product.

How long does it take to develop a payment gateway?

Building custom payment gateway requires more time and resources, but the result is totally worth it. The length of the process depends on the features you decide to incorporate and many other factors.