Our clients

OUR AI TRADING SOFTWARE DEVELOPMENT SERVICES

Custom AI Trading Platform Development

Custom AI Trading Platform Development

Our custom AI-driven platforms feature unique algorithms, optimization for various asset classes, and capabilities such as real-time data analysis and automated trading signals.

Data Integration

Data Integration

We integrate data from multiple sources, such as market feeds, trading history, and financial reports, into a unified system, so your users can have a complete and accurate picture of their trading activities.

API Integration

API Integration

When developing, we connect your AI trading platform with external services and tools, including brokerage platforms for trade execution, financial data providers for real-time market information, and any other third-party tools.

Analysis Tools Development

Analysis Tools Development

Our team develops advanced tools like dashboards for tracking performance, custom indicators for spotting trends, and analytics for actionable insights, enabling your users to refine AI trading strategies.

AI TRADE SOLUTIONS WE PROVIDE

Inoxoft provides a variety of AI trading software services. Explore what we can offer:

Quantitative Platforms

Create new trading opportunities for your users with advanced data analytics! Our platforms analyze vast datasets to spot trends and provide actionable insights for profitable trades!

Algorithmic Platforms

Automate trading with precision! Our platforms execute trades based on predefined strategies, responding to market conditions and price triggers without manual intervention.

High-Frequency Platforms

Capitalize on market movements with lightning-fast trades! AI-powered algorithms handle high volumes in milliseconds, making the most of small price fluctuations for consistent profits.

Backtesting and Simulation Tools

Give your users the power to perfect their strategies! Our tools simulate trades using historical data, allowing them to predict real-time performance before risking actual capital.

Have a project in mind? Discuss it with our experts and get a detailed roadmap

LENDING SOFTWARE FEATURES WE CAN IMPLEMENT

Automated trading execution

Real-time market data feed

AI-driven predictive analytics

Customizable trading algorithms

Multi-asset trading

Personalized portfolio management

Sentiment analysis

Advanced charting and technical analysis

WHY INOXOFT FOR AI STOCK TRADING SOFTWARE DEVELOPMENT

Make your platform exceptional with AI-powered capabilities

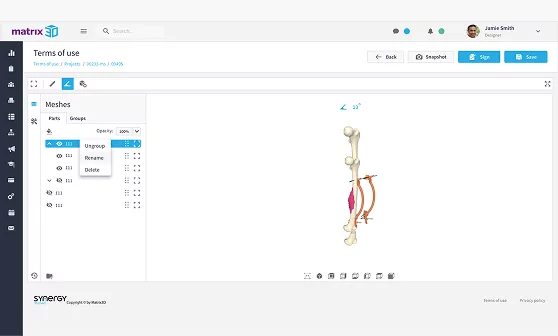

OUR SUCCESS CASES

OUR AI-POWERED TRADING SOFTWARE DEVELOPMENT PROCESS

We handle every part of AI trading software development, using top project management methods to build solutions that fit your business like a glove. Here’s how we do it, step-by-step:

OUR COLLABORATION MODELS

Frequently Asked Questions

What types of AI algorithms do you use for developing trading software?

We use several AI algorithms to create trading software, depending on the specific needs of the system our client uses.

- For predictive analytics and market forecasting, we rely on machine learning models such as regression, decision trees, and neural networks, which help identify finance market trends and patterns.

- We also use reinforcement learning, as it’s key for optimizing trading strategies, allowing the AI to learn from previous trading outcomes.

- Additionally, we use natural language processing (NLP) to analyze news, financial reports, and market sentiment, helping our clients make more informed trading decisions.

What data is used by AI trading software?

Our AI trading software systems rely on a variety of data sources to make informed decisions.

- First, they use historical price data to analyze past market trends and patterns, helping predict future movements.

- Second, real-time market data, including stock prices, trading volumes, and order book data, is needed for executing trades with precision and speed.

- Third, economic indicators like interest rates, inflation data, and GDP figures are incorporated into the models to understand broader economic impacts.

- Additionally, news data, social media sentiment, and financial reports offer insights into market-moving events, enabling AI to adapt to new information swiftly.

Can your AI trading software be customized to meet my specific needs?

Yes, our AI stock trading software development company can customize software solutions to fit your specific needs. We’ll work with you to understand your trading strategies, goals, and any special requirements you have. Based on that, we’ll tailor the algorithms, features, and interface to match your preferences and improve your trading efficiency.

Can AI trading software be integrated with my existing trading platform or broker?

Yes, our AI trading software can be integrated with your existing trading platform or broker. We design the software to connect seamlessly with your current systems through APIs and other integration methods, so you can continue using your preferred tools and platforms while benefiting from our AI enhancements.

How much does AI trading software cost?

The cost of AI trading software varies based on factors like the complexity of the system, customization needs, and the features you require. We provide different pricing models to fit various budgets and project scopes, so you can choose the one that best suits your needs. We’ll give you a detailed quote based on your specific requirements after discussing your project with us.