Our clients

OUR BANKING SOFTWARE DEVELOPMENT SERVICES

Thrive in today’s digital landscape with our comprehensive banking software development services:

Development

Our banking software development company delivers secure software solutions within e-banking software development services. That includes robust core banking systems that consolidate your back-office operations, and innovative customer-facing applications for a seamless and engaging experience for your clients.

Integration

Inoxoft specializes in custom corporate banking software integration with existing systems in a cohesive and efficient workflow. Our expertise extends to third-party integrations, and APIs with a strong emphasis on security protocols to protect sensitive data.

Modernization

We revitalize legacy systems, incorporating the latest banking software to enhance performance of internal processes, security, and user experience. Count on banking IT software solutions that empower banks to embrace digital transformation, and stay competitive in the industry.

SOLUTIONS OUR BANKING CORE SOFTWARE DEVELOPMENT AGENCY OFFERS

Inoxoft — your loyal banking software development company — provides custom banking software development services to release the best solutions:

CUTTING-EDGE FEATURES IN INOXOFT’S DIGITAL BANKING SOFTWARE DEVELOPMENT

Inoxoft propels your digital banking strategy forward with innovative web and mobile banking software development services. Our expert team of online banking software development delivers feature-rich software that streamlines operations, enhances customer experiences, and drives growth.

WHY CHOOSE INOXOFT FOR CORE BANKING SOFTWARE DEVELOPMENT?

Get an accurate estimation of your banking software from us

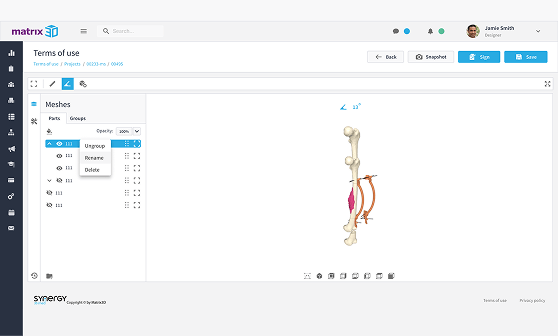

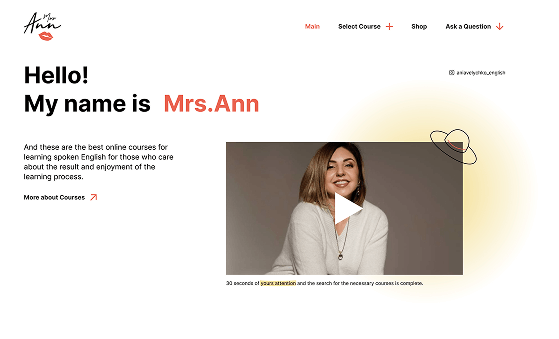

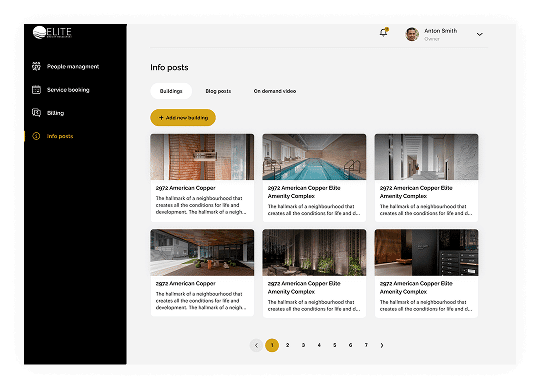

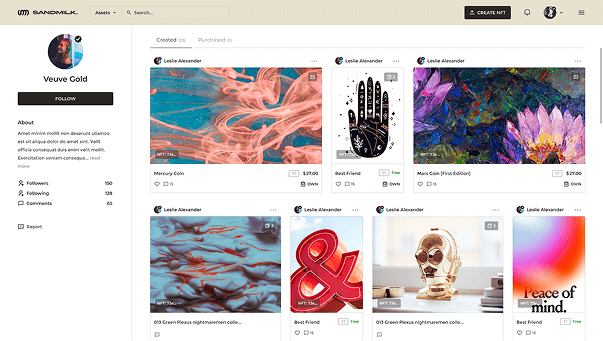

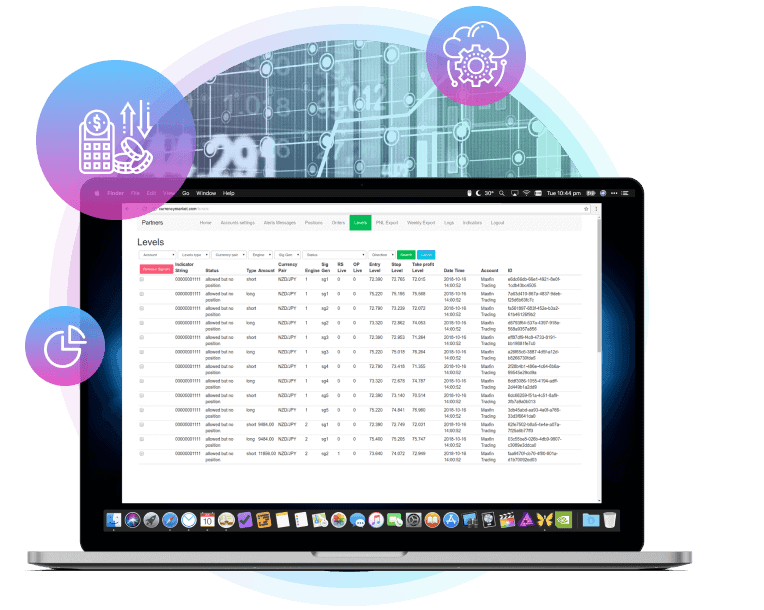

SUCCESS CASES

OUR BANKING SOFTWARE DEVELOPMENT PROCESS

OUR COLLABORATION MODELS

Frequently Asked Questions

What is the typical timeline for developing banking software?

The timeline for developing banking software varies significantly based on project complexity, scope, and specific requirements. Smaller projects with defined functionalities can be completed within several months, while large-scale enterprise solutions may take a year or more.

Our agile development methodology allows for flexibility and adaptability, ensuring timely delivery without compromising quality. Factors such as integration with existing systems, customization needs, and regulatory compliance also influence the overall project timeline.

Inoxoft offers free consultations to estimate your project — don't hesitate to contact our team.

How do you handle regulatory compliance?

We have a dedicated compliance team with in-depth knowledge of relevant regulations such as GDPR, CCPA, and industry-specific guidelines. Our processes of custom software development for banks incorporate rigorous security measures and data protection protocols to ensure compliance. We stay updated on the latest regulatory changes to safeguard your business and maintain the highest industry standards.

Can you customize the software to meet our specific needs?

Absolutely. We specialize in providing tailored banking software solutions that align precisely with your unique business requirements. Our experienced team collaborates closely with you to understand your specific needs and develop a customized solution. Whether it's integrating legacy systems, implementing new features, or adapting to changing market conditions, we offer flexibility and adaptability throughout the development process.

How do you ensure the software is user-friendly?

User experience is a top priority in our development process, therefore we:

- Prioritize user needs and preferences throughout the development process.

- Create a clean and easy-to-navigate interface that requires minimal user effort.

- Maintain visual consistency throughout the software for a cohesive user experience.

- Present data and instructions in a clear and understandable manner.

- Conduct thorough testing to identify and address potential usability issues.

- Ensure the software functions seamlessly on various devices.

- Minimize loading times and system resource usage for a smooth user experience.

What is the cost of developing banking software?

The cost of developing banking software depends on project scope, complexity, features, and development methodology. Inoxoft offers flexible engagement models to accommodate different budgets and project requirements. Our transparent pricing structure ensures that you have a clear understanding of costs from the outset.

We also offer free consultations to estimate your project — contact our team to get all details.

Why choose your company for banking software development?

Inoxoft combines deep industry expertise with cutting-edge technology to deliver exceptional banking software solutions. Our experienced team offers a comprehensive range of services, including custom software development, integration, and ongoing support.

We have a strong commitment to quality, security, and customer satisfaction that sets us apart as a trusted partner for your banking software needs. Choose Inoxoft, a banking software provider, if you seek a development partner who can provide strategic guidance and innovative solutions to drive your business forward.

Do you offer cloud-based banking software solutions?

Yes, we specialize in cloud-based banking software solutions. We understand the critical nature of banking data and have implemented stringent security measures to protect sensitive information. For instance, we offer robust AWS infrastructure, ensuring scalability, security, and high availability. If you are interested in getting more information, reach out to us.