According to the 2022 Hubspot survey with over 500 sales professionals polled, 74% of cross-sellers said it contributed to up to 30% of revenue. Therefore, cross-selling is a critical sales technique that increases customer lifetime value, generates revenues at low incremental costs, and strengthens customer loyalty and client relationships.

What is cross-selling in banking? Although this strategy is used across industries, cross-selling in the financial sector is particularly useful. It helps increase revenue by customer value without recurring costs. Access to mobile technologies opens up new channels for cross-selling. The market for mobile banking is anticipated to grow to $1.8 billion, with a CAGR of 12.2% by 2026. The rising popularity of mobile payments offers financial institutions additional cross-selling possibilities for more existing customers.

This article will review the cross-selling opportunities in mobile banking, suggest valuable tips for efficient in-app advertising, and outline CRM integration and predictive analytics as effective strategies for boosting sales to existing customers. Finally, we will share the expertise of Inoxoft in banking software development and software integration to demonstrate how winning fintech solutions leverage cross-selling opportunities.

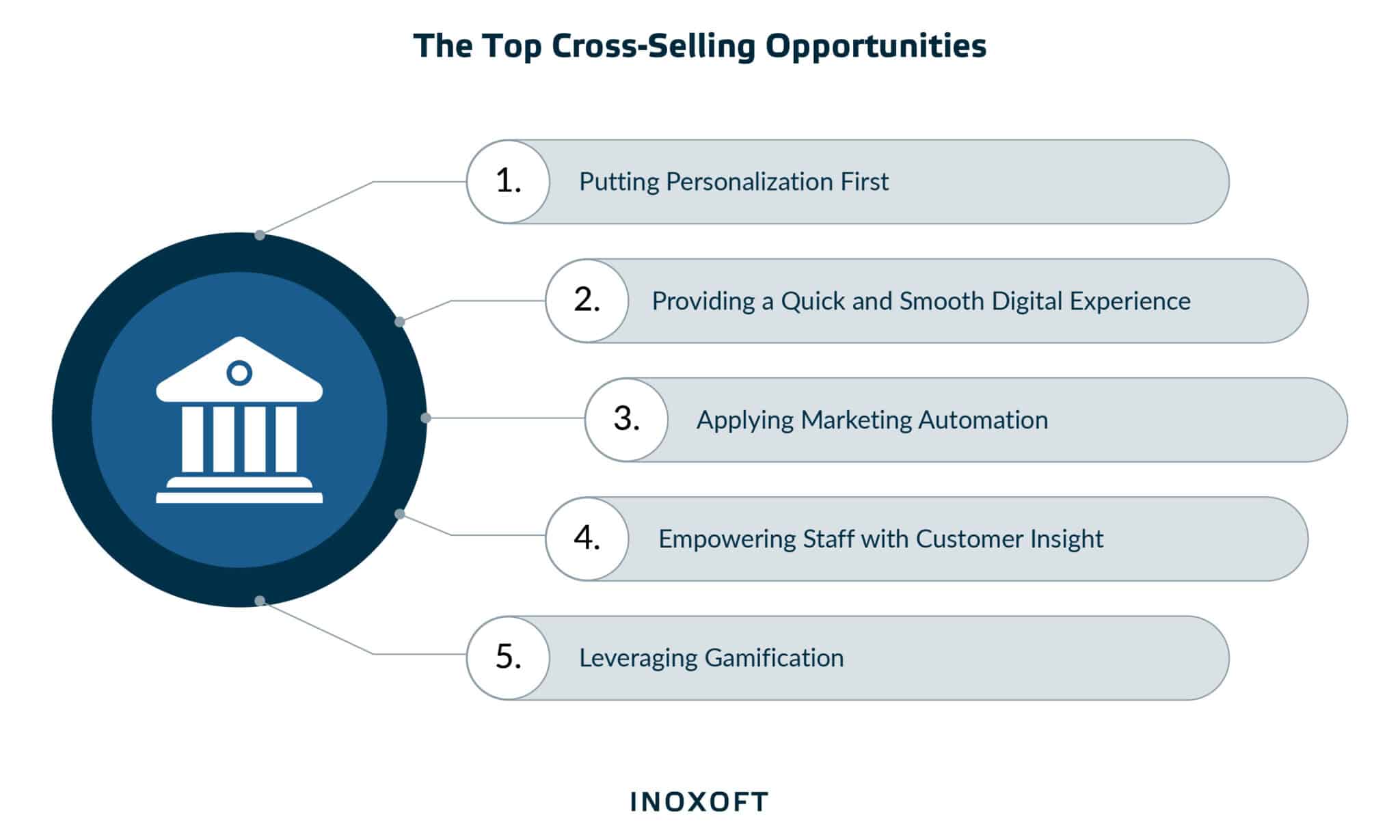

- Five Opportunities of Cross-Selling in Mobile Banking

- Putting Personalization First

- Providing a Quick and Smooth Digital Experience

- Applying Marketing Automation

- Empowering Staff with Customer Insight

- Leveraging Gamification

- Cross-Selling Tips In Mobile Banking Apps

- Choose The Right Timing

- Define Optimal Frequency

- Add the CTA Button

- Mind UX and UI

- Use Simple Wording

- How CRM Integration Supports Cross-Selling in Mobile Banking

- Increasing Knowledge About Customers

- Creating Campaigns for Targeted Cross-Selling

- Managing Cross-Selling Activities

- Raising the Sales Force Efficiency

- Why Predictive Analytics Is Another Winning Cross-Selling Strategy for Digital Banks

- Formulating a Question

- Collecting Data

- Building a Predictive Model

- Watching the Assumptions

- Final Thoughts

- Consider Inoxoft Your Trusted Partner

Five Opportunities of Cross-Selling in Mobile Banking

Cross-selling in banking is a sales technique that involves selling an additional product or service to an existing customer. It raises revenue and improves customer experience and engagement. All of that contributes to developing strong and enduring relationships with customers.

Let’s review the top cross-selling opportunities.

Putting Personalization First

Traditional banks and credit unions often use broad-based marketing to engage with clients. However, a data-driven strategy with a specific emphasis is more efficient. Mobile banking technologies give greater access to customer data than ever, allowing them to know their clients better. Creating a customer insight model allows using various data sources, after which campaigns with particular solutions target higher-priority categories.

Finding relevant and timely product recommendations is much easier by keeping track of purchase history, payment activity, channel preferences, and borrowing information. Bankers may anticipate their customers’ requirements by using consistent and precise consumer data rather than simply selling things that appear random.

Need-based cross-selling in banking improves conversion rates and lowers the possibility of annoying clients with irrelevant offers. As a result, people are more likely to regard a financial institution as a trustworthy advisor rather than a pushy salesperson when they receive individualized service and are the center of attention.

Providing a Quick and Smooth Digital Experience

Financial institutions must improve their online account opening and onboarding capabilities. Customers have high expectations for speed and ease when opening accounts. Therefore, a quick, frictionless digital experience is vital for successful cross-selling in banking.

According to the Digital Banking Report research, abandonment rises by 60% if a financial institution can’t open a new account or finish a new loan application in five minutes or less. By perceiving and responding to consumers’ shifting requirements, your financial institution can become more relevant and provide better customer services.

Applying Marketing Automation

Automating marketing enhances the bank’s cross-selling success and gradually gains wallet share with the correct data and tailored tactics. Being a customer’s primary financial institution is the most efficient way to raise the wallet share.

There are a few other crucial things to do to increase the share of the wallet. Among these are the use of data for insights and targeting and the exploitation of digital channels for targeted cross-selling in banks. Financial institutions must make sure their automated communications are individualized and pertinent at the same time.

Empowering Staff with Customer Insight

The past aggressive tactics for cross-selling products in banks fail in the current market. Nowadays, it’s all about delicacy, training, and empowering staff members with the correct information. Ensuring employees quickly access all consumer data lets them provide relevant recommendations for cross-selling bank products.

Front-line staff members should know about products and how to match them to customers’ needs, whether working in the branch or on the phone. When personnel has reliable information, they can establish trust with clients. The cross-selling process becomes more effortless and seamless as customer confidence in the bank grows.

Leveraging Gamification

Mobile banking enables the creation of competitions, challenges, and rewards centered around particular features of your product. Setting objectives, monitoring progress, and achieving milestones can be used to unlock rewards. These rewards incentivize customers to explore and engage with cross-selling offerings.

Gamification allows you to influence desired consumer behavior or the customer journey and build a strong brand connection in their minds. You can make your banking apps more exciting and enjoyable by incorporating gamification components like quizzes, surveys, and minigames.

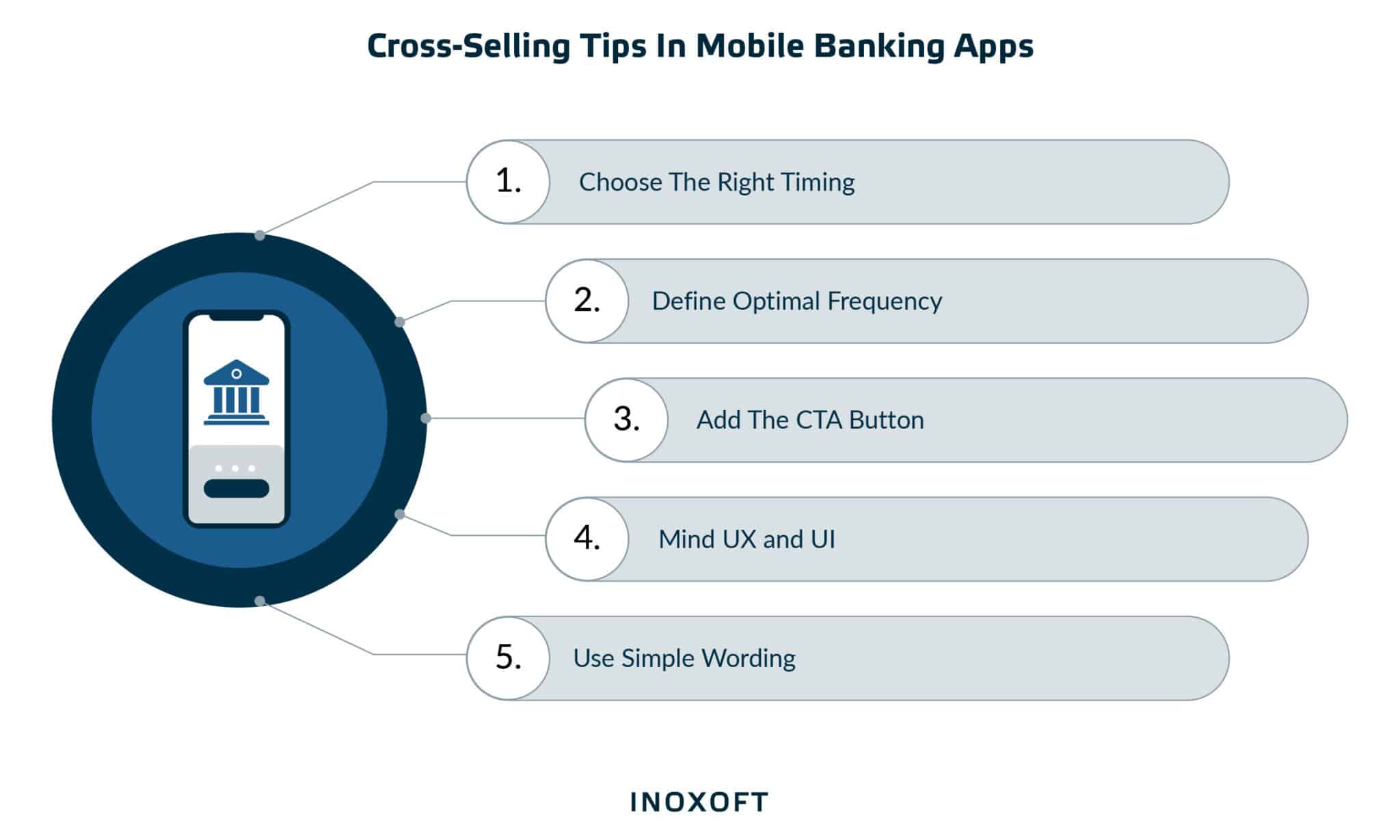

Cross-Selling Tips In Mobile Banking Apps

Mobile banking applications have created new possibilities to customize offers based on the user’s preferences. Banking apps can provide substantial value by using behavioral data to advertise relevant products and services.

However, several pointers will help you to employ cross-selling strategies more efficiently. Here they are:

-

- Choose the right timing;

- Define optimal frequency;

- Add the CTA button;

- Mind UX and UI;

- Use simple wording.

Choose The Right Timing

Cross-selling can happen at various time frames depending on the banking services and products. Notifying customers about new offerings when a special promotion on a specific product or service can increase the likelihood of persuasion and sales. The mobile clickthrough rate (CTR) typically rises when consumers conduct most of their financial transactions — for instance, at dinnertime.

Define Optimal Frequency

Push notifications in a mobile banking app are typically less bothersome than SMS as they pop on the screen without interfering with users’ ongoing tasks. However, if shown excessively, they рmight become unpleasant. Therefore, banks should develop an intelligent algorithm to communicate the offer to avoid being annoying. For instance, limit their frequency to 1-2 times daily, remove interruptions, only display the promo message after successful transactions, and hide ads when app issues or failures occur.

Add the CTA Button

Users should be able to access the promotional advertisement by clicking when they see it. Clients who click on a particular advertisement should be taken to the home page of the specific service rather than the main home page. Apply a call to action (CTA) button so that users can be taken to the promoted page to initiate and complete the activity.

Mind UX and UI

Cross-selling banking products will be more efficient if financial institutions use readable fonts and decent images. The elements should be kept light for quick loading and have their interface checked on various mobile devices. Banks can use A/B testing to compare multiple components and determine superior ones.

Use Simple Wording

Most mobile banking users don’t know a lot of financial terminology. Thus, tailor the wording in cross-selling messages to clients. Speaking customers’ language helps to avoid scaring them away, strengthen communication, and succeed in cross-selling endeavors.

How CRM Integration Supports Cross-Selling in Mobile Banking

Banks require efficient tools and motivational training to transform sales consultants into qualified product and service experts. In this situation, a CRM system is helpful. We have found several ways sales consultants use CRM to boost their share of client wallets.

Increasing Knowledge About Customers

CRM in banking allows for a single customer database with unique profile information. These profiles incorporate data from backend systems, websites, mobile banking, and other sources about accounts, customer profitability, purchasing history, preferences, and behavior. CRM database is the foundation for identifying client behavior patterns, identifying the most relevant cross-selling opportunities, and planning more contacts.

Creating Campaigns for Targeted Cross-Selling

Banking CRM segments clients based on several factors in conjunction with customer analytics, such as demographic status, occupation, lifestyle, etc. It enables financial institutions to assign the best product options for them. In addition, sales consultants can identify consumers who are more likely to purchase a specific product and determine the clients who generate the most significant value.

Managing Cross-Selling Activities

With a bank CRM, sales representatives can manage multiple cross-selling tasks simultaneously, including customer base management, planning sales activity, and creating analytics and reports. In addition, the CRM solution streamlines corporate and individual profiles processes and assigns duties to sales consultants, enabling them to schedule customer calls and meetings and record the system’s outcomes.

Raising the Sales Force Efficiency

CRM allows sales professionals to centrally store contacts, track recent actions, and conveniently arrange calls and meetings. Therefore, CRM can aid sales teams in streamlining their daily chores, establishing personal objectives, prioritizing their workload, and allocating time to each client, increasing the likelihood of cross-selling.

Why Predictive Analytics Is Another Winning Cross-Selling Strategy for Digital Banks

Banks can use predictive analysis to personalize interactions with consumers and offer them only relevant financial services and products by timely tailoring offers based on customers’ activities in their accounts and habits and lifestyle changes.

Predictive analytics for finance enhances basic segmentation and conventional marketing scripts. In addition, it offers real-time product recommendations and the best communication channels by considering all available client data.

Here is a checklist for applying predictive analytics for cross-selling in mobile banking.

Formulating a Question

Predictive analytics allows you to foresee future events and formulate a strategy beforehand. Analytics software helps banks to find answers to various queries, including the number of new leads, potential profit, customer retention rate, and purchase probability.

Collecting Data

The next stage is to identify the data that reflects the response after a bank has asked a question. Every prediction’s confidence level correlates with the data quality used in its analysis. Only reliable data can offer insights. Banks should regularly update and examine their client profiles to simplify the data collection process.

Building a Predictive Model

At this stage, data analysts develop a model specifying the likelihood of a specific future event. They use machine learning (ML) techniques ranging in complexity from deep learning to linear regression to do this. After several training iterations of processing data entries, the analyst receives a predictive model that explains customer attrition. The model’s prediction ability is now evaluated using the test data set. If the model is inaccurate, it can be further enhanced to increase precision.

Watching the Assumptions

Predictive analytics makes the critical assumption that the future will resemble the past. Humans indeed tend to develop strong behavioral patterns and stick to them over time, making a prediction model reasonably accurate. However, the model may no longer be valid since people occasionally alter their behavior patterns. Moreover, time or shifting market conditions can change a predictive model’s assumptions. As a result, a model that includes a variable that changes over time can eventually lose its forecasting ability.

Final Thoughts

Mobile banking has expanded cross-selling opportunities in the industry. In addition to increasing revenue, it also boosts customer satisfaction and engagement, helping businesses to establish long relationships with their clients. However, to cross-sell bank must balance encouraging consumers to buy more and making practical, relevant offers. Therefore, financial institutions should only recommend services that will aid customers in managing their finances

Consider Inoxoft Your Trusted Partner

Inoxoft is a certified partner and a global software development company specializing in banking software development services and software integration services. Our team comprises the best banking software developers worldwide, skilled in developing banking apps and implementing cutting-edge ideas to drive cross-selling opportunities. We build software that improves client satisfaction, automates processes, and generates revenues as you scale.

Thanks to our banking software development services, we ensure your solution will have essential and cutting-edge features. Inoxoft follows best practices and takes an empathic approach while generating client journey maps. We can help you implement customer-centric banking software solutions with CRM integrations and predictive analytics.

Inoxoft is a leader in integrating online payment services with enterprise software for companies of all sizes. To speed up the processes involved in financial transactions, we adapt “PayPal-like” online payment systems to your business’s needs. By modernizing and updating your company, we add value to it.

Contact us to consult on your mobile banking solution and get an estimate.

Frequently Asked Questions

What are upselling and cross-selling in banking apps?

Upselling refers to offering a more advanced or improved version of a banking product or service. Cross-selling is when a bank is marketing or selling related goods or services to what its customers are already purchasing.

How to succeed in cross-selling in mobile banking?

To succeed in cross-selling, a mobile banking app should offer relevant products and services, leveraging opportunities like personalization with customer insight, cutting-edge digital experience, marketing automation, and gamification. It is also vital to mind timing, frequency, UX design, user interface, language, and applying the CTA button.

What are examples of cross-selling in mobile banking?

Cross-selling examples in banking include providing customers with a savings account when they open a checking account or homeowner's insurance in conjunction with a mortgage. Further examples of cross-selling in banking are recommending life insurance with a retirement plan and providing investors with additional investment products.